In the recent times, the common investor’s viewpoint of the Colombo Stock Exchange (CSE) has been:

“I lost all my savings!”

“I lost more than half the value of my portfolio”

“We burnt our fingers”

In the meantime, however, foreign institutional investors bought shares with massive discounts in 2012 and amassing a net inflow of roughly Rs. 38 b. This figure is the highest so far in the history of the CSE.

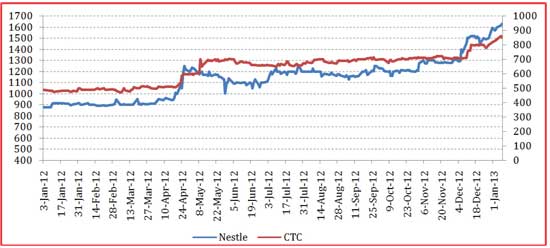

The current position of the stock market stands as an excellent opportunity for “stock picking”. Even during the recent down trend, stocks such as Ceylon Tobacco Company and Nestle have rallied during the 2012 calendar year! There is opportunity even during the worst of times. Do not turn a blind eye. “The stock market can provide decent returns to astute investors even during down markets”

Ceylon Tobacco Company and Nestlé

These two companies have a dividend payout ratio in excess of 90%. CTC is a monopoly and Nestlé is a market leader in its products.

The two companies follow good corporate governance principles. There is no doubt about the sustainability of these two even during adverse economic conditions. Investors who had confidence in these two entities reaped benefits last year. The graph illustrates just how much the shares appreciated in 2012.

According to the graph, Nestlé has gained by more than 86.3% and CTC has gained by more than 73.2%. Nestlé has provided an annual dividend of Rs. 47.50 for the 2011 financial year and CTC has given Rs. 37.10 as dividends. Therefore, do not exit the stock market during these difficult times but rather “pick” shares which are have better upside potential.

Stocks have exceptional potential?! Which? When?

As mentioned earlier, the CSE is a “stock pickers” paradise. Our stock market is semi-efficient. This in simple English means that any investor can outperform another investor based on information available him/her.

Most Sri Lankans tend to invest when everybody else is investing in the stock market (herd instinct).

A knowledgeable investor on the other hand will buy when other investors run away from the market and sell when the majority of the investors start buying.

So what are the industries with potential? All industries have potential but few industries such as dairy, tourism and engineering hold the most promise with rapid economic growth required to reach the 100 billion dollar economy by 2016 the Government is envisaging.

The dairy industry for example, the government wants the country to be self-sufficient in dairy production by 2016. We currently produce only around 30% of our requirement. With economic development the per capita demand for dairy will also rise.

If you talk to your investment adviser, you will be able to find out listed companies in the above mentioned industries. However, we should remember that all businesses have risks.

2012 was dreadful year, but did we miss an opportunity?

The All-Share Price Index hit a recent low of 4,851.88 on 9 August 2012. Since then the ASPI has climbed to 5,751.93 points by 8 January 2012.

That’s a gain of more than 18.5%! Premier blue-chip John Keells Holdings hit a low of Rs. 159.20 on 18 January 2012 and now trades at around Rs. 224. This translates to gain of more than 40.7%! Figures speak for themselves. There are opportunities in this market but we Sri Lankans have turned a blind eye.

Opportunities arise when there are adversities. Baron Rothschild, an 18th century British nobleman and member of the Rothschild banking family, is credited with saying: “The time to buy is when there’s blood in the streets.”

He should know. Rothschild made a fortune buying in the panic that followed the Battle of Waterloo against Napoleon.

What can we do to make profits from this situation?

Retail activity was the main driver in terms of activity and sentiment during the bullish period of mid-2009 to early 2011. Rise in interest rates, margin calls and global financial crisis have been a few talking points on the reason for the negative sentiment in the Colombo Stock Exchange (CSE).

In the current situation as discussed earlier stock picking is the most suitable option available for investors.

For the aggressive investor trading on the values of the Relative Strength Index (RSI) can be suggested as a reasonable option.

The RSI has values from 0 to 100. If a stock has a RSI of less than 30, it is regarded as oversold and conversely a RSI of more than 70 is regarded as overbought. The idea is to buy a stock when it is oversold and sell when it is overbought.

The condition of the stock market has improved considerably from mid-2012 and we are looking ahead for better times. To put things in perspective, premier John Keells Holdings is trading at the same price levels (share split-adjusted) as it did when the ASPI was at an all-time high in the 7,800 region.

However, on the other hand the ASPI has lost almost 2,000 points since its peak.

Patience is a virtue

Reaping the benefits of investing in the stock market takes time.

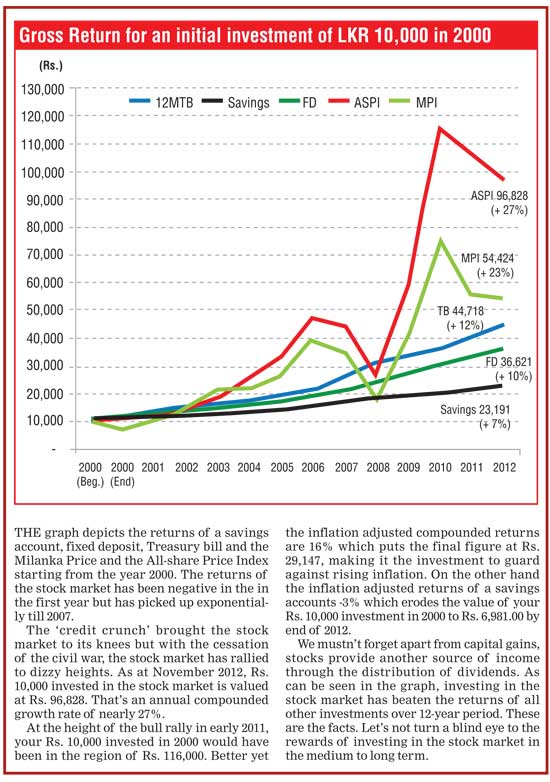

These time periods sometimes run into a few years. But according to data compiled from the Central Bank reports returns from the stock markets have always outdone all other investments.

http://www.ft.lk/2013/01/24/2012-the-year-of-missed-opportunities-for-local-investors/#more-132013

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home