For many years for us Lankans the CEB or the Ceylon Electricity Board was the source of power for our household and industrial electricity requirements. However, recently released data seems to show otherwise. Despite its pivotal role the CEB is no longer the source of power. Then who is, we ask. Yet before we answer this question it is important to understand the context of the problems that plague the masses in this country of ours. Today we stand at the threshold of being crushed by the cost of living. It is interesting to see whether the impending mammoth increases in electricity tariffs will have any bearing on any of the cost of Living (COL) indices in the country.

The first issue that the CEB has maintained is a root cause and need for this increase is the need to alleviate subsidies. True, it is a fact that as people (if this is truly happening) should pay more and more for their usage as they earn. The question is, are we earning more money? Whilst an answer to this question remains beyond the scope of this investigation, the CEB maintains that its costs are forever increasing. Let us take a look at chart I.

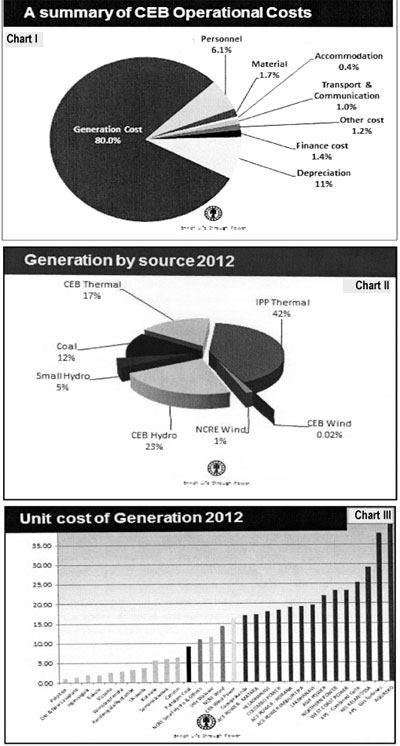

As is clearly visible, the CEB maintains that it incurs 80% of its costs in the generation area. So wasn’t that the idea? The CEB generates and the LECO looks after the distribution. Interestingly, the chart does not indicate any transmission costs. Why we do not know. Whether this is because another organization bears this cost is important but not key to our argument. If the CEB which is the power generating authority, then indeed it’s biggest costs should be generation. What is the problem then? To seek an answer to this question it is important to draw your attention to chart II.

This chart details the sources of power and their respective contribution to the entire pie. For instance CEB’s thermal power generation contributes 17%. Ooops…!! Really. I am baffled. The CEB only generate 17% of the thermal power when we thought the CEB generated 59% of its power from thermal. Another point is given hydro capacity; these numbers must fluctuate. But then when the powers that be release numbers, it is no longer possible to be really sure. So who generates the other 42%? This is the most interesting question? Take a look at chart III.

What this chart provides is the list of independent contractors who provide thermal power to the CEB grid and at what cost.

In the first instance it is clear that there is no standardization of power purchase agreements. This means that the authorities have left it at the discretion of whoever holds office to determine the rates at which power would be purchased from each contractor. At one end Polpitiya sells one unit of Electricity to the CEB at Rs. 1.3 whilst at the other extreme AGGREKO sells one unit of electricity at Rs. 40.02. Now do you see? There are altogether 30 Independent contractors supplying thermal power to the CEB grid. Did you know that this was the case? Now if we were to get ballistic, then we could have run statistics on minimums, maximums, which I have already detailed along with standard deviations and means. But all those technicalities are unnecessary. The fact is that 59% of thermal energy is generated and that 42% comes from independent contractors. Whilst from an academic perspective it would have been interesting to know which supplier provided what quantity, the issues are that;

* There is no standardization of pricing

* Discretion appears to have been used in the determination of the rate at which power is purchased

* And clearly the IPPs (as the CEB likes to call them) are now calling in their pound of flesh.

Bar corruption, waste and a host of other popular factors, the ``most dangerous moment’’ after Churchill’s for us Lankan’s have arrived: the moment when the corporates take over the social structure and turn utilitarian services into profit maximization opportunities.

What is the Washington Consensus?

The term Washington Consensus was coined in 1989 by the economist John Williamson to describe a set of ten relatively specific economic policy prescriptions that he considered constituted the "standard" reform package promoted for crisis-wracked developing countries by Washington, D.C.-based institutions such as the International Monetary Fund (IMF), World Bank, and the US Treasury Department. The prescriptions encompassed policies in such areas as macroeconomic stabilization, economic opening with respect to both trade and investment, and the expansion of market forces within the domestic economy. Subsequent to Williamson’s coining of the phrase, and despite his emphatic opposition, the term Washington Consensus has come to be used fairly widely in a second, broader sense, to refer to a more general orientation towards a strongly market-based approach. Williamson himself has argued that his ten original, narrowly-defined prescriptions have largely acquired the status of "motherhood and apple pie".

As Williamson has pointed out, the term has come to be used in a broader sense to its original intention, as a synonym for market fundamentalism or neo-liberalism. In this broader sense, Williamson states, it has been criticized by people such as George Soros and Nobel Laureate Joseph E. Stiglitz. The Washington Consensus is also criticized by others such as some Latin American politicians and heterodox economists such as Erik Reinert. The term has become associated with neo-liberal policies in general and drawn into the broader debate over the expanding role of the free market, constraints upon the state, and the influence of the United States, and globalization more broadly, on countries’ national sovereignty.

"Stabilize, privatize, and liberalize" became the mantra of a generation of technocrats who cut their teeth in the developing world and of the political leaders they counseled.

—Dani Rodrik, Professor of International Political Economy, Harvard University in JEL ‘Dec’06

So what are these points of the consensus?

A discussion on all the points may be beyond this piece. But the following paragraph provides an outlook at how the Washington Consensus views subsidies by a government to its people. The Washington Consensus as formulated by Williamson includes provision for the redirection of public spending from subsidies ("especially indiscriminate subsidies") toward broad-based provision of key pro-growth, pro-poor services like primary education, primary health care and infrastructure investment. This definition leaves some room for debate over specific public spending programs. One area of public controversy has focused on the issues of subsidies to farmers for fertilizers and other modern farm inputs: on the one hand, these can be criticized as subsidies, on the other, it may be argued that they generate positive externalities that might justify the subsidy involved.

The Argentinian experience

Here we look at the effect of the consensus on one aspect of the totalitarian Argentinian experience. Mark Weisbrot says that, in more recent years, Argentina under former President Néstor Kirchner made a break with the Consensus and that this led to a significant improvement in its economy; some add that Ecuador may soon follow suit.

However, while Kirchner’s reliance on price controls and similar administrative measures (often aimed primarily at foreign-invested firms such as utilities) clearly ran counter to the spirit of the Consensus, his administration in fact ran an extremely tight fiscal ship and maintained a highly competitive floating exchange rate; Argentina’s immediate bounce-back from crisis, further aided by abrogating its debts and a fortuitous boom in prices of primary commodities, leaves open issues of longer-term sustainability.

The Economist has argued that the Néstor Kirchner administration will end up as one more in Argentina’s long history of populist governments.

In October 2008, Kirchner’s wife and successor as President, Cristina Kirchner, announced her government’s intention to nationalize pension funds from the privatized system implemented by Menem-Cavallo. Accusations have emerged of the manipulation of official statistics under the Kirchners (most notoriously, for inflation) to create an inaccurately positive picture of economic performance. The Economist removed Argentina’s inflation measure from its official indicators, saying that they were no longer reliable.

Interesting isn’t it? Because we hear on a daily basis that our per capita income has increased and that it will be such and such in a number of years. Furthermore, and resulting from this increase in average income, the government justifies its removal of subsidies. In particular the loss of confidence in the Argentinian government’s measures is a fact that several businesses fear today in this very country. Under anonymity, several businessmen find corporate planning exercises extremely difficult due to the fading reliability of national statistics.

Economic hitmen and coal

The Minister of Power and Energy has gone on record stating that several more coal power plants will be established in the country and put down that with their commissioning this situation could become better. Given primarily that many intelligent naitons are moving out of coal, and the experiences with the existing second hand forever broken down coal power plant, there may not be too many citizens who would rely too much on these statements. However, the fact is that the independent contractor may despite the increasing down time of the power plant end up owning the facility due to our inability to service our debt component. Now this is straight out of any Washington Consensus Script you could find anywhere in the world.

To illustrate the point I leave you with two quotes form the "confessions of an economic hitman"

"For them, this is a war about the survival of their children and cultures, while for us it is about power, money, and natural resources ."

"We’re a small, exclusive club," she said. "We’re paid — well paid — to cheat countries around the globe out of billions of dollars . A large part of your job is to encourage world leaders to become part of a vast network that promotes U.S. commercial interests. In the end, those leaders become ensnared in a web of debt that ensures their loyalty . We can draw on them whenever we desire — to satisfy our political, economic ,or military needs . In turn, these leaders bolster their political positions by bringing industrial parks, power plants, and airports to their people. Meanwhile, the owners of U.S. engineering and construction companies become very wealthy."

Rings a bell, anyone?

http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=77745

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home