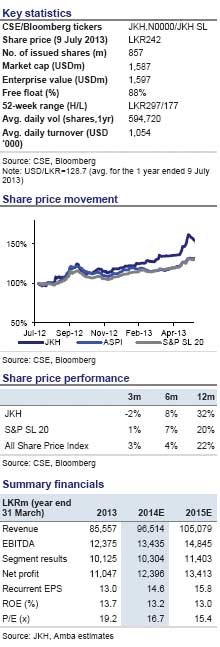

John Keells Holdings (JKH), Sri Lanka’s largest conglomerate, accounts for over 9.0% of the Colombo Stock Exchange’s (CSE) total market capitalization. Its businesses encompass consumer food and retail (CF&R), hotels, oil bunkering and containers, property development, finance and IT services. We forecast that JKH will post a revenue CAGR of 9.0% over FY14E-FY16E, while its EBITDA margin should remain roughly stable around 13.9%. This relatively slow growth trajectory reflects management’s cautious approach towards investment and expansion, and implies that JKH may face challenges in maintaining its market position in some segments. However, it is encouraging that the company is focused on generating shareholder value and unwilling to pursue growth at the expense of margins. Our DCF/SOTP valuation analysis and P/E analysis suggest a valuation range of LKR218-292, compared with the share price of LKR242 as of 9 July 2013.

JKH’s revenue will likely grow at a 9.0% CAGR through FY16E. We expect JKH’s top-line growth to be driven primarily by the leisure segment, which is primarily made up of hotels in Sri Lanka and the Maldives. Growth of 400bps in occupancy rates and a 5.2% CAGR in average room rates over FY14E-FY16E should bolster the top line. We forecast that revenue at JKH’s CF&R segment, will post a 13.2% CAGR through FY16E, boosting the company’s overall revenue growth. JKH’s transportation business should grow in the low single digits, but continue to account for a large portion of total revenue.

We estimate that the EBITDA margin will remain around 13.9%. Due to JKH’s highly diversified nature, growth in one segment is often offset by weakness in other areas. We believe that its EBITDA margin will decline to 13.9% in FY14E from 14.5% in FY13, as overall expenses rise and property segment revenue (where margins can be high) continues to be volatile. JKH’s real estate development efforts should boost margins in the coming years as revenues from apartments sold are recognized. However, the business’s relatively small size limits its overall impact. During FY14E-FY16E, cost containment efforts in the leisure segment should broadly support margins. If JKH’s upbeat plans for its supermarkets are achieved, the CF&R segment – where we currently forecast an EBITDA margin of just above 6.0% – may have some scope to surprise to the upside.

A cash cushion and low leverage could allow for growth. Management has not demonstrated a strong interest in pursuing acquisition-driven growth, and it has been cautious in allocating capital to cultivate organic growth. JKH’s strong cash (and cash equivalents) position of 15% of market capitalization and low leverage of 17% suggest that the company should be in a strong position if it elects to be more assertive. Also, the company’s large land bank – which accounts for 6% of our estimate of JKH’s valuation – may allow for some additional upside, depending on its end use.

We establish a valuation range of LKR218-292, compared with the current share price of LKR242. JKH trades at an FY14E P/E of 16.7x, a premium to its peers. This valuation premium stems from a share liquidity premium and the perception that the company is one of the most transparent and shareholder friendly entities in Sri Lanka. That JKH is not controlled by a single shareholder (unlike many other locally listed conglomerates), also contributes to its valuation premium. In coming quarters, we will be closely tracking the performance of JKH across a number of key areas and will be updating our valuation range in future earnings updates.

JKH’s revenue to post a 9.0% CAGR over FY14E-FY16E: We expect JKH’s revenue growth to be driven primarily by the company’s leisure and consumer foods and retail (CF&R) segments. The transportation segment will remain a significant contributor to revenue, although in our view, its growth will lag that of the company as a whole.

Leisure segment:

Leisure segment revenue CAGR of 7.6% over FY14E-FY16E driven by higher occupancy and rising average room rates: We expect the leisure segment’s revenue to post a CAGR of 7.6% over FY14E-FY16E, to reach approximately LKR26bn in FY16E. The segment’s growth should be fuelled by modestly rising occupancy levels, which we forecast will increase from a blended 67% in FY13 to 71% in FY16E. Additionally, marginal increases in average room rates (ARR), which should post a blended CAGR of 5.2% over FY14E-FY16E, would likely bolster segment growth. Industry growth in room inventory (total room inventory in Colombo is forecasted to rise by over 50% through 2015 as new hotels are opened) should serve to cap upward movement in occupancy levels and ARRs.

We expect the company’s room inventory (excluding the upcoming business hotel JV project with Sanken) in Sri Lanka to remain flat through the forecast period. Although the launch of the new business hotel will increase JKH’s room inventory in Colombo by 28% in FY15E, JKH currently holds only a relatively small stake (27.8%) in the hotel, and therefore, we expect the incremental addition to revenues to be minimal.

On another front, JKH recently invested in a small national air taxi service called Cinnamon Air. While JKH’s minority stake will not be material to the firm’s overall performance, the operation will help consolidate the company’s position in the leisure sector.

JKH has indicated that it continues to search for attractive expansion opportunities in the leisure sector, but has been unable to uncover any that meet its investment return hurdles. Although we expect JKH’s market share to decline, the company’s focus only on investment efforts that will deliver returns above its required hurdle rates reflects positively on the company’s desire to deliver shareholder value.

More broadly, Sri Lanka’s tourism industry faces numerous challenges that will also serve to limit JKH’s growth in its leisure segment. Tourist visits to Sri Lanka, at just over 1.0m in 2012 (up 17% YoY) substantially lag those of other countries in Southeast Asia. In 2012, the Philippines recorded 4.3m tourist arrivals (up 9% YoY), Vietnam received 6.8m arrivals (up 13% YoY) and Indonesia reported 8.0m visitors (up 11% YoY). Sri Lanka’s tourism infrastructure – in terms of airports, roads and transportation, and services – trails those of competitors for tourism growth. Further, minimum room rate regulations could dampen Sri Lanka’s international competitiveness. Perhaps most critically, Sri Lanka’s tourism product is at risk of pricing itself out of the market if the cost of electricity and low labor productivity (due to a shortage of skilled labor) continue to rise.

On a related front, the tourism industry in the Maldives, while thriving, continues to be threatened by political instability and regulatory uncertainty. There is a risk that the government may pass legislation (such as a recent short-lived but nevertheless worrisome ban on spas) that is contrary to the interests of the leisure industry. That the tourism industry accounts for just over a quarter of the country’s economy, though, suggests that the government – which is projecting an 8.1% CAGR in tourist arrivals over FY14E-FY16E – will likely be more cautious in its approach.

JKH’s Maldives properties account for 27% of JKH’s leisure segment revenues and 6% of overall group revenue and the company currently has no plans to increase its room inventory there. The likely stabilization of the investment and political environment in the Maldives should bode well for the tourism industry in the country.

Consumer Foods and Retail…

Rising per capita GDP and consumption to support CF&R segment’s revenue CAGR of 13.2% over FY14E-FY16E: We believe JKH’s CF&R segment will contribute substantially to the company’s overall revenue growth. We expect the consumer foods component (comprising ice cream, carbonated soft drinks and frozen processed/convenience foods) to post a revenue CAGR of 10.3% over FY14E-FY16E, while retail (which includes the company’s 51 supermarkets) records a 15.4% CAGR over the same period.

Both elements of the CF&R segment are driven by overall macroeconomic growth, and, more concretely, disposable income. As shown in Figure 5, JKH’s consumer foods and retail businesses both roughly track the two macroeconomic data points, with the company’s growth being substantially higher than either – a trend we forecast will continue over the coming years.

We believe JKH’s top-line growth in the consumer foods component will also be supported by the following.

* New product launches. Over the past two years, JKH launched two new ice cream flavors and a soft drink flavor, along with an expanded range of sausages. The group also relaunched its premium ice cream range. In addition, JKH also recently introduced mineral water into its product portfolio.

* Geographical expansion. Since launching in the Maldives over a decade ago, Elephant House – JKH’s ice cream brand – has become the market leader. The brand was also introduced into the Middle Eastern market in FY12. Management has indicated that Elephant House may be launched in additional markets, although timing is unclear.

* Additional available capacity. JKH reports that it has substantial scope to increase production using current capacity simply by adding an additional shift. Currently, the company’s key production facilities operate on one shift. JKH also acquired a meat processing plant in FY13 to enhance its production capacity.

* Closing consumption gaps. Sri Lanka’s per capita consumption of ice cream, at 1.7 liters/year, is well above the levels of China and the Philippines. However, consumption levels – reflecting both purchasing power and consumer appetite – in nearby Malaysia and Singapore are substantially higher.

On a macro level, Sri Lanka’s modern food retailing sector is attractive, with only 15% of food sold through modern outlets (i.e., large organized retail stores); the balance is bought through markets and other informal channels. The experience of other emerging markets suggests that increasing disposable income is positively correlated to modern food retail market share, as consumers search for a more convenient grocery shopping experience.

JKH’s food retailing operations account for approximately 57% of the CF&R segment’s revenue (as of FY13), and roughly 16% of the company’s revenue. The company’s food retail operation is the third-largest in Sri Lanka by revenue, and the second-largest in terms of total store count, as shown in Figure 7. JKH reports that its focus will be on opening relatively large stores of 7,000 saleable sq. ft; previously, the company’s store sizes varied around the 3,500-4,000 sq. ft. range.

JKH’s retail store expansion rate has been relatively slow, with store count increasing by two stores per annum over the past five years. After many years of being in operation, the company’s retail arm became profitable for the first time in FY12. Now that the breakeven point for the business – of around 50 stores – has been achieved, JKH should begin to reap the rewards of scalability of its food retail business.

However, management has also said that its policy is to launch food retail operations only in areas of the country that are at a sufficiently high level of disposable income. Indeed, a majority of the company’s 51 stores (as of March 2013) are in the Colombo area, which is Sri Lanka’s most affluent region. JKH’s conservative approach to store launches implicitly allows more aggressive competitors – most notably, Cargills – to establish a strong local market position well before Keells Super outlets are launched in a particular region.

On a related front, JKH’s own internal investment return hurdles may stand in the way of any substantial acceleration in store openings. The company has a target return on capital employed (ROCE) of 15% for any new investment. This should be difficult for the food retail business to achieve, given that management aims to achieve a net margin of 2% – which is unlikely to be consistent with the targeted high ROCE level. Capex of LKR100m required per new store may thus be a hard sell internally. Management has indicated its desire to accelerate the rate at which new stores are launched to potentially as much as 10 units per annum. However, we are less aggressive than JKH and forecast only two new store launches per annum through FY16E.

Transporation…

JKH’s transportation business to grow slowly, but continue to account for a substantial share of total revenue: The growth of JKH’s transport segment will be hampered by capacity constraints. We expect overall segment revenue to increase at a CAGR of 4.5% over FY14E-FY16E, to reach LKR22.6bn in FY16E, owing primarily to growth in the oil bunkering business. JKH is active in the container business via a 42.2% stake in South Asia Gateway Terminals (SAGT), which is accounted for as an associate business.

JKH’s oil bunkering business to provide a steady revenue flow: JKH’s oil bunkering business imports oil and supplies bunker fuel primarily to ships calling in for transshipment at the Colombo port. Total current storage capacity for bunker fuel at the Colombo port is 35,000 metric tons (MT). The three largest industry players – JKH’s Lanka Marine Services (the industry leader, with a 40% market share), state-controlled Lanka Maritime Services and private company Lanka Indian Oil Company – dominate the sector, although there are a number of smaller players.

Growth in the oil bunkering business is hampered by oil storage capacity at the Colombo port. The government has said it hopes to increase capacity by more than twofold. The timetable of this expansion, and how additional space would be made available, has not yet been announced. In the meantime, the only real possibility for top-line growth is via an increase in the price of oil. We assume that although the Colombo port’s oil bunkering services are operating at capacity, intense competition will gravitate against any efforts to substantially increase prices.

Moreover, growth in regional trade, which leads to greater demand for transshipment services, should drive the oil bunkering segment’s revenues. However, while Sri Lanka is in a geographically strong location, it still faces stiff competition from other ports within a radius of a few hours.

On another front, the port development at Hambantota – a site of significant infrastructure investment in Sri Lanka – may threaten the position of the Colombo port, and JKH’s oil bunkering business. The 82,000 MT of oil storage capacity at the Hambantota port is currently under state control, and it may become an increasingly important factor as the port’s container operations evolve.

Container business faces pressure following capacity expansion at the Colombo port: JKH’s container business entails loading and unloading container vessels at the Colombo port. Two main operators – South Asia Gateway Terminals (SAGT), in which JKH owns 42.2%, and state-owned Jaya Container Terminals (JCT) – dominate the Colombo port’s container capacity of 4.9m twenty-foot equivalent units (TEU). Currently, the government controls about 60% of total port capacity.

JKH reports that SAGT’s installed capacity of 1.3m TEU/year has been increased to 2m TEU/year thanks to the application of upgraded equipment and technology. Currently, the facility is operating at 85% capacity, and any additional increase is pending the privatization of additional area. In December 2011, China Merchant, a Hong-Kong listed Chinese state firm, entered into a public-private partnership (PPP) for a build-operate-transfer arrangement that added 2.5m TEU in capacity in July 2013, equivalent to an overall 50% increase in capacity. This sharp increase in total port capacity should pressure pricing as the new market entrant carves out its customer base. It will likely also defer any additional privatization of space. Therefore, we believe SAGT’s growth prospects, both at the top line as well as in terms of margins, are challenging.

Other segments…

Financial services, IT and other segments to make a small contribution to top-line growth: In our view, JKH’s financial services, IT and other segments (which include produce broking and warehousing, and other real estate operations) will post a combined revenue CAGR of 9.3% over FY14E-FY16E, generating revenue of LKR24.9bn in FY16E (or roughly 22% of total revenue). Some of the key issues relating to these segments include the following:

* Insurance: We assume that JKH’s insurance operations will grow roughly in line with GDP. While there is a clear growth opportunity in Sri Lanka’s insurance industry, as disposable income rises and the outlook of consumers becomes more long term in nature, the market is also highly competitive. As a mid-tier player, Union Assurance (UAL) – in which JKH holds a 96% stake – is subject to pricing pressure from larger competitors. We estimate UAL’s book value and forecast its value generation into our SOTP valuation using a P/BV multiple (valuing UAL at a 5% premium to its 2012 P/BV).

* Banking: Nations Trust Bank (NTB), in which JKH holds a 29.9% stake, is a small-tier asset in a fast-growing sector that is dominated by state-controlled and some of the large private commerical banks. We forecast NTB’s value generation into our SOTP using a P/BV multiple valuing NTB at a 10% premium to its FY12 P/BV (and at a premium to its peer average).

* Stockbroking: John Keells Stock Brokers (JKSB) accounted for only 2% of the financial services segment’s revenue in FY13. Overall low trading volumes, an over-broked market, weak stock market performance and declining commissions all contribute to mixed prospects for JKH’s stockbroking activities.

* IT: JKH offers a niche product in the IT segment. We believe that the business does not appear to be a major priority; additionally, heavy competition – particularly from India – exerts downward pressure on pricing. We forecast top-line growth to be around 10%.

(Excerpts from a joint research report by the Colombo Stock Exchange and Amba Research)

http://www.island.lk/index.php?page_cat=article-details&page=article-details&code_title=83721

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home