Dr.Nalaka Godahewa, Chairman of the Securities and Exchange recently shared his thoughts with the Mirror Business about the year that ended and his expectations for the country’s capital market for the New Year. The following are excerpts.

Q: Let’s begin with your expectations for the capital market in the New Year?

Expectations for 2014 are extremely positive. There is a lot of positive sentiment about the market activities if you talk to any stakeholder.

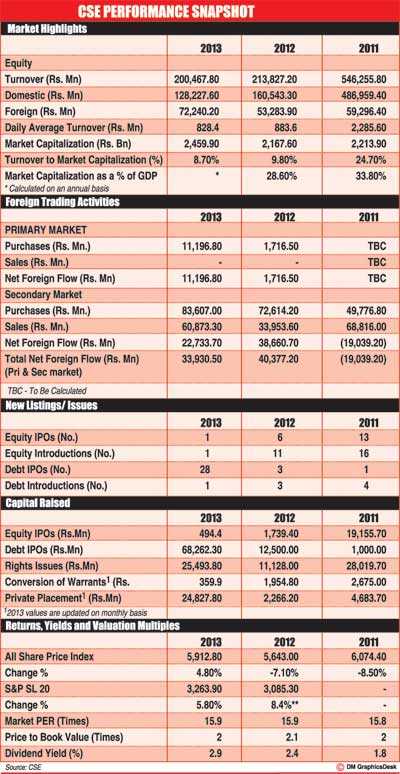

One of the key reasons is, in 2013 we stabilized the market and laid a very strong foundation for us to grow from this point onwards. The regulatory leaks that were there were plugged and very clear-cut three year plan was introduced and of which at least 40 to 50 percent is completed. And also, if you look at the total capital raised in 2013, that was the perhaps the best in the recent past. It grew over 270 percent.

So, I would say in 2013, the capital market has done well. Since we have now laid strong foundation, the market stakeholders should make sure to deliver on the strong platform we have created.

Q: Though you say market stakeholders are extremely positive, we hear that a number of stockbrokers are struggling?

They are struggling because of what happened in the past. They are not negative about what will happen in the market in the coming years. Last year, the equity market reported a growth of 4.8 percent. So, the people who depended on the equity market—when the business is distributed among 29 brokers—had to undergo certain hardships. In fact almost 50 percent of them are struggling. It is a fact. If you look at every other industry it is same. That’s why the Central Bank is asking finance companies to merge and consolidate. Same thing goes for brokering companies. There are far too many. When there’s too many, some consolidation needs to come in. Either they could consolidate or become deactivate for a while, and come back when the market is ready accept a larger a number.

Q: Is there such a possibility? For those struggling to go into hibernation and come back when the times are good?

There’s proposal which has come to the Colombo Stock Exchange (CSE). They have forwarded it to us. We have not discussed it at the Commission level but at the Secretariat level we have discussed about it, and we are looking at it positively. In many other countries this has happened and it’s not a new thing.

Q: We hear that some brokers are even closing their regional branches.

Yes, we are aware of it. As I said about 50 percent of our brokers are currently losing money. When they are losing money and the market is not growing they are compelled to scale down their operations. We don’t like it. But as I said, we cannot interfere into their business and tell them what to do. My only hope is that market will pick up faster, so they can expand or at least maintain where they are. To support them, we went a little beyond our scope and talked to all these large government entities and asked why they were not active in the market. We felt that they were missing the bus. Now I can see they are coming back and this will help brokers. At the same time, we have given fair warning to brokers not to mess it up like the last time by trying to dump shares into these state agencies. The professional fund managers at these state agencies should also be mindful not to get caught. We as the regulator will also closely monitor this and expect to take proactive actions to avert any misconduct.

Q: Since you admitted that many brokers operate, is the SEC actively, like the Central Bank, encouraging the brokers to consolidate?

Unlike the Central Bank who clearly told finance companies to consolidate, we haven’t told brokers anything of that nature. We are not telling them what to do. The industry has to decide itself. If you look at the last one and a half years, every time they have come up with a constructive idea, we have accommodated it. We have these consultative meetings with them which are part of an ongoing programme. But we are not here to tell them how to do business. Our job is to develop the market and protect investor interest.

Q: What is the current position of the SEC Act amendment?

SEC Act amendment as you know was handed over the Finance Ministry after the Commission approval in July last year. Then the Treasury took a decision to review it once again with an independent group, which I think is a good move. There were several bills that came into the parliament last year which were challenged. Therefore it is important to get an independent view. They are regularly meeting and SEC representatives are also there.

From what I hear, 50 percent of the draft bill has been looked at. If you ask me I would like them to finish fast as possible. But I don’t know how long that’ll take. But as soon as that process is over, it should go the Cabinet and then to the parliament. We need it very badly.

Q: What are the salient points in the amended Act?

The new Act will give SEC civil sanctions. Everything we currently have is criminal sanctions. When it comes to criminal sanctions, everything you have to prove beyond reasonable doubt which takes a longer period and sometimes you might not be able to prove at the end. That’s why regulators all over the world have moved towards civil sanctions where you can make a call on probability. When the market is growing, to strengthen the regulation we need those powers. At the same time the Act will facilitate product development, CCP and demutualization of the CSE.

Q: When you assumed duties as SEC Chairman in 2012, the market was in turmoil. It was referred a “casino” run by a certain “mafia”. Three were stories of manipulation, front-running and all kinds of market malpractices. Some alleged that your appointment to the SEC was also engineered by a section of powerful investors who wanted manipulate the market the way they wanted. But in 2013, the market sort of stabilized and as far as we know there were no major incidents of market misconduct. And top of that you are bringing new regulations. What was the formula you adapted?

First of all I thank you for asking that. When I assumed duties there was a crisis. I was in fact asked to come by the President because there was a crisis.

In a crisis, people always tend to find scapegoats. So there was a lot of suspicion and allegations. Even when I came, there were allegations that my motives are different. But my approach was to be patient and focus on what we need to do.

Firstly, we sat down, analyzed the situation and developed a long term plan. We got all the market stakeholders involved and got their views and put in an action plan to recognize what we needed to do to develop the market in the long term.

Secondly, we focused on the issues. There were a lot of investigations going on and we went into each and every one and completed them. One position I took was you can’t go by what people say. You have to go by the book and follow procedures. Rather than making statements to the media about what I feel about investigations, I kept my mouth shut. I declined to comment and allowed the Secretariat to do their job. They went to the Commission with their recommendations and now everything is completed.

During the initial period, our focus was stabilizing the market because I felt that was what we were lacking at that moment. Having stabilized the market, now our focus is shifting more towards the regulatory areas.

If you look at the last 3 to 4 months, we have focused heavily on the gaps that were there in the regulatory mechanism. Sometimes it’s easy to find fault with people and the system when there are gaps in the regulation. There is no point in crying over spilt milk. You must find out why these things are happening. I believe we have identified the issues and addressed them so that they cannot happen any longer. And even the surveillance system was much focused last year. They were very proactive and when we feel that there was something funny going on, we called them and took proactive measures to prevent any market misconduct. That is why if you take 2013, it was more of an eventless year. If you ask me from 2014 onwards, our focus will be more on regulation and protecting investor interest.

Q: As you said during last few months, you have been bringing in a number of new regulations. Don’t you think that’s far too many at a short span of time?

Actually someone else also asked me the same questions whether it’s far too many. I don’t think so, because if someone wants to get ready for the future, we should have done those things long time before. The series of regulations that came into play were not new ideas. They were in the system.

The SEC had been discussing those with the CSE and the industry for many years. If you take minimum free float, there were three previous consultations but nothing really happened. What’s the point of talking about them and doing nothing? Somebody has to act. Then when you act there is fear that there would be resistance. But I was confident there wouldn’t be resistance because everything we did was brought in after a lot of discussion. We have discussed with every concerned party before implementing. Although you saw a number of regulations coming in together, none of them were ad-hoc. The media also gave us a lot of support and looked at the new regulation at a very positive manner.

Q: With regard to the minimum 20 percent free float rule, I was told that about 100 companies will have to comply. Has any concerned party contacted the SEC and asked for any kind of leeway of exception?

About 100 companies listed are below 20 percent and about 70 are main board companies. And if you look at some of the companies, they have only about 3 to 4 percent public free float and some even don’t have that. Formerly nobody has spoken to use but informally a few people have checked about the process. We in fact ran a few advertisements clearly putting down the formula and we got the CSE to write to all the companies. It was more or less a clarity issue rather than a concern.

At the same time, there was fear among the people that the multi-nationals won’t like this. The little bit of informal feedback I’ve received suggest that it is not the case going to be.

Q: Since you came in, we see the SEC and CSE working together and doing a lot market development activities on a joint-basis. Don’t you think in doing that the SEC has gone beyond its scope?

First of all, we cannot say we have gone beyond our scope because our scope has two aspects; market development and investor protection.

When I say market development, people think the SEC is talking about marketing. Market development is creating a market where people can raise funds and trade in a transparent and fair manner. World over capital markets have become very sophisticated and offer a number of new products and instruments. We need to create those things in our market so that there are opportunities to raise funds. That is one of the primary objectives of the SEC.

At the same time, because people are raising money from the public, the SEC has the primary job of protecting investor interest. That becomes a more important aspect in a developed and established market. In our case the market was not there. We were at least 20 years behind when you compare with our closest neighbour, India.

I would like you to look at SEBI (Securities and Exchange Board of India) which was set up in 1987, the same year where our SEC was set up. At the time our market was far ahead of India in terms of technology and sophistication. But if you look at India today, their markets are as sophisticated as any other market in the world. And who was driving that? It was SEBI. They played a very active role in developing the market and are still doing it. But in Sri Lanka, we got this mindset that we are regulators and didn’t do much to develop the market. Now what we are trying to do is to do both; market development and investor protection. That’s why we work closely with the CSE and we would continue to do so.

Q: There were indications that Sri Lanka was seriously looking at in setting up a commodities exchange. What is the current status of it?

Commodities exchange I understand had been an assignment at one point given to the SEC. But it is not necessarily SEC’s mandate to establish a commodities exchange as it involves a number of other stakeholders and ministries. The SEC has come to a particular level with regard to this about two-three years ago and got stuck. To me, a commodities exchange was not a priority last year. We need Treasury advice in this if we are to pursue a commodities exchange.

Q: There was strong speculation that you will either step down or asked to leave. What do you have to say about these speculations?

Question is for what? And if those speculations were correct, I wouldn’t be here now. I have a term and if the term is to end early there has to be a valid reason. So far I have not been communicated anything in this regard by those who appointed me to this position.

http://www.dailymirror.lk/business/features/41540-foundation-laid-time-for-other-stakeholders-to-deliver-godahewa-.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home