You and your Noodles Ranferdi. Average Blaind man is none other than you. Majority of Sri Lankan will show the exit door to you and your govt if you have the guts to hold elections(They have already shown the exit door to you & your govt in Feb 2018)ranferdi wrote:DS Wijesinghe wrote:ranferdi wrote:Yes the market crash in china has given some bones to the ones who oppose current government. We cant make instant noodles here the change will come after sometimes.

Ranferdi the blood bath at CSE still continues isn't it? Still your Noodles are on fire??? Its now almost 4 years since the Yahapalana govt was formed?

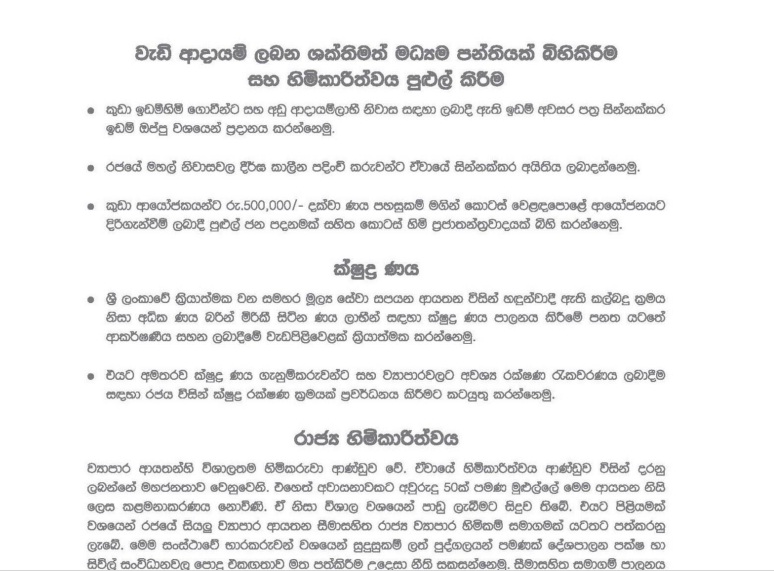

Will your govt ever grant that Rs. 500,000/- margin trading facility to small and retail investors of CSE as promised in your Manifesto? Or will it end up as just another broken promise of yours just like so many other broken promises made by you?

Your govt and it's strong supporters like you have lied and deceived CSE investors and taken them for a big rid

Yet the noodle is not cooked. Noodle will be cooked only when all the debts taken by prior regime is paid off. I do not blame the current government for the status of Sri Lankan economy as of today. The situation can be explained taking below example.

There was a blind man which is Average Sri Lankan Citizen, and in about 2015 he was going to fall into a pitfall of about 10ft, But someone has diverted the path and while taking the alternative path he has fallen to the 3 ft pit. Without knowing that he was saved from falling to 10ft pit now the blind blames the savior.

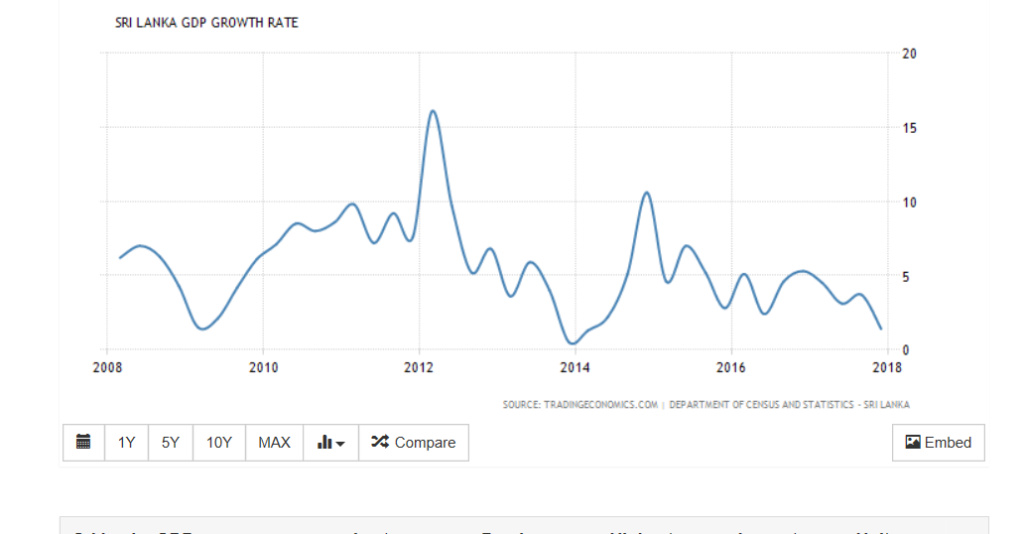

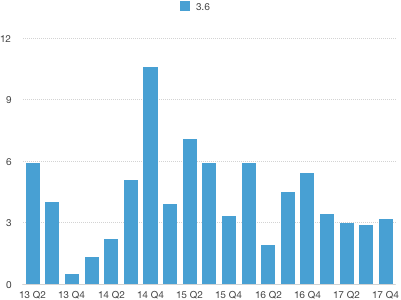

I do not wish to bring statistics

here as I do not have enough time.

Is this the statistics you could not post as you did not have time?

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home