Market Reaction to Sri Lankan Elections - Thu Jun 18, 2020 4:20 pm

[url=

View this post on Instagram

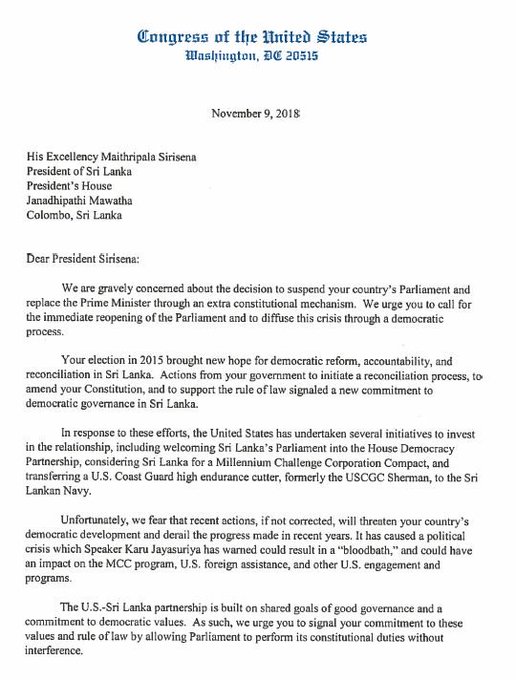

Did you know elections can move the stock market and your chance of profiting from it is high if you time it right? After days of teasing, Mako finally announced it is on August 5th. Fundalyse Intelligence took the liberty of analyzing movements of the ASPI index from the date of announcement until the big day during the past five years. Why does your vote matter to the stock market? Elections can have a long-term effect on the economy and people's lives. It gives power to the public to decide whether they want to re-elect the existing government and stick with the status quo without disrupting their plans for the country or to change the regime by voting for the opposition if they are unhappy. Ultimately, your vote awards a political party a mandate to govern the country and introduce policies that are market-friendly and can bring economic stability, consistent policies that would impact our businesses and lives positively but most of the time it has been a let down in Sri Lanka. Our votes are taken for granted and they b**** slap our faces with disappointment. But we are here not to get political about it. By looking at the data and the performance of the ASPI, it can help you prepare for the upcoming elections. The index tends to be volatile and rallies to about 6-8% from the trough, a month before the big day. It recovers the losses it made before it starts to reverse again after elections making it shortlived phase. Studies have shown that the market reacted positively to the elections before and during the elections and negatively after the election during the last 5 years. Therefore it doesn't matter who comes to power, but the implementation of sound consistent economic, market-friendly policies along with political stability will increase the business confidence making the markets prosper in the long run. However, unlike any other elections, this time the parliamentary election is a different ball game due to COVID-19 because you won't be seeing stage rallies and V8's on the street which increases consumption in the economy which could hinder the rally in #cse or maybe not. #srilanka #elections #stockmarket #covid19A post shared by Fundalyse Markets (@fundalyse) on Jun 10, 2020 at 5:01am PDT

Here is the full post!

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

[/ltr]

[/ltr]