mono wrote:aj wrote:I wonder how countries inhabited by humans like other countries other than Sri Lanka, don't take double, triple extortions from the citizens and still control the traffic, balance of payments or whatever, oil prices etc.

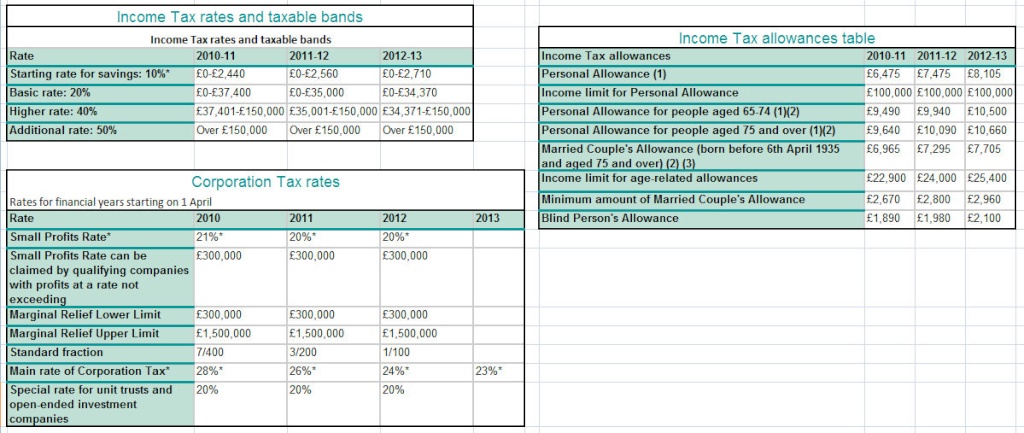

Those countries have 60% income tax, 80% inheritence tax, 40% corporate tax. 20% tax on capital gains. are you happy with that?

@Mono,

I do not know which country you talk about. But some countries do not have as much tax as you have mentioned. Tax logic is that more you earn more you pay tax. Inefficiency of tax authorities/government should not be a burden on average citizens.

See UK tax rates here.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

:Deleted:

:Deleted: