would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 4:15 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 4:15 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 4:21 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 4:21 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 4:25 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 4:25 pm

slstock wrote:

Good inflow. Appears JKH , DFCC and maybe some PABC bought by "foregin" accounts?

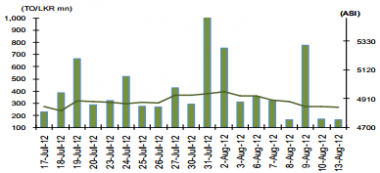

LBT:Market Wednesday Wed Aug 15, 2012 4:29 pm

LBT:Market Wednesday Wed Aug 15, 2012 4:29 pm

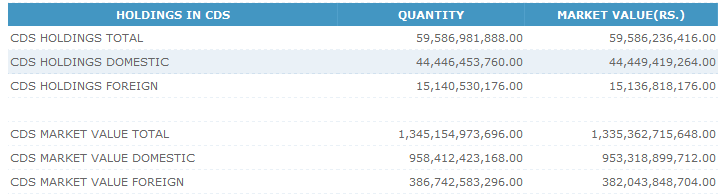

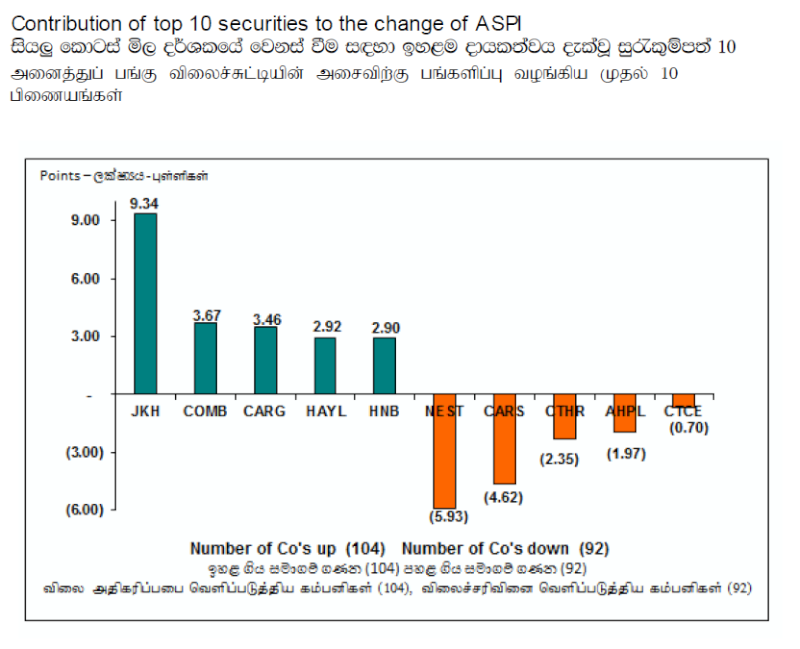

Crossings - 15/08/2012 and Top 10 Contributors to Change ASPI Wed Aug 15, 2012 4:42 pm

Crossings - 15/08/2012 and Top 10 Contributors to Change ASPI Wed Aug 15, 2012 4:42 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 5:02 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 5:02 pmslstock wrote:

Good inflow. Appears JKH , DFCC and maybe some PABC bought by "foregin" accounts?

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 6:00 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 6:00 pm

.jpg)

.jpg)

.jpg)

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 7:51 pm

Re: Trade Summary Market - 15/08/2012 Wed Aug 15, 2012 7:51 pm

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum