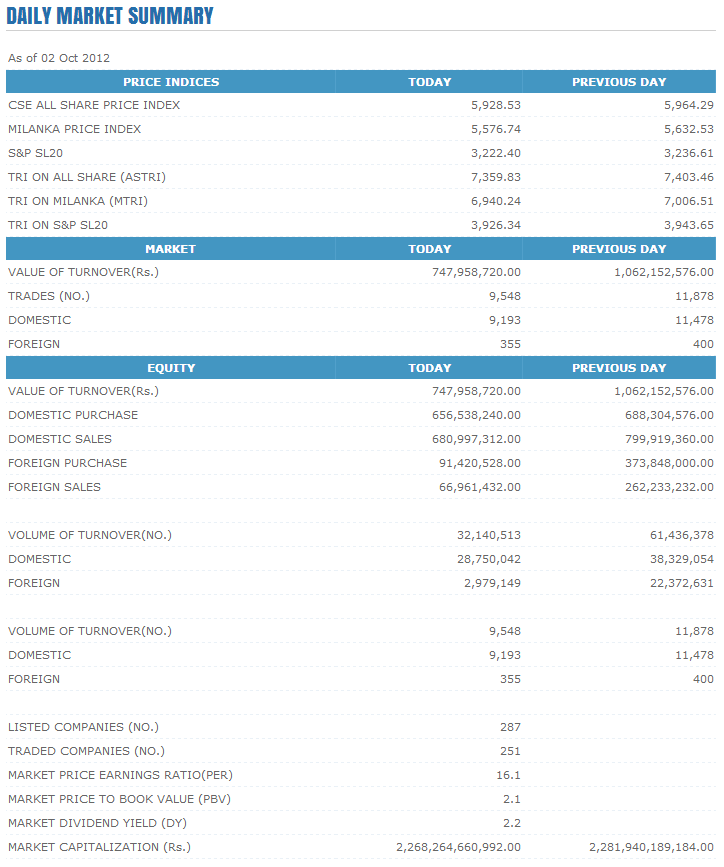

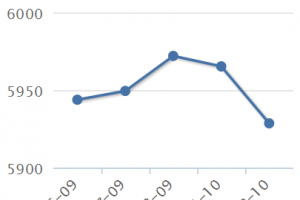

Oct 02, 2012 (LBT) - Colombo bourse extended losses from yesterday, as the benchmark index drifted further away from the 6,000 psychological barrier to close with a 35.8 point dip at 5,928.5 points. Heavyweights, John Keells Holdings (-1.1%), Sri Lanka Telecom (-1.6%), Commercial Bank (-1.1%) and Shalimar (Malay) (-13.6%) primarily weighed on the index negatively. The liquid MPI followed a steeper slope downwards as it touched a low of 5,561.6 (down 71 points), before witnessing some recovery to close with a 55.8 points plunge, whilst the S&P SL20 managed to minimise losses (down by 14 points) with notable appreciations in steady players; Aitken Spence (+2.7%), Nestle (+0.5%), Sampath Bank (+0.6%) and Aitken Spence Hotel Holdings (+1.3%). The activity levels dropped to a one - week low as the volume read 32.1 mn shares.

Albeit the volatility witnessed in the bourse during the past two weeks amidst some profit taking, it is visible that the benchmark index has continued to remain steady above the 5,900 level. We remind the investors to utilize the current consolidation phase to strengthen their positions into quality stocks which are still considerably undervalued, that have not over performed the market during the previous rally and thus are likely to be the front runners in the next bull run. We also remind the investors to focus on the sectors including Finance, Hotels and Manufacturing which are likely to witness a turnaround in performance particularly during 2013.

Retail & high net worth investor hunt in Touchwood continued as the counter climbed up to the top position in the turnover list amidst several large on board deals. The counter touched a high of LKR21.5, before closing at LKR19.1 with a 2.7% advance. It was announced during the day that the company has approved a capitalization of reserves (1 for 2) at a consideration of LKR8.75 per share. Interest also extended in Lanka Orix Leasing Company as further on board trades were registered in the counter, where it advanced by a marginal 0.6% at its close of LKR50.6. Vallibel One and its related companies Royal Ceramics & LB Finance attracted substantial interest during the day. Buying interest was prominent in LB Finance and Vallibel One as each advanced 8.7% & 2.7% to close at LKR160.4 & LKR22.5 respectively. The manufacturing subsidiary of the group, Royal Ceramics, also proved to be active as the counter saw several large deals being drawn in the market as it advanced 2.5% at its close of LKR104.2.

Access Engineering and Overseas Realty defined the day’s crossings board. The former witnessed a block of 900k shares at LKR22.5, whilst the latter recorded a parcel of c1.3 mn shares being crossed off at its 52 – week high of LKR15.0. Retail play was evident in counters including Laugfs Gas [Non – Voting], Bairaha Farms, Citrus Leisure and Lanka Hospitals Corporation. Banking & finance sector counters including Commercial Bank [Non – Voting], Central Finance, National Development Bank, Sampath Bank and Nations Trust Bank retained interest.

European Stocks Retreat Following Yesterday’s Rally: European stocks declined after the region’s equity benchmark yesterday rallied the most in more than three weeks. The Stoxx Europe 600 Index lost 0.5% to 270.93 at 8:02 a.m. in London, paring yesterday’s 1.4% rally. The MSCI Asia Pacific Index gained 0.1% today. Oil advanced to a one-week high as US manufacturing unexpectedly expanded and Spanish banks’ capital deficit dropped in September from June: Crude oil for November delivery rose 29 cents to USD92.48 a barrel on the New York Mercantile Exchange.

http://lbt.lk/stock-market/movement/2733-lbt--market-tuesday

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Capital Trust Technical Analytical Outlook 02/10/2012 Tue Oct 02, 2012 4:33 pm

Capital Trust Technical Analytical Outlook 02/10/2012 Tue Oct 02, 2012 4:33 pm Crossings - 02/10/2012 and Top 10 Contributors to Change ASPI Tue Oct 02, 2012 4:41 pm

Crossings - 02/10/2012 and Top 10 Contributors to Change ASPI Tue Oct 02, 2012 4:41 pm

Trading Tuesday - Sri Lanka stocks closed down 0.60 pct Tue Oct 02, 2012 5:45 pm

Trading Tuesday - Sri Lanka stocks closed down 0.60 pct Tue Oct 02, 2012 5:45 pm LBT : Market Tuesday Tue Oct 02, 2012 5:47 pm

LBT : Market Tuesday Tue Oct 02, 2012 5:47 pm

Re: Trade Summary Market - 02/10/2012 Tue Oct 02, 2012 5:52 pm

Re: Trade Summary Market - 02/10/2012 Tue Oct 02, 2012 5:52 pm

.jpg)

.jpg)

.jpg)