If you need a blast from the past, I will be happy to give you statistics from that era.

Kicking it of with details for Buki in FY 1978/1979

Profit - Rs 2.5 million

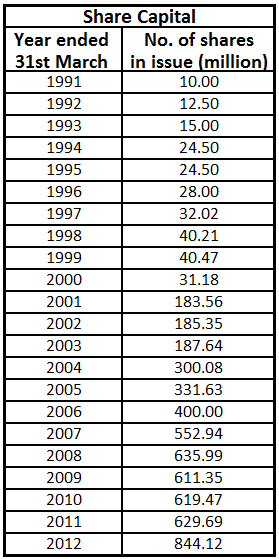

Number of shares issued - 100,000 (increased to 400,000 in 1979/1980)

NAV - Rs 333

EPS - Rs 25

Dividend - Rs 12.50

Share Price as at 31st March 1979 - Rs 55

They dont come so cheap anymore i guess !

adding further.... (1979 details)

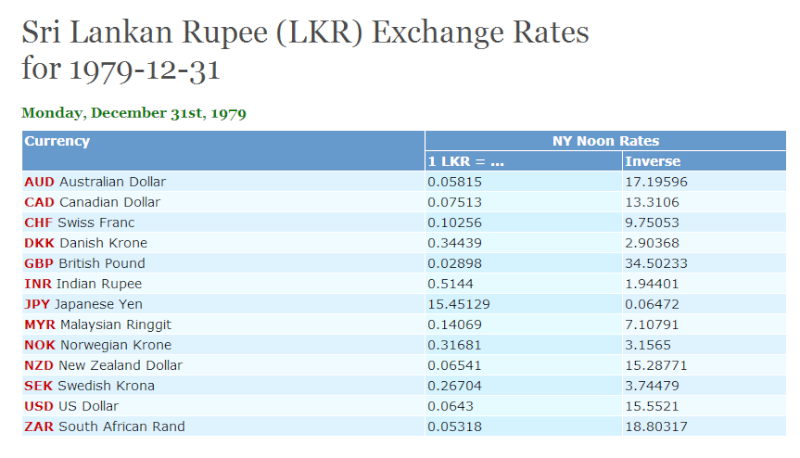

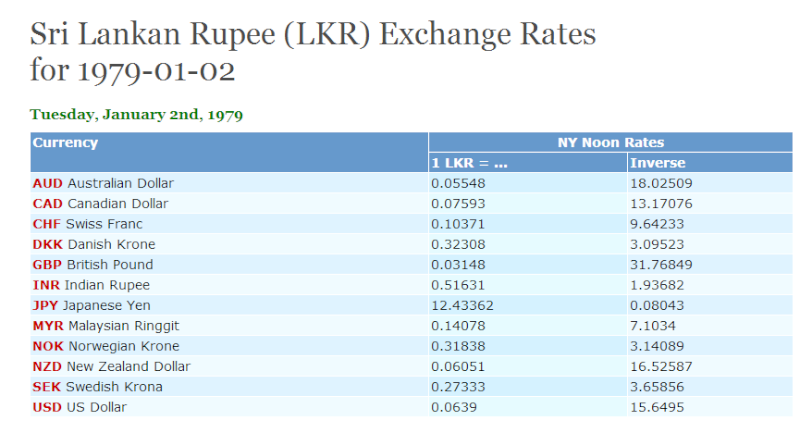

1 usd = Rs 15.55 in 1979 (34 years later 1 usd = 126)

Gold = usd 307 per ounce cumulative average price (34 years later = approx 1400 per ounce)

Prime Havelock Road real estate (30 perch + house) = Rs 1.8 Million (Today Rs 150 Million ?)

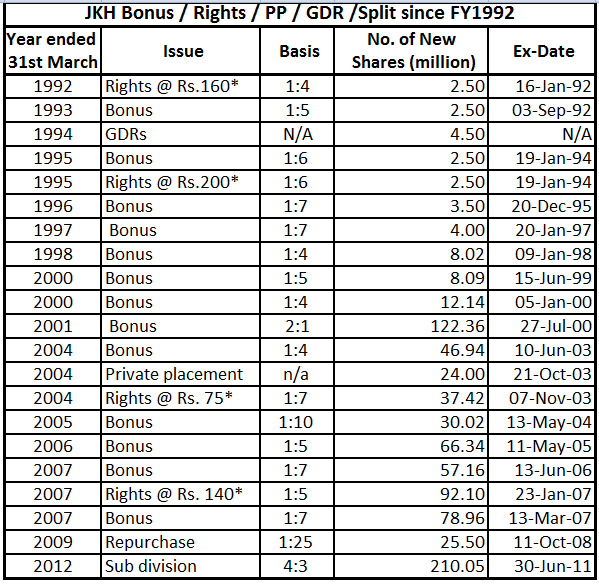

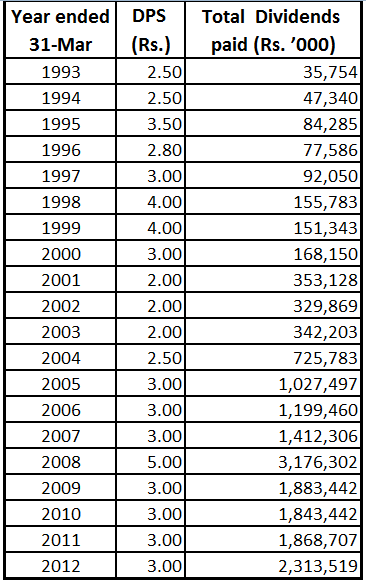

Rs 55 invested in Buki in 1979 = Rs 720,000 in 2013

usd 3.50 invested in Buki in 1979 = usd 5700 in 2013

In 1979, Microsoft IPO happened at usd 27 per share

In 2000, Microsoft was trading split adjusted at usd 3375, up 125 times in 21 years !

Last edited by The Alchemist on Sat May 25, 2013 12:00 am; edited 3 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home