The week saw heavy institutional and foreign interest on large cap counters which was a trend seen from the beginning of 2013. On the other hand retail involvement in equities continued to increase assisting the small cap counters to gain notably during the week. The fact that small cap counters have significantly regained the trading interest is an indication that the risk appetite of the market participants has returned and is gaining in momentum. The continuous drop in government T-bill rates and the expectations of a stronger LKR and hence a subdued level of inflation in the economy would further assist this trend going forward.

Moving onto global markets the Japanese economy grew 3.5% YoY in 1Q2013 exceeding the rate of U.S recovery, which positioned the Japanese Nikkei 225 firmly in green territory alongside U.S equities. Markets in the rest of the world notably in Europe and Asia remained subdued on account of the growth concerns of the two regions. It is observable that price of industrial commodities are moving in opposite direction to that of equity markets in U.S which is an indication that the current exuberance in U.S stocks may well be largely driven by U.S and Japanese stimulus funds reaching equities given that market interest rates in the two regions remain close to zero. Hence, the positive sentiment shown in U.S equity markets may not necessarily be driven by prospects of real economic growth given that U.S industrial production is down 0.5% in April and jobless claims increased according to latest Federal Reserve’s data.

Turning back to the activities at the Colombo bourse the turnover during the week was mainly assisted by Banking and Diversified sector counters which received special preference by foreign market participants. Heavy institutional involvement was also seen in these counters while retailers focused more on small and mid cap stocks with the aim of reaping short term returns.

The highest contribution to the week’s turnover was made by Commercial Bank accounting to circa 24% of the weekly turnover while heavy weight John Keels Holdings contributed to 12.5%. During the week crossings were also recorded in counters such as Royal Ceramics, Cargill’s Ceylon, Hatton National Bank, Distilleries Company and Sampath Bank. On the back of these developments, the week saw an average turnover of LKR1.2bn and an average volume of 31.1mn.

Furthermore, Amana Takaful, Commercial Bank, Overseas Realty, Seylan Development and Panasian Power topped the list in terms of volume traded during the week.

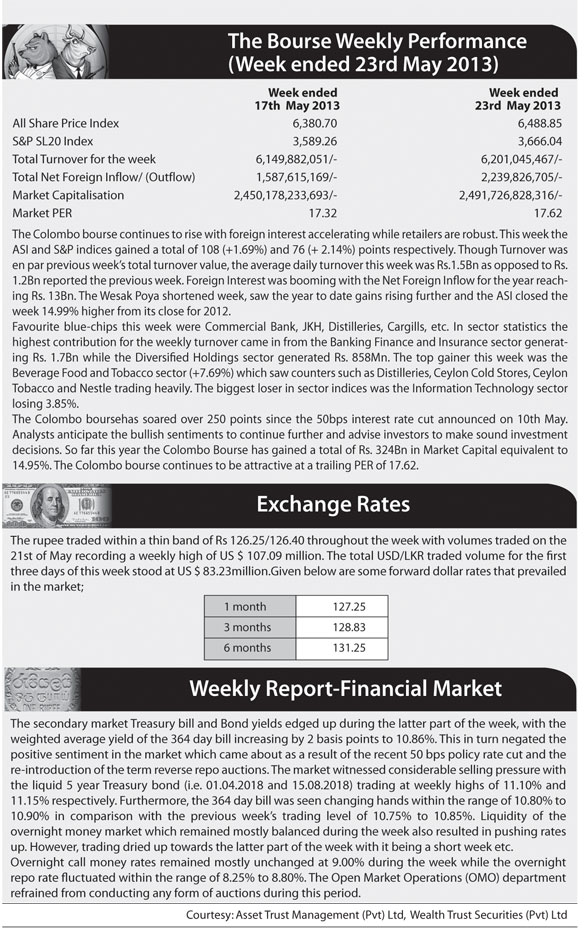

The week saw foreign purchases amounting to LKR 2,486.8 mn whilst foreign sales amounted to LKR 582.3 mn. Market capitalisation stood at LKR 2,491.7 bn, and the YTD performance is 15%.

Conclusion:

Bourse continues to rise in value with majority of the counters reaching their 52 week peak...

The Colombo bourse commenced the week on a positive note gaining considerably, however the momentum gradually slowed down towards mid week owing to profit taking witnessed across the board. Conglomerate giant John Keells Holdings which made hefty gains over the past weeks reached its all time high of LKR299.80 during the week and also witnessed its market cap reach the UDS2bn mark, accounting for c. 10% of the total market capitalization. Majority of the large cap counters including banking and diversified counters encountered crossings during the week supported by institutional and foreign interest, whilst the counters witnessed substantial price gains. Further, retail play too was heavily observed on selected counters.

Meanwhile, Standard Charted Bank expressed its concerns over the policy rate cut indicating that the 50bps cut in key policy rates exceeded their expectation of 25bps and was too aggressive considering the economic challenges and issues faced by the country. It further stated that it has revised the country’s projected GDP growth for 2013E to 6.5% from 6.7% due to the weak export performance in 1Q2013. The bank also raised concerns over the country’s ability to maintain a desirable level of inflation and it expects the inflation to rise during 4Q2013 due to the expected increase in demand from the private sector investment resulting from low interest rates. On this backdrop, we urge the investors to align their portfolios towards a medium to long term time horizon focusing on fundamentally sturdy counters which we believe will be less volatile even if the market is to face a correction due to short term profit taking.

Source: Asia Wealth Research

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home