Diversification is one of the central concepts in investments. The theory says that your money should not be locked in any one asset. It should be split to buy different types of assets like land, shares/mutual funds, gold, FD’s etc. The reason is quite simple – no asset class can keep delivering profits year after year consistently. That’s because, every asset moves in a cyclical trend. There will be exceptional growth in some years and then it will be followed by sluggishness. This phenomenon is true in almost every assets class. So, if your investment is in a single asset, you make money only if that asset increases in value and at the same time, you also miss the chance to participate in any other asset boom. Hence, the risk you take is high. For example – what would happen if you’ve put all your money into stocks and the stock market tumbles?

The way to reduce such risks is to diversify your money into various assets. In fact, diversification is one of the cardinal rules of investments.

TWO LEVELS OF DIVERSIFICATION

Diversification should be considered at two levels-

Level one – Diversifying between major asset classes.

Level two- Diversifying within the same asset class.

Level 1.

At the first level, your money should be diverted into various assets which are not correlated. For example – if you have 60% of investments in stocks, then it’s not a good idea to park your balance 40% in mutual funds or stock market related instruments since, when stock markets crashes, such assets drop in value. It happens because these assets are indirectly connected to the stock market. Instead, bonds or fixed deposits may be a good option since these assets tend to perform well when there’s a market crash.

Level 2.

One more level of diversification is required-this time it’s within the asset class. For example – if you have decided to diversify some amount into real estate, it is better to buy 2 plots at two different places rather than locking up your funds in one huge property. Or if you are planning to invest in stocks, its better buy a mix of large caps, mid caps and small caps in different sectors.

DO NOT GET INTO TROUBLE.

You have to diversify and make sure that your funds are in different baskets. Fine. But that does not mean that you should put your money into as many baskets as possible!! That results in over diversification. An over diversified portfolio would be very hard to monitor. Periodic monitoring of your investments and re-balancing of investments between various asset classes is necessary to keep your portfolio growing. Hence, while diversifying your portfolio, it is important to keep the number of asset classes at a manageable level.

HOW TO ALLOCATE YOUR MONEY?

The basic idea of diversification is to have different kinds of investments. That means you should have some or all of the following assets in your kitty-

Stocks.

Bonds and Fixed deposits.

Real estate.

Cash.

Gold.

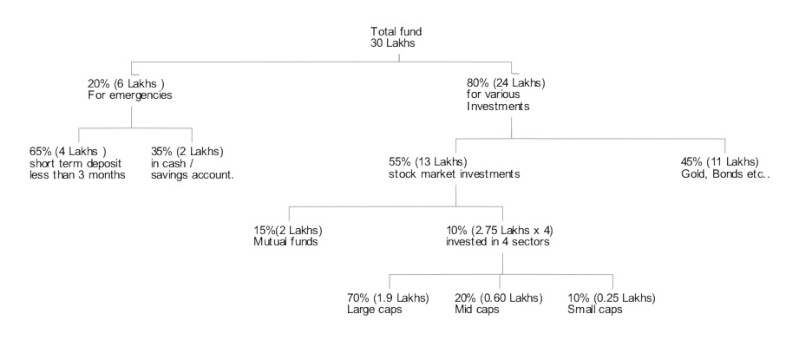

Here’s an illustration:

Step 1:

The first step is to set aside some amount in cash so that you can meet any emergency. It’s basically an emergency fund. How much would be required depends from person to person. Let’s assume that you need 20% of your money as emergency fund. Out of this money 65% can be kept in short term deposits ( for example 2 or 3 month fixed deposits) and the balance 35% in liquid cash.

Step 2:

As a next step, subtract your age from 90 and invest the resulting percentage in stocks. For example if your age is 35, invest 55% (90-35) of the remaining fund in stocks.

Step 3:

The balance 45% can be invested in bonds, real estate or gold.

Step 4:

Now, within that 55% invested in stocks, you need to diversify further. You cannot invest all your money into one stock or sector. You have to choose 4 or 5 independent sectors to invest. For example, you can consider investing 10% in an industrial giant like Tata, 10% in Pharma sector, 10% in banking, 10% information technology and 15% in mutual funds.

Step 5:

Since you are going to invest 10% in a particular sector, you need to make one last diversification. Every sector consists of large caps, mid caps and small caps. Depending upon the risk you’re willing to take, you need to split that 10% across various market caps. 70% in large caps, 20% in mid caps and 10% in small caps would be a decent split.

Now, assuming that you are 35 years old, let’s have a look at your portfolio, if you had 30 lakhs to invest:

You would have kept 6 lakhs as emergency fund, out of which 4 lakhs earn short term interest and the balance earn interest at savings bank rate.

Out of the balance 24 lakhs, 13 lakhs will be invested in equities.

The remaining 11 lakhs in a mix of gold, fixed deposits or bonds (in all probability, this should give an average annual return of 9 or 10 %.)

Out of the 13 lakhs set aside for equities, 2 lakh moves to mutual funds and the balance 11 lakhs across 4 different sectors at 2.75 lakhs each.

Out of that 2.75 lakhs in one sector, 1.90 lakhs will be invested in large caps 0 .60 in midcaps and the balance 0.25 in small caps.

If we draw a graph, it would look like this:

That was a general example. The ratio of diversification depends on a person’s risk bearing capacity, age, financial goals, amount of funds invested and many other personal factors. There are also many other asset classes like arts and antiques which can be considered for diversification provided you have good knowledge in it’s valuation.

It’s important for everyone to sit with an investment consultant and draw up a plan like this.

http://www.sharemarketschool.com/principle-22-diversify-your-investments/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home