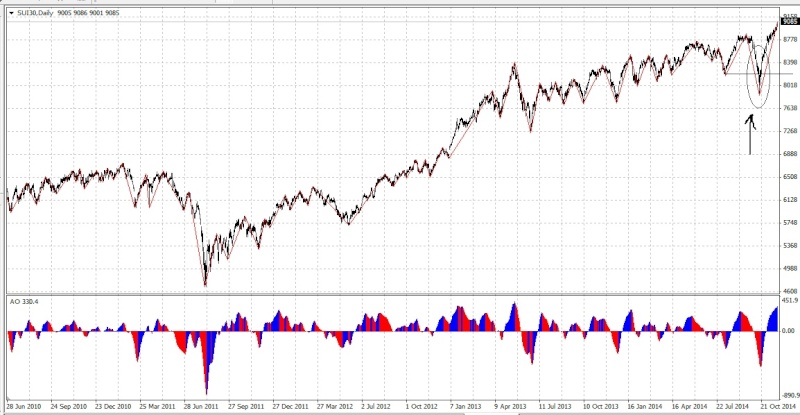

If you're in profit in can collect some and others can adjust their PF. Don't get panic, and loose your hard earned money. Foreigners're continuously buying. And CSE has to go a longway in next 2-3 years exceeding the 10,000 level of ASPI. Thus the market is not going in a straight line, instead its zigzag. Wait for the right time to sell if you want, otherwise you may sell at low and buy at high. A bull or bear sentiment has to be fade step by step not from a couple of days...

Be a Rational investor who do not drived by emotions and others.

බොරුවට කලබල කරලා කරන, එක එකාගේ plan වලට අහුවෙන්න එපා...

" Letting your emotions override your plan or system is the biggest cause of failure. So, If you can't deal with emotion, get out of trading. "

- J. Welles Wilder

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home