CLAIM

Investing in Govt. securities today riskier than Greece bonds

RATING

ORIGIN

Article published in Daily Mirror dated 2017-08-26

Investing in Govt. securities today riskier than Greece bonds

Former Central Bank Governor Ajith Nivard Cabraal said an investment today in the Sri Lankan Government Securities such as Treasury Bills, Treasury Bonds, Development Bonds, and International Sovereign Bonds pose a much higher credit risk than that faced by those who invested in Greece Bonds in April 2011.

“Further, it is also to be noted that in April 2011, when the Central Bank invested in the Greece Bonds, the international credit rating of Greece was BB+ which was 3 notches higher than Sri Lanka’s current rating of B+ (negative).”

http://www.dailymirror.lk/article/Investing-in-Govt-securities-today-riskier-than-Greece-bonds-135388.html

__________________________________________________________________________________

Published on ECONOMYNEXT dated Mar 08, 2017

Sri Lanka’B+’ rating confirmed by S&P; negative outlook unchanged

http://www.economynext.com/Sri_Lanka_B+__rating_confirmed_by_S_P;_negative_outlook_unchanged-3-7510-1.html

__________________________________________________________________________________

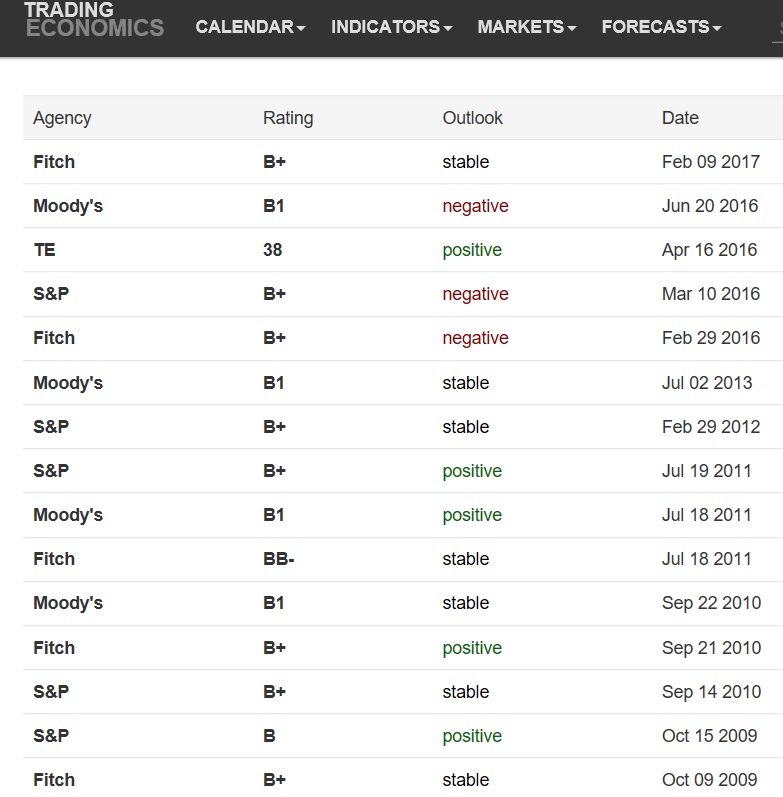

Sri Lanka | Credit Rating

Standard & Poor’s credit rating for Sri Lanka stands at B+ with negative outlook. Moody’s credit rating for Sri Lanka was last set at B1 with negative outlook. Fitch’s credit rating for Sri Lanka was last reported at B+ with stable outlook. In general, a credit rating is used by sovereign wealth funds, pension funds and other investors to gauge the credit worthiness of Sri Lanka thus having a big impact on the country’s borrowing costs. This page includes the government debt credit rating for Sri Lanka as reported by major credit rating agencies.

https://tradingeconomics.com/sri-lanka/rating

__________________________________________________________________________________

Greece | Credit Rating

Period between 2010 – 2011

https://tradingeconomics.com/greece/rating

_________________________________________________________________________________

Sri Lanka Fitch Credit Rating as of March 2017 is B+

Greece Fitch Credit Rating as of January 2011 is BB+

Investing in Govt. securities today riskier than Greece bonds in January 2011

https://factchecksrilanka.com/2017/08/26/investing-in-govt-securities-today-riskier-than-greece-bonds-rating-true-and-correct/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home