Jana1 wrote:

Thanks for your post.. Just I wanna clarify 1 thing,

Ididn't go more depth with CITK and CITW ipo prospectus. Why CITK's introductory price was 17 and CITW was 12 whilst both has same asset value? And y do u prefer CITW over CITK as both expected dates are by 2015 (according to prospectus)

You are correct, in both, promoters paid 10/- per share.

Without going into specific details we can see Kalpitiya is a huge project compared to Waskaduwa, although their estimated costs are same.

At the time of IPOs CITK had more interest & value than CITW..They showed a good u/r capital gain from CLND investment for CITK. CITW had nothing like that.

I think the real value is in the extent of the land, costs of lands and different in their long term prospects.

CITW build on 8 acres, CITK has 80 Acres. It is very difficult to find that much of land in a beachfront anywhere in the region.

At Waskaduwa they paid approx. 300,000 per perch. For Kalpitiya the land was bought @ 30,000 per perch.

I think if you revalue 80 acres in Kalpitiya after they developed it into a star class hotel area you get higher value addition. They have the land to build and sell 50 villas in addition to 150 room hotel in CITK.

And y do u prefer CITW over CITK as both expected dates are by 2015

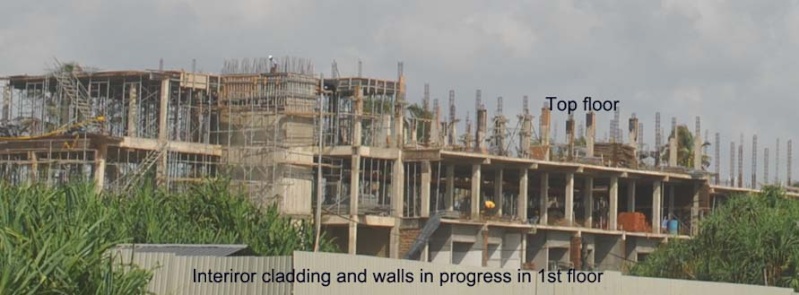

Although they planned that way, now we know Waskaduwa will be in operation about 2 years before Kalpitiya.

Hence, -if not CLND factor- we can forget CITK and buy CITW expecting a fair return in about 1 year and then go to CITK when they start clearing the jungle and removing the cow-dung in that marshy land.

Due this unusual CLND investment, people expect a sudden impact on CITK even before they start construction.

Because of that, now I want to hold both in equal quantities.

Personal answer to the same question is , I got unrealized return from CITK due to recent price appreciation, I sold part of that and settled the broker credit I utilized to buy CITW last month.

---

NOTE:

Due to the circumstances I talked much about this REEF group here and there. Please note my main interests are with some other stocks and I do not allocate over 15% of my funds for any particular group of companies.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home