- Reverses decision given in May 2020

- Banks can pay dividends after finalising annual accounts

- But calls for banks to be vigilant of capital requirements under Basel III

- Capital expenditure, non-essential expenses, payments to directors still restricted

Central Bank in its latest circular has reversed a decision given in May last year and allowed licensed commercial and specialised banks to pay dividends post-finalisation of annual accounts, which typically takes place around February.

In May 2020, the Monetary Board of the Central Bank of Sri Lanka restricted the payment of cash dividends by banks until December 2020 due to the initial concerns of liquidity and capital adequacy being impacted by COVID-19.

However, the latest set of instructions to banks indicate that the Central Bank does not consider these to be major concerns. Central Bank Governor Prof. W.D. Lakshman speaking to reporters on Tuesday was confident of the soundness of the banking system and growth of private sector credit in 2021.

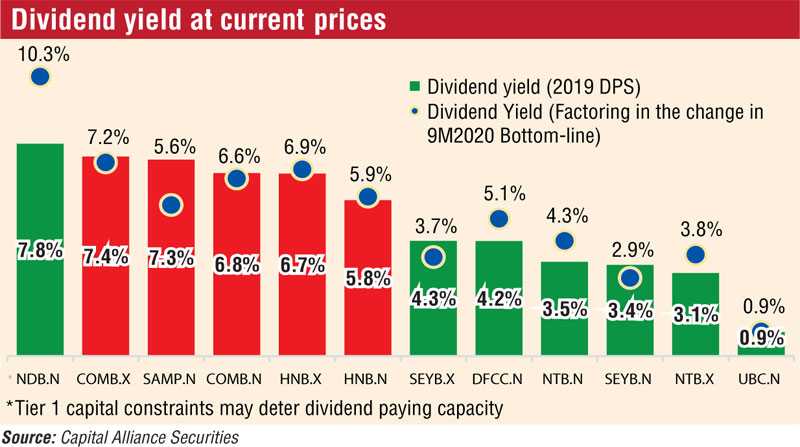

On the same day the Central Bank said licensed commercial and specialised banks could pay dividends after their financial statements have been finalised by the respective external auditor. Analysts noted that this will likely result in banks paying dividends from February onwards and is likely to give a boost to banking shares, which was borne out during trading yesterday.

However, the Central Bank called on licensed banks to take into account capital requirements under Basel III, expected asset growth, business expansion and the impact of the pandemic when deciding on the payment of the cash dividend.

“Licensed Commercial Banks shall also refrain till 30 June 2021 from buying back its own shares, increasing management allowances and payments to Board of Directors, exercise prudence and refrain to the extent possible from incurring non-essential expenditure such as advertising, promotions, gift schemes, entertainment, sponsorships, travelling and training.”

The circular also insisted banks exercise due diligence and prudence when incurring any capital expenditure.

Fitch ratings in special report titled ‘Sri Lanka Banks Report Card 2020’, released in December warned sluggish economic activity, external and domestic vulnerabilities, muted private credit growth and the sovereign’s weakened credit profile are significant downside risks to the operating environment for Sri Lankan banks.

“We lowered our assessment of the operating environment score for Sri Lankan banks to ‘CCC’ with negative outlook from ‘B-’ with negative outlook, after the Sri Lanka sovereign rating was downgraded to ‘CCC’ from ‘B-’ in November 2020. The weaker sovereign credit profile could affect the banks› operating environment, which is already weak due to the coronavirus pandemic,” the statement said.

Fitch expects heightened operating environment risks to manifest primarily in the banks’ financial profiles, with asset quality and profitability likely to be the most impacted.

Fitch-rated banks impaired (stage 3) loan ratios have been rising (9M20: 10%, 2019: 9.4%) despite the spate of relief measures announced by the Central Bank of Sri Lanka for borrowers as well as banks in terms of bad loan recognition.

“We expect this trend to continue in to 2021, albeit at a slower pace. Deteriorating asset quality and the associated higher credit costs are expected to keep banks’ profitability lower in 2021 than pre-2019 levels, despite improvement from 2020 profitability.”

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home