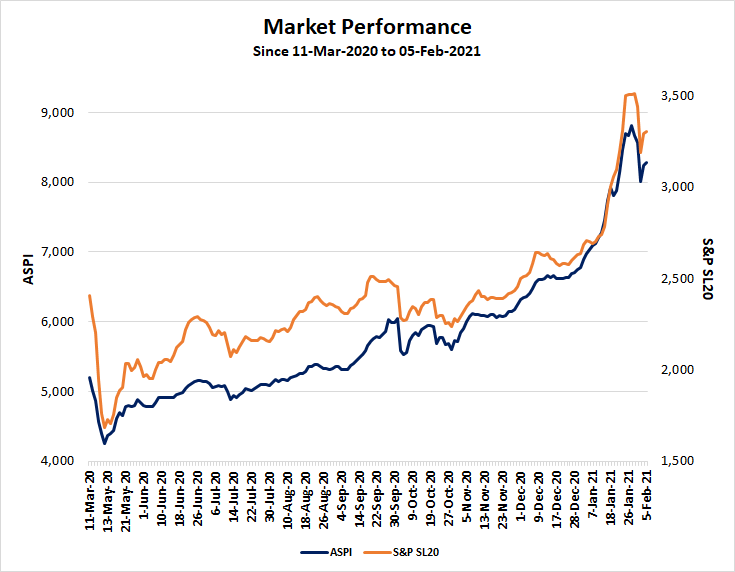

The Colombo Stock Exchange (CSE) said yesterday the All Share Price Index (ASPI) has retained its position as the best performing primary stock market index in the world with the index closing trading on 5 February at 8,275.37 points, marking a 22.16% growth year-to-date (YTD).

According to CSE research, the ASPI as at 5 February has recorded greater percentage growth than any other primary index globally in 2021.

The S&P SL20 index, which includes the 20 largest and most liquid stocks closed the week on 3,304.30 points, marking a 25.25% growth so far in 2021 YTD.

The ASPI maintains its top position in terms of YTD growth amidst recording its highest daily points drop in history on 2nd February 2021, with a drop of 561.75 points within the trading day. The ASPI and S&P SL20 index gained by 3.37% and 3.67% respectively in the two market days since, to end the week on a positive note. This positive performance has also resulted with Rs.118 billion in value being added to the market capitalisation in the two market days since 2 February.

The world-beating performance of the ASPI is consistent with noteworthy levels of trading activity recorded in the Sri Lankan stock market in 2021. The total turnover of Rs. 227.8 billion recorded within the first 22 market days of 2021, is already higher than the full-year figures recorded in 2012, 2013, 2016, 2017, 2018 and 2019. The highest annual turnover of Rs.570.3 billion was recorded in the year 2010.

CSE Chief Executive Officer Rajeeva Bandaranaike said: “The resurgence of the Sri Lankan stock market has taken place during a period of unprecedented challenges, sparked by a global pandemic. While the ASPI has had setbacks since COVID-19 was declared as a pandemic by the World Health Organization on 11 March 2020, the compelling characteristic of the Sri Lankan stock market during the period, has been its ability to rebound and maintain an upward trajectory.

“It is important to note that local investor interest and engagement has been a great strength to the Sri Lankan stock market, at a time when Asian and frontier market equities have experienced foreign capital outflows in-line with global investment trends.

“The ASPI rising during this period and continuing to be one of the best performing indices in the world is a positive development for investors, all stakeholders in the Sri Lankan capital market and for Sri Lanka. Investing in shares of listed companies will remain to be a viable option for local investors as we move forward.

“As the global economy recovers from the impact of COVID-19 and foreign capital flows into frontier markets return, the progress achieved during this period will place Sri Lankan equities in a strong position to potentially attract the interest of foreign investors and further consolidate on this growth.”

http://www.ft.lk/front-page/CSE-says-ASPI-continues-to-be-best-performing-primary-index-globally-in-2021/44-712814

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home