“A company dances to the will of dominant shareholders shows nothing but the tragic fate of everyone concerned with the company including the majority shareholders themselves”

The shareholder regime that exists in Sri Lankaas in most of the other developing countries is known as controlling shareholder regime, where a large block-holder controls the corporation by owning a majority of shares. According to the majority rule which laid down in the caseFoss v Harbottle the decision of the majority shareholders will prevail over minority shareholders and the minority shareholders are required to accept the decisions made by the majority shareholders.

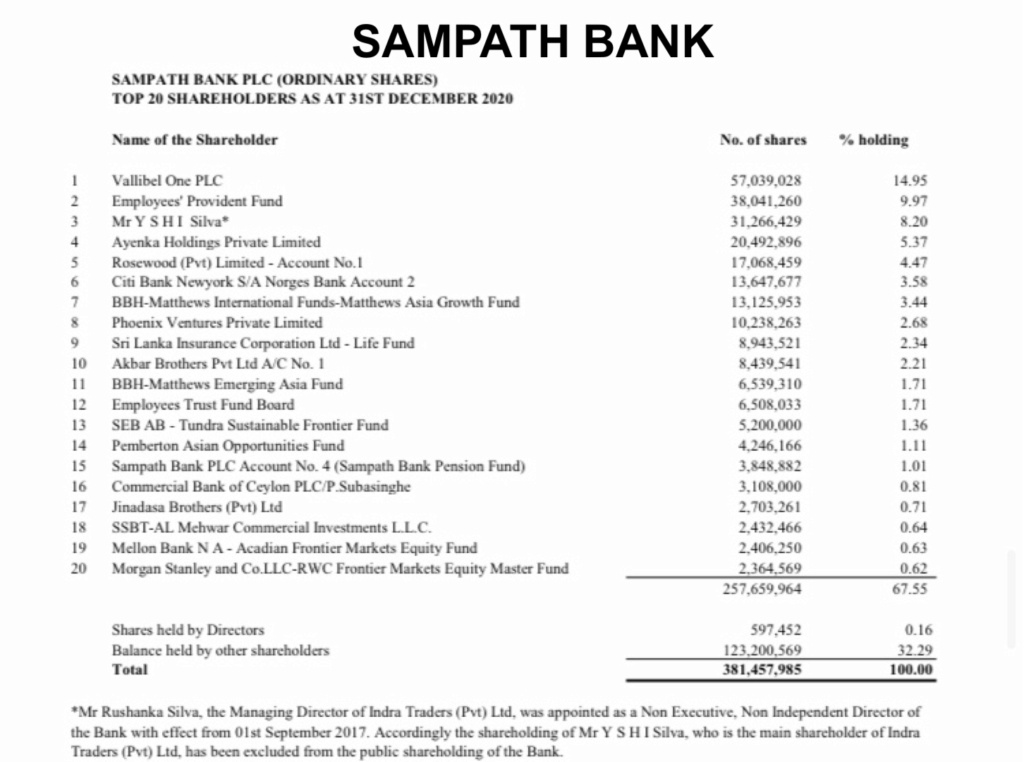

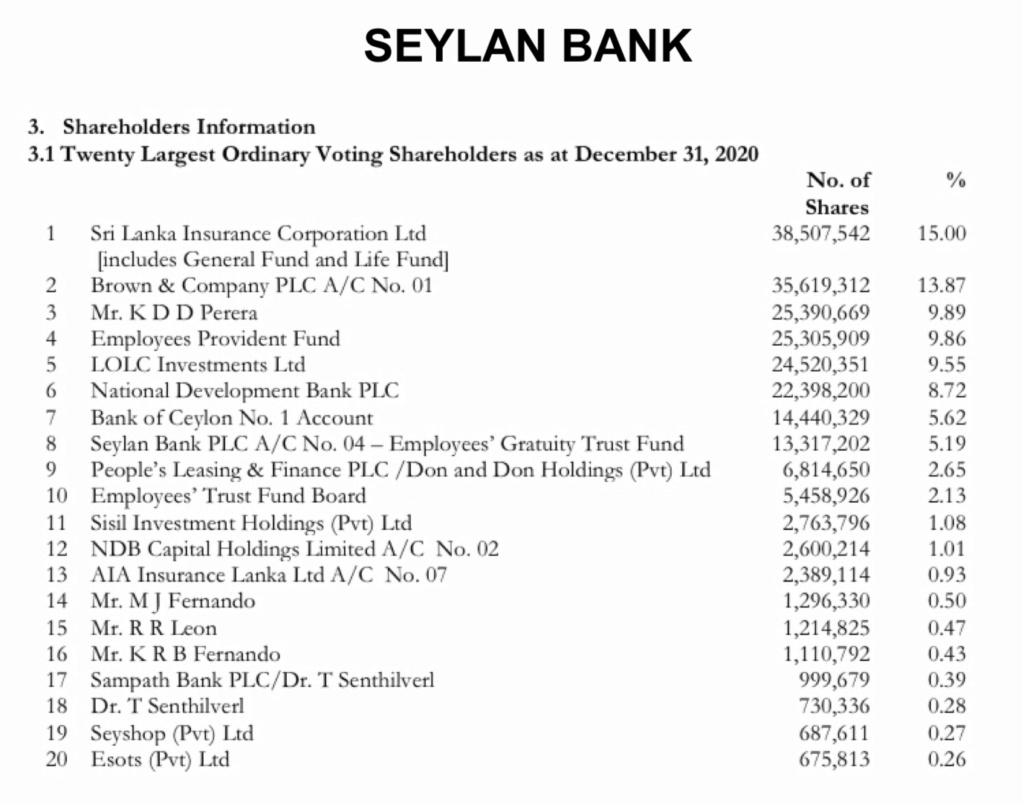

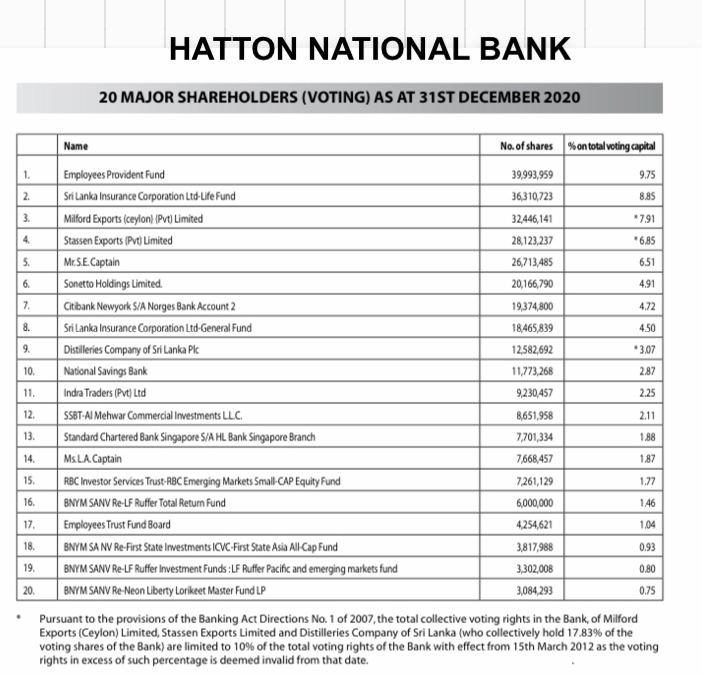

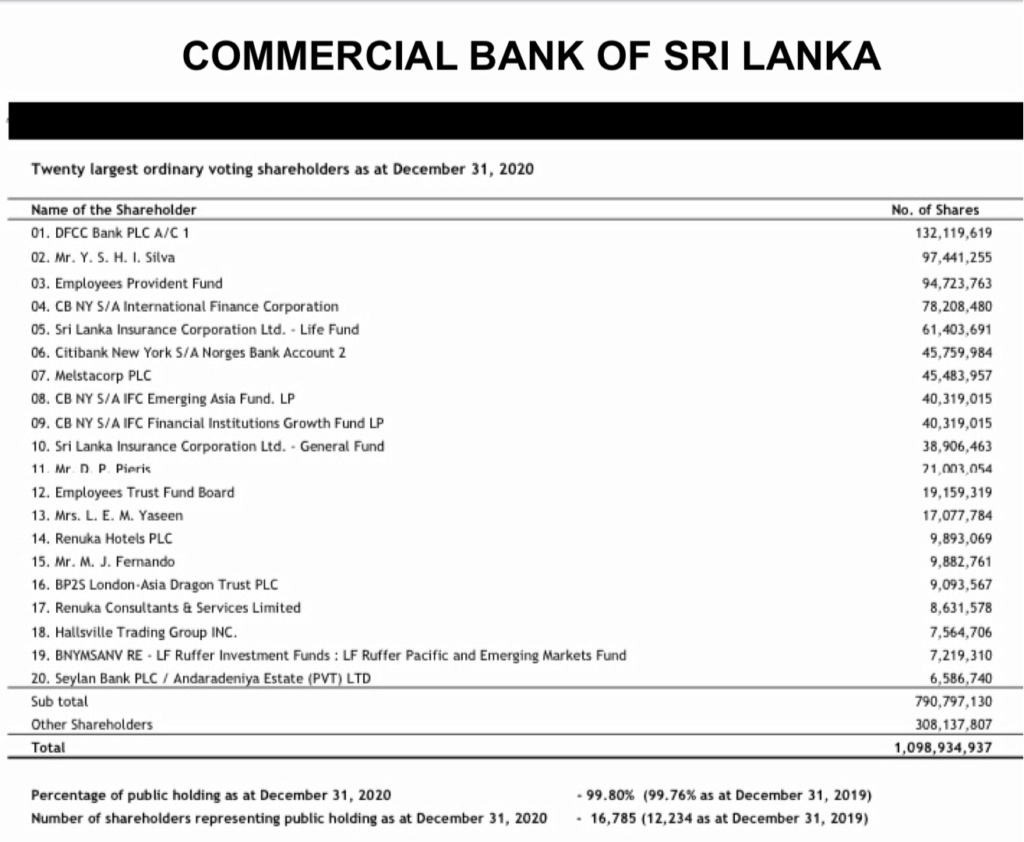

ikewise most of the banks are dominated by an individual person, family members, relatives or separate corporate entities belonging to the same individual. Usually in Sri Lanka 80-20 rule of ownership applies with regard to the banks where the 80% of the shares are held by 20% of the shareholders and the remaining 20% of the shares are held by 80% of the shareholders. Further the majority shareholders may form different companies both regulated and unregulated under their direct or indirect ownership to make a control pyramid to confer power over the bank.

This regime is on hand beneficial. The concentrated ownership is beneficial for corporate valuation, because large shareholders are better at monitoring managers (Jensen and Meckling). Notwithstanding the benefits this model may adversely affect the interests of other stakeholders, the corporation and the economy as a whole as there is the tendency of dominant shareholder abusing his dominant position.

Usually in Sri Lanka where the Boards of Directors are also consistedof close alliances of the dominating shareholdersit acts not in the interest of the company, but in their own individual interests which will be detrimental to all other stakeholders of the bank.

In these two banks board meetings, annual reports, and other corporate governance mechanismsdid not serve its intended purposes rather they had been ceremonial and a marketing mechanism. Therefore eventhough Sri Lanka has necessary laws to control the conduct of the directors and make them accountable to the shareholders they are being crippled in the traditional ownership context in Sri Lanka.

B. The weak role of the minority shareholders

'Get up, stand up, stand up for your rights. Get up, stand up, Don't give up the fight’.

-Bob Marley

The second basic reason for the failures in the corporate governance in Sri Lanka is the poor role played by the minority shareholders. Even though they are provided with the mechanisms to protect their rights they are reluctant to resort to such mechanisms. One of the basic reasons behind this is the higher legal costs that a plaintiff will have to bear in the Sri Lankan legal context. The second reason is the lack of faith on the part of minority shareholders on the judicial system in Sri Lanka which was exceedingly under the influence of the executive in recent past.

Due to these reasons there is no proper implementation of the existing minority shareholder protection mechanisms and where there is no implementation the laws are of no value.

“When the director board consists of family members the company affairs become family affairs’

In the controlling shareholder regimes the majority shareholders may take various steps to retain the power within them. One of the basic methods of achieving this purpose is forming a board of directors consisted with family members and friends. The examination of the annual reports of the banks disclosed that approximately 80% of the banks are controlled by the family members. The chairman, CEO and the members of the board usually belong to the same family and the Chairman and CEO positions were generally held by the same individual regardless of the existing laws and regulations.

Further there is a huge gap between the annual and corporate governance reports of the bank and the reality. The inspection of these reports revealed that the corporate ownership structure is not properly revealed in the reports. There are many in-law relationships, friendships and other alliances between and among the majority shareholders and directors (including non- executive directors) which are unknown to the shareholders or public and which cannot be traced from the annual or corporate governance reports of the banks

In summary the political influences and family affairs continue to affect the corporate governance legal structure in Sri Lanka relating to banks which is particularly supported and strengthened by the ignorance or unwillingness on the part of other stakeholders to compel the banks to comply with the laws and regulations.

Empowering Minority Shareholders.

The excessive powers held by the majority shareholders shall be controlled, checked and balanced in such a manner that they will not be able to abuse their dominant position. Minority shareholders shall be made aware and encouraged to resort to minority shareholder protection mechanisms conferred by the law.

http://www.kdu.ac.lk/proceedings/irc2015/2015/law-012.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home