Renewed Optimism

Surmounting unexpected challenges has been the order of the day in 2020. Unfortunately, all business problems impact us in different ways, ranging from demotivation to rejuvenation. At Asia Capital, we chose to remain in the optimistic spectrum as we strive to overcome new obstacles with innovative strategies and solutions. This has kept us resilient in the past and will drive us in the future.

Whilst we endeavour to remain buoyant and enthusiastic in the face of calamity and catastrophe as a team, we never lost sight of our responsibility to our stakeholders and indeed to ourselves to grow and develop our conglomerate of companies. Towards this end we have been persistently dynamic, rethinking our plans and revisiting our tactics whenever necessary, yet maintaining our position of stability and steadfastness of resolve as we move forward.

With the vaccinations programs rolling out across the country and the government introducing economic stimulus packages, ACAP’s Corporate Advisory unit is optimistic about a gradual economic revival in 2021 with sectors such as Tourism, Real Estate and Services expected to generate new business opportunities as things return to some form of normalcy.

Given the expected buoyancy in the capital markets and to leverage on ACAP’s strengths in capital markets, the management has focused on a strategic re-alignment to venture into stock broking business. The proven track record of ACAP in stock broking sphere is expected to be instrumental in the success of this new business venture. Therefore, the strategic focus for the short to medium term will remain firmly aligned to the development of the stock broking business, where the Company will actively seek greater institutional and high net worth participation. In the long run, the Company will place strategic emphasis on securing mandates in the financial advisory space by pursuing growth opportunities in sectors which are anticipated to thrive in the years ahead. In addition, it will continue to work diligently with the Group subsidiaries in order to strengthen their operations and to seek growth opportunities.

Chairman’s Statement

THE KEY HIGHLIGHT OF THE YEAR WAS THE COMPANY’S ACQUISITION OF A MAJORITY STAKE OF NAVARA CAPITAL PARTNERS LTD (NCPL) AS PART OF OUR DIVERSIFICATION PLAN BECAUSE OF THE INCIDENTAL RISKS OF CONFINING TO A LIMITED NUMBER OF BUSINESSES. THE GOAL OF THIS

STRATEGIC MOVE IS TO RE-ENTER THE STOCK BROKING BUSINESS AT A TIME WHEN CAPITAL MARKETS IN SRI LANKA SHOWED RESILIENCE AND PROMISE.

The financial year 2020/21 was riddled with difficulties simply due to the devastating impact the pandemic had with the resultant impact on the Sri Lankan economy and for that matter of the world.

Given the bans on international travel and various lockdowns from time to time, the Tourism Industry was negatively impacted at unprecedented levels. With no revenue being generated the Company had to take various cost cutting measures at every level although staff remuneration reductions were kept to a bare minimum as the Company recognised its employees are their most valuable asset.

The key highlight of the year was the Company’s acquisition of a majority stake of Navara Capital Partners Ltd (NCPL) as part of our diversification plan because of the incidental risks of confining to a limited number of businesses. The goal of this strategic move is to re-enter the stock broking business at a time when capital markets in Sri Lanka showed resilience and promise.

With international tourists almost absent and local guests down to a mere trickle, drastic cost reduction methods were necessitated to soften the financial impact. All hotels operated with minimum number of employees while the corporate office team switched to working from home thereby ensuring their safety and minimising operational costs. Asia Leisure hotels rapidly responded to the changing requirements of the pandemic by obtaining the KPMG Sri Lanka’s Safe and Secure hotels certification which enabled us to deploy various safety protocols at all our hotels as per the required health guidelines. In this way the necessary preparations were anticipated and addressed to revise when the opportunity arises.

Meanwhile, the Corporate Finance Department had to change its approach during the year by pivoting towards advising Group subsidiaries on strengthening and streamlining their operational efficiencies to meet the obvious challenges.

With the COVID vaccination program reaching unprecedented levels we are hopeful to see light at the end of the tunnel in the not too distant future when business could reach normalcy as it has done in some European states. Accordingly, we must not be disheartened and pessimistic but see how we can emerge when the time and the opportunity arrives.

I like to take this opportunity to extend my thanks to my fellow directors for the cooperation they extended and to the staff for their commitment. We have no option but to await and wish for better times.

J.H.P. Ratnayeke

Chairman

25th August 2021

Review of group operations

IT IS CLEAR THAT THE FINANCIAL YEAR 2020/21 WILL GO DOWN IN HISTORY AS ONE THAT WITNESSED UNPRECEDENTED UPHEAVALS AND BUSINESS CHALLENGES PRIMARILY DUE TO THE COVID-19 PANDEMIC THAT BROKE OUT IN EARLY 2020 AND CONTINUES TO ADVERSELY INFLUENCE EVERY ASPECT OF OUR LIVES EVEN TODAY.

It is clear that the financial year 2020/21 will go down in history as one that witnessed unprecedented upheavals and business challenges primarily due to the COVID-19 pandemic that broke out in early 2020 and continues to adversely influence every aspect of our lives even today. Following the horrific Easter Sunday attacks of 2019, Sri Lanka has undergone a dark period of uncertainty from which the country seemed to be emerging in early 2020 until the pandemic struck. The pandemic brought the healthcare systems and economies of virtually the entire world to a standstill, disrupting international travel and trade as well as local supply chains. The global economic downturn triggered by the pandemic saw the Sri Lankan economy contracting by 3.6% in real terms in 2020, highlighting the impact of the difficulties faced by the country during the year. It was a nightmare scenario for a large majority of industries while a minority benefitted to a great extent. Unfortunately, ACAP is not in that minority as the principal activities of the Group include corporate finance, asset management, treasury management, dealing and investing in securities, financial services and operating hotels.

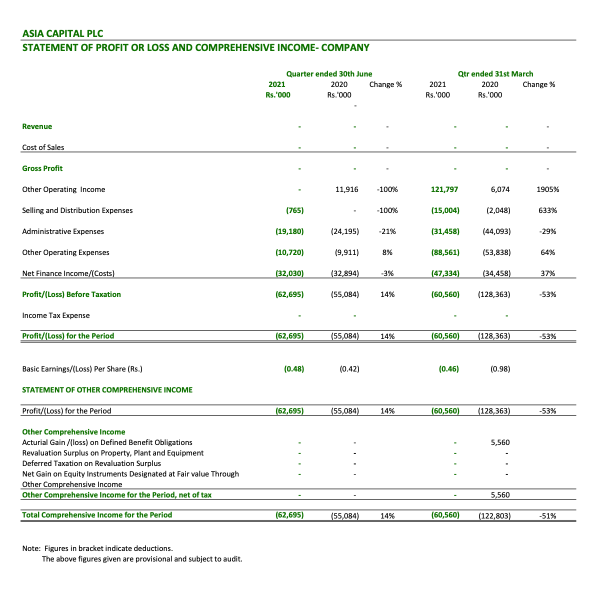

FINANCIAL PERFORMANCE

REVIEW OF OPERATIONS

While the debt moratoriums introduced by the Government have certainly had a positive impact, it must be taken into account that such moves are only temporary solutions to the ever-increasing burden of debt management. This is one of the main reasons for the Group to exit the smaller high debt ratio properties during the year and focus on larger properties that have a lower debt ratio.

The fast-changing, uncertain nature of the economic landscape allowed ACAP management to relook and focus on Asia Capital’s investors to financially re-engineer the asset base. In December, as part of our expansion plan, ACAP entered into a share purchase agreement to acquire 70% stake of Navara Capital Partners Ltd. (NCPL) with the aim of re-entering the market and recommencing stock brokering business at a time when capital markets in the country were performing well due to policy certainty prevailing in the current economic landscape of the country. ACAP acquired 3,536,400 ordinary voting shares representing 70% of NCPL held by Navara Capital Ltd. as per the agreement entered by both parties. While we hope to commence operations of the new venture towards the latter part of 2021, the management will continue to focus on expanding into new business avenues to broad base the Group’s revenue streams.

TRAVELS

The global ban on international travel meant that our Travels business also suffered a substantial drop in revenue. Due to the lockdowns and general reluctance to travel around the country, the office was closed for large parts of the year as the staff operated from home. After the first lockdown, the Travels team was able to put together innovative social media campaigns targeted at local travellers with business, channelled directly to Asia Leisure hotels.

Tourism was almost non-existent during the year under review as the bans on international travel and lockdown from March 2020 onwards meant that all our Travels and Hotels businesses were significantly affected. The local travel that took place when the first lockdown eased in June resulted in some revenue to the hotels. However, with revenue streams severely restricted, the key focus during the year was on cost reduction on all fronts. Although staff remuneration was one area that many companies in the country looked towards when considering cost reduction, at ACAP, significant efforts were made to refrain from reducing salaries and laying off employees although as the pandemic wore on, some adjustments were inevitable given the gravity of the situation. Overall, through prudent cost cutting measures, the Group was able to reduce operating expenses by 46%.

PROJECT OPERATIONS

Although there was a marginal recovery after the Easter Sunday attacks, the disruption caused by the COVID-19 pandemic was unprecedented for project development as reduced productivity and lack of focus complicated the business environment for project development considerably. Curfews, travel restrictions and socially distancing affected the operations at construction sites, negatively impacting project completion deadlines. Additionally, there was an increase in costs due to the need to adhere to special health guidelines and a result of reduced efficiency.

447 Luna Tower has reached 92.3% overall working progress with the key highlight during the year being the completion of the super structure and building facade. Currently, the finishing works are being attended to with an overall project completion target of October 2021. Marine Drive Hotel has achieved 97.23% overall working progress with the key highlight being the completion of the super structure. The finishing and interior works are currently being attended to and the expected project completion deadline is December 2021. Meanwhile, the Galle Beach Hotel project has entered its final phase with the super structure being completed. This final phase, which included the commissioning of the finishing works, commenced towards the end of the Financial Year 2019/20 and is expected to be completed by end 2021.

LEISURE

During the first lockdown period, far-reaching cost reduction methods were introduced, and all hotels were operated with minimum number of staff members. The corporate office activities were carried out remotely to ensure the safety of employees and minimise the operational costs. During this period, all Asia Leisure (AL) hotels were certified by KPMG Sri Lanka as Safe and Secured hotels. Accordingly, numerous safety protocols were established at all AL hotels as per the required health guidelines. Overall, with the announcement of closure of international borders in mid-March 2020, AL was hit with a large number of cancellations for future reservations as well as weddings amounting to over USD 175,000. Despite the challenging circumstances, AL was able to successfully maintain the high-quality standards resulting in the customary high rankings on Trip Advisor and Booking.com.

As a strategic restructure, during the year ACAP has disposed its investment in Shinagawa Beach Resort (Pvt) Ltd by swoping majority shares of Beach Resort Kosgoda (Pvt) Ltd (The Habitat Hotel) in order to maximise benefits to the shareholders.

CORPORATE ADVISORY

The repercussions of the pandemic meant that Corporate Finance Department had to refine its approach during the year. Resultantly, the Corporate Finance Department spent a majority of the financial year advising Group subsidiaries on strengthening their operational efficiencies while also searching for avenues of business growth, enabling ACAP to venture into new fields. The Department focused on identifying the critical measures that were needed to streamline the operations of the Group’s subsidiaries and support them to alleviate the impact of the pandemic.

One of the approaches taken by the Group to minimise the loss of valued employees was the reallocation of staff to different areas, primarily the Head Office staff to the new securities business. One of the main positives in expanding to a domain where we have experience in is that the Group readily has a number of employees with the qualifications, experience and expertise to take the business forward rapidly. Therefore, there is no requirement to recruit new staff, and this in return helps the Group to maintain the current cost structure while increasing our revenue streams.

The Parliamentary Elections of 2020 resulted in the strengthening of the Government’s position due to the 2/3rd majority obtained. This is a much-needed positive development for the country as such a stable Government is a prerequisite for the establishment of consistent, long- term economic policies and instils confidence in foreign investors as well as local enterprises and entrepreneurs. Unfortunately, the prolonging of the pandemic has greatly delayed any positive impact that would have been achieved had the economic landscape been normal.

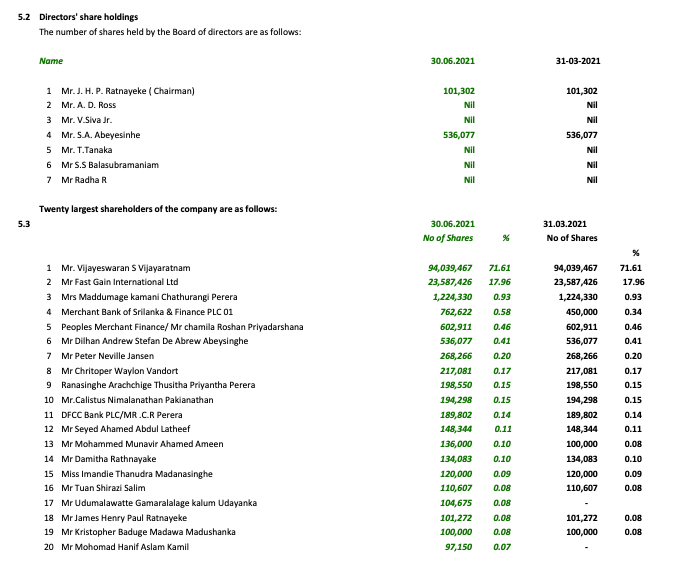

MANAGEMENT CHANGES

During the year Mr. S.A. Abeysinhe, who was acting as an Executive Director of the Company, resigned with effect from 31st March 2021. He continues to serve as a Non-Independent, Non-Executive Director of the Board of Directors of the Company. With the resignation of Mr. Abeysinha from his executive role, the responsibilities of the day today executive functions have been assigned to the Group CFO and Joint COO’s under the guidance of Board of Directors.

FUTURE FOCUS

With Sri Lanka’s vaccination rollout happening smoothly, we believe that there is light at the end of this dark tunnel and that the year 2022 will hopefully see the country and the economy returning to some form of normalcy. A lot will be riding on the outcome of the upcoming tourist season as the Tourism Industry badly requires a boost sooner rather than later. While remaining hopeful that the capital markets pick up, there are some positive signs in the form of low interest rates and IPOs of several new companies.

The pandemic has increased the use of technology at every level and it is clear that the way forward for the Company is to build on that aspect by becoming more tech dependent and less human resources dependent. The existing staff will be given additional training on how to further improve their efficiency levels by better utilisation of multi-tasking and technology. Elements such as working from home, online meetings, and online trainings will be continued with to reduce costs, save time and increase communication. Further, we have begun investing heavily into deploying a world-class IT system for Asia Stockbrokers in order to provide us an edge as we attempt to re-establish ourselves in the industry.

APPRECIATIONS

As we come to the conclusion of our review, we would like to take this opportunity to thank the Chairman and the Board of Directors of Asia Capital PLC for their support and guidance throughout this challenging year. We also wish to express our appreciation to the Central Bank of Sri Lanka (CBSL), Sri Lanka Tourism Development Authority (SLTDA), Excise Department of Sri Lanka, our Banking Partners and other Stakeholders, for their immense support during this difficult period. We would like to state our gratitude to all ACAP employees for going the extra mile and demonstrating great passion, commitment, and hard work. We are also grateful to our valued clients, guests, shareholders, and business partners for their continued trust and confidence in us.

We also wish to thank our major shareholders for the continued support given to us throughout the year.

The past year has been probably the toughest period not only for the Company, but also for the country and the world. The dark clouds seem to be clearing and if we continue to work hard and demonstrate a positive attitude, we are confident that we will bounce back sooner rather than later.

Thusitha Perera

Group Chief Financial Officer

Reyhan Morris

Joint Chief Operating Officer

Sandun Thushara

Joint Chief Operating Officer 25th August 2021

https://cdn.cse.lk/cmt/upload_report_file/363_1630297298298.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home