Quote : Prospectus Debenture Issue 2021

The funds raised through the Debenture Issue will be utilised to part finance the acquisition of

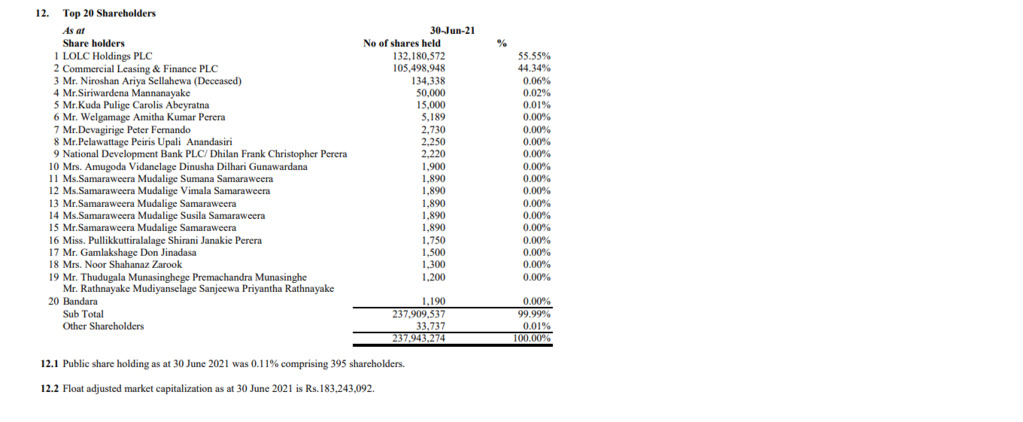

LOLC Holding PLC’s equity stake in LOLC Development Finance (“NIFL”) within 1 Months from the Date of allotment. As at the date of the prospectus LOLC Holdings PLC has a 55.55% stake in NIFL.

The purchase price for the share transfer of NIFL would be the latest market price of NIFL shares as per the requirement of SEC in its in principle approval. The share transfer shall be executed at the last traded price at the point of the share transfer.

Unquote

With the listing of LOCH many expect that CLC and LOFC counters will be appreciated in multiples.

According to the Technical s , both the counters flagged as “ BUY “ .

Best option :

Due to the high illiquidity of CLC , ( 99% own by the parent) can expect a very high demand for the counter in next week onwards making it the most sought after share in CSE.

Also understood that all shares in the public float of CLC had been already traded above Rs 30/= in last ten days , making current prices very attractive to make a re-entry.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home