It doesn’t take a genius to accept that we’re in unprecedented times, but how does this impact tea’s supply chain – both now and going forward?

Firstly, a quick look at shipping rates pre-covid and now. A 40’ container rate from Calcutta to New York was US$6,500 and now between US$15,000 to US$20,000. Same from Shanghai with rates moving from US$3,500 to US$20,000 (with a correction to US$15,000 recently) – and the same for any other route you care to imagine.

All of this is happening despite crude prices being below where they were at the start of the pandemic, so it’s not all driven by costs – and in reality, an opportunity grasped.

Of course, we all know what the COVID-19 pandemic did to shipping volumes, schedules and the impact on container positioning. As we all sat at home during the pandemic – bored and online – we shopped hard, increasing shipping space requirement to an all-time record. In 2021 the Port of Long Beach, Calif., processed over nine million 20’ containers, a record in its 110 years of operation. But this “East steaming” trade was not reciprocated west bound, and the appetite to dead head (shipping empty containers back) lost its luster as steamship time at anchor (queued) lengthened.

So, we get to where we are now: Queues of vessels across the Pacific (and other routes) moving slow and steaming towards a pre-appointed berthing date – approximately 90 vessels at any one time – exacerbating already stretched supply chains.

Where’s the Opportunity in All of This?

Approximately five years before the pandemic, the shipping companies moved to cooperate with each other – a logical move to share resources, increase route utilization, and offer a more comprehensive service during a time of low and competitive pricing.

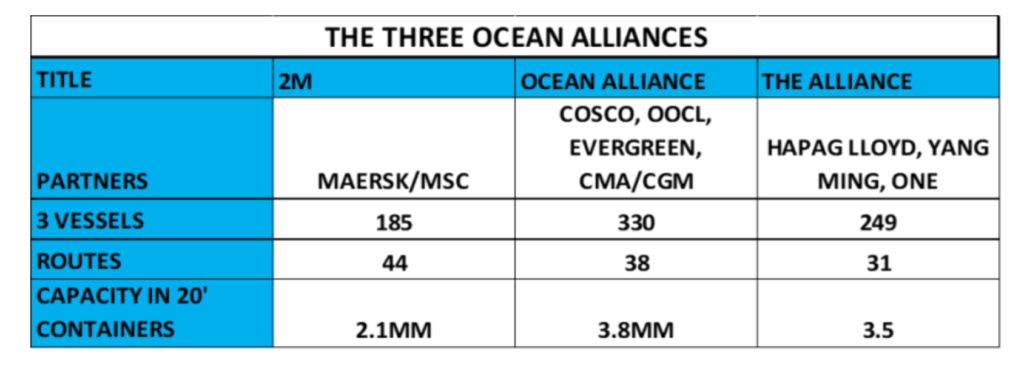

It’s also important to note the three major shipping alliances and their volumes:

Supply Chain issues in Tea 2022

As COVID-19 struck and shipping lines struggled with equipment in the wrong place, and/or there wasn’t enough vessel space in others, these alliances came into their own. However, this time the shared intelligence led to the opportunity. A shared and equally realized environment that afforded rate hikes be made, in concert, without fear of being less attractive than viable competition – and so the mayhem began.

To be fair to the shipping industry, for years they had made little money on ocean freight and this was an opportunity to recoup ground, but the pendulum kept on swinging past the point of reason and here we are, with some predicting that profits for the shipping industry, will be US$300 billion this year up from US$214 billion last year (Fortune, December 2021).

The issue for tea is that, without capacity, space goes to the highest bidder and consumer goods – feeding those on-line shoppers – have more room for freight increases than tea, where rates can represent 50 percent of the value of the product shipped. The alliances coordinate to place equipment at the disposal of the most lucrative routes, which has some tea ports scrambling The dearth in container/space leads to an “auction” above stated shipping rates, which can add up to an additional US$5,000 per 40’ container.

One could argue that – just like the shipping industry – this is an ideal opportunity to reestablish a higher price for tea with packers and retailers (not a bad thing). However, the fact of the matter is that passing on all freight increases has proved difficult and will continue to cost farmers and producers.

The Ukraine Factor

Two-plus years into the COVID-19 pandemic and – with a light at the end of the tunnel for many around the globe, as COVID-19 rates improve and things get better – Russia invades Ukraine and the tea industry is back in another heap of trouble.

The West responds to the war with sanctions on exports (for tea, the two that count are fuel and fertilizer exports) and imports, which despite there being an allowance for tea, will impact demand.

The oil embargo has seen prices at the pumps increase and this – in an inelastic supply chain situation – lends credence to further freight rate hikes, not just ocean carriage but local transport at both ends of the supply chain. Additionally, where fuel is required to collect leaf and process tea, higher cost of production will add to the price of tea IF the industry is to be sustained.

Fertilizer (Potash)

Russia and Belarus represent about 25 percent of the global potash market, and fertilizer rates have already reacted (price increases of four-fold, in some cases) adding further costs to tea producers. Of course, without potash, tea crops can be reduced by 20 to 30 percent.

Let’s use Sri Lanka (an industry incubator) to illustrate the worst of impacts to the industry.

COVID-19 travel bans decimated two of Sri Lanka’s primary sources of hard currency, tourism and remittances from foreign workers. This, plus poor political leadership, left them in default to their lenders. With no hard currency, they cannot pay for inputs, including fertilizer, or the fuel required to produce and bring tea to port. Add to this a reduced number of sailings from the island, as import volume has all but disappeared, and costs to export have skyrocketed.

From a demand standpoint, Russia consumes an extraordinary amount of tea (140 million Kgs) and it is likely that supply routes will be found by imaginative sellers (a land route from India to Uzbekistan, for instance) that will ensure trade goes on, but these will be more expensive and, with a heavily devalued rouble, pricing may not be that attractive.

These complications will lead tea producers to consider easiest routes for sale, and they will cater to markets most likely and able to pay, in a climate of economic slowdown and inevitably, rising rates of finance.

Value Addition

And what of consumer packaged tea sales, a holy grail of sorts for producing countries? With increased e-commerce and consumption in general, there has been a run on packaging raw materials from corrugate to paper and plastic. This lower availability has increased prices (fueled further by raw material shortages) and shipping costs just make this worse – both inbound and outbound – where voluminous packaged goods are hit even harder.

Is There Relief in Sight?

There is very little evidence that the war in Ukraine and/or economic sanctions against Russia will be over soon, but container sale prices (resale and new) have dropped, an indicator that there is a bit more elasticity in the system. However, more has to be done and done quickly, as before we know it the autumnal buying season will be upon us and demand for space will ramp up again.

A cloud looming on the horizon is a contract negotiation between 22,000 workers at 28 west coast ports, which has to be done by July 1, 2022, if further disruption is to be avoided. Already, some, major U.S. companies are increasing inventories “just in case,” and this cannot help ongoing congestion.

Longer term, there is evidence that – apart from major shipping lines – independents are seeing enough profit in freight movement to invest in the space, and this could invite competition and act as much-needed gravity on a pendulum swung too far.

Watch for part two of this article series at World Tea News and in an upcoming edition of the weekly World Tea News eNewsletter. If you’re not already a subscriber to the eNews, you can register for your free subscription at this site.

John Snell, NMTeaB Consultancy, has spent 40 years in the tea industry, working with everyone from global brand leaders to traders and private label packers, in management of procurement, development and sustainability. His day job is now consulting for those that “do not want to spend 35 years trying,” in his words, and work ranges from product development and GTM strategies to international development projects. Snell has spent the last 27 years in North America, where he has been an active member of the trade, sitting on the board of the Tea Association of the USA and as a regular speaker at North American Tea Conferences. He sits on the Canadian Tea Association’s grading panel and is a regular contributor to World Tea News. If you ask him what “floats his boat” (a relevant analogy given his earlier days in the Royal Navy), it is always about empowering others to arrive at responsibly derived beverage solutions that deliver outstanding results for the companies he works for. He is clear that sustainably sourced and produced products are more profitable.

https://www.worldteanews.com/issues-trends/look-supply-chain-issues-tea-industry-grappling-2022-part-one

Last edited by CHRONICLE™ on Thu May 19, 2022 9:09 am; edited 3 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home