More Problem Than Solution

Central banks won multiple plaudits for being the “only game in town” when crises hit.In the wake of the financial crisis of 2008 and pandemic of 2020 they were the fastest to erect defenses around their economies.

So it will prove a shock that many now blame them for being more problem than solution as soaring inflation proves the greatest challenge to the global economic outlook.

The result is a scramble to catch up.

Today alone…

- The US Federal Reserve is forecast by most on Wall Street to raise its key interest rate by the most since 1994 in a shift that few predicted just a week ago. See here

- The European Central Bank is holding an emergency meeting to discuss the recent selloff in government bonds in weak economies. See here

- The Bank of Japan is struggling to fend off an attack on its policies in bond markets. See here

At the root of the tension is that officials failed to spot the lasting power of surging inflation and then proved sluggish to respond to it. Throw in various mixed messages and policy reversals along the way and it’s fair to ask if the managers of monetary policy have lost their touch, Enda Curran writes here today.

Aggressive Action

More than 50 central banks around the world have raised interest rates by at least a half point in one go this year

Source: Bloomberg

Take the Fed, for example.

Chairman Jerome Powell only retired his outlook for “transitory” inflation in November. Even then, the central bank began 2022 maintaining a zero interest rate and sucking in Treasuries and mortgage-backed securities.

Having then raised its benchmark by 25 basis points in March it was forced to double the pace of tightening in May and signal two more 50 basis-point steps in June and July.

Only that plan was upended in the past week as data showed inflation and expectations for it pushing even higher. So now 75 basis points is on the table for today’s policy meeting and potentially for the next one too.

The Fed isn’t alone in coming under fire.

As recently as December, ECB President Christine Lagarde was describing a 2022 rate hike as unlikely. Now the bank is set to end negative rates in coming months.

Meantime, today’s ad hoc meeting of its Governing Council comes after it chose not to detail a tool it has reportedly been working on to combat so-called fragmentation in which the bond yields of vulnerable euro-area members such as Italy surge.

As for the BOJ, it’s struggling to convince markets that its ultra-loose monetary policy is sustainable as peers raise rates. Governor Haruhiko Kuroda also faces a tough call this week as the yen trades at its weakest in 24 years.

The mounting worry of investors is that the race to tackle the inflation reality makes it more likely than not that the Fed and its counterparts will ultimately tip their economies into recession. Global stocks have already entered a bear market.

Accordingly, look today for the Fed officials to shift from their soft landing scenario of March to a bumpier touchdown.

—Simon KennedyCentral banks are in a dilemma,” said Sayuri Shirai, a former Bank of Japan board member who’s now a Keio University professor. “To restore confidence, central banks need to raise policy rates” sufficiently to bring down inflation, and that “may lead to a further slowdown in the economic recovery,” she said.

- Got tips or feedback? Email us at ecodaily@bloomberg.net

The Economic Scene

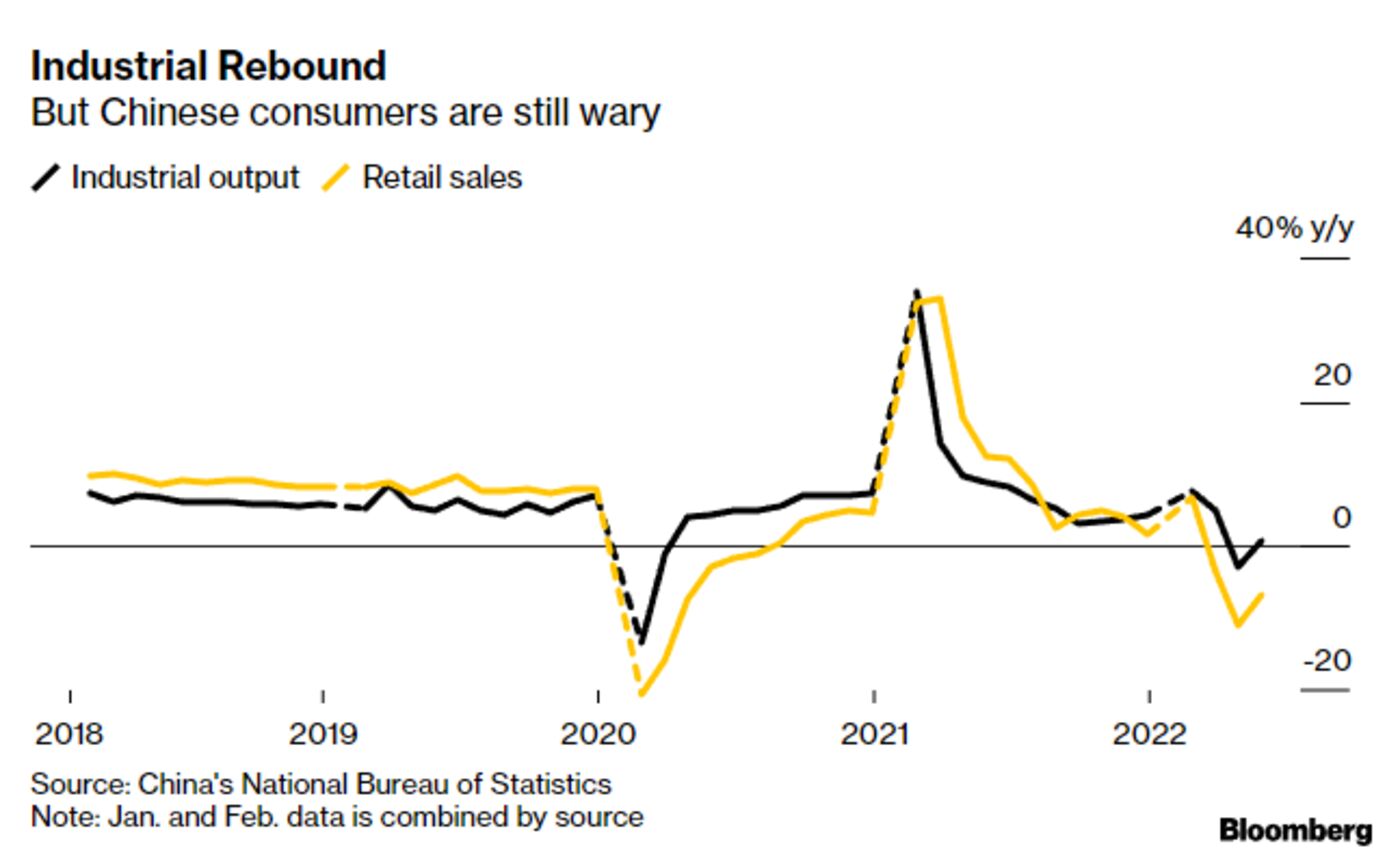

China’s Wednesday data dump showed the economy was navigating a mixed recovery in May as industrial production unexpectedly chugged along while the housing market and consumption showed further ailing.

The data raise further questions of how long Covid restrictions will weigh on sentiment and translate to economic suffering, and whether a gradual pivot on the Covid strategy will bring some relief.

Earlier Wednesday morning, China’s central bank refrained from cutting its one-year medium-term lending facility. The no-change stance was in line with the majority of analysts in the Bloomberg survey and a nod to the need to stem further divergence with US monetary policy that would put more stress on the yuan.

With flush interbank liquidity alongside weak corporate and consumer credit demand, Chinese policymakers have favored targeted lending tools and faster government spending as they navigate the economic growth slowdown.

PBOC watchers can now turn their focus to a potential Monday announcement of a reduction in the loan prime rate to help shore up the ailing housing market.

Today’s Must Reads

- Fed protest | A group of protesters gathered outside the Fed’s headquarters to remind them that the aggressive rate increases they’re considering to combat inflation have a human cost.

- Union victory | Canadian labor unions are scoring bigger salaries than they’ve seen in more than a decade, even as gains are short of soaring inflation

- Inflation prophet | Economist Tim Congdon, a so-called “monetarist,” was one of the first to spot the inflation surge. Now he thinks the Bank of England should be preparing to end rate hikes.

Money Binge

Strong growth in UK money supply presaged a sharp pickup in inflation

Source: Bank of England, Office for National Statistics

- Worst dropout rate | Britain is leading much of the world when it comes to people dropping out of the workforce, not filling jobs despite a historic squeeze on living standards.

- Trucker settlement | Korean truck drivers began hitting the roads again Wednesday morning after a weeklong strike ended in a fresh wage deal with the government

- Swiss rates | Policy makers in Switzerland are poised to join global peers in signaling concern on inflation, generating the rare spectacle of a Swiss rate decision that has financial markets on edge.

- Art inflation | Sales volume on the opening day of Art Basel, the Swiss art fair where dealers bring their most important artworks to sell to their richest clients, signal a number of wealthy collectors are willing to spend more than ever before.

Need-to-Know Research

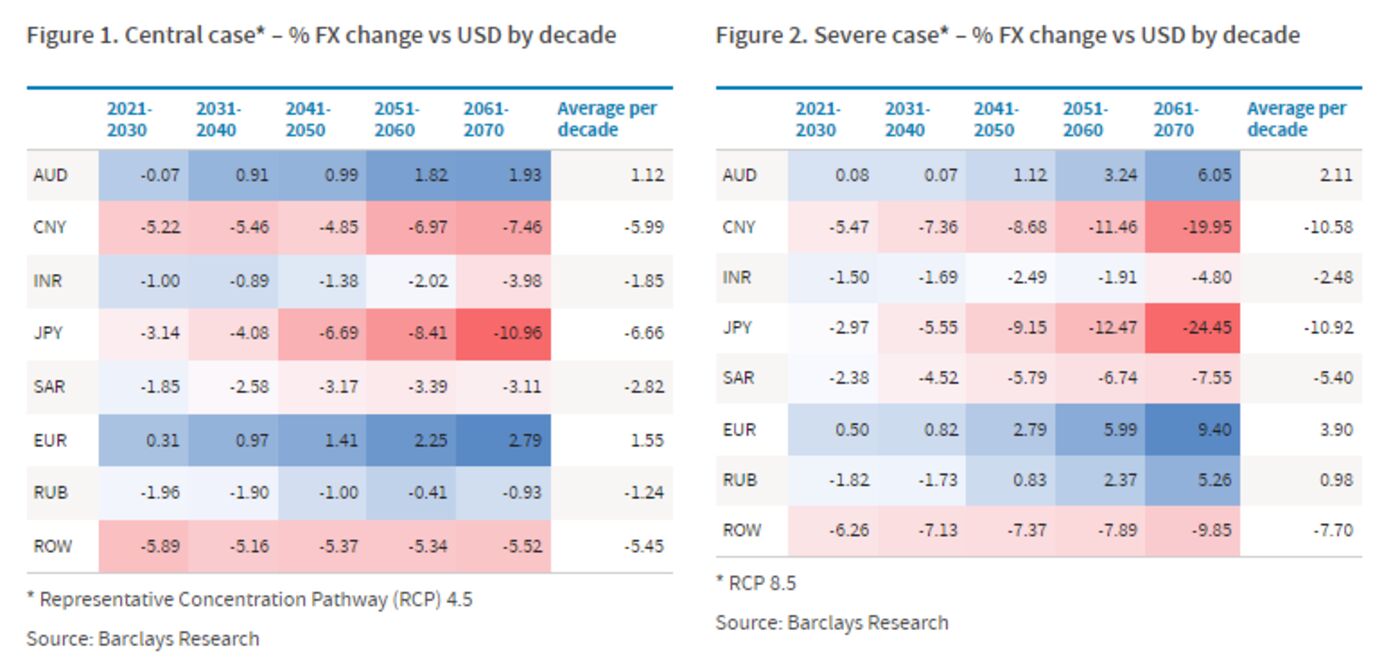

Climate change could cause the Japanese yen and Chinese yuan to lose half their value over 50 years, according to an adverse scenario detailed by economists at Barclays.The theory is that a warming planet could rob economies of productivity and capital.

China’s exchange rate is vulnerable because its industrialization and lenient regulation have put pressure on the environment in recent years, according to Themistoklis Fiotakis and Wen Yan. As for Japan, its vulnerable to rising sea levels.

On the flip-side, long-term trends play out to the advantage of the US dollar, euro and Australian dollar, Barclays said.

On #EconTwitter

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home