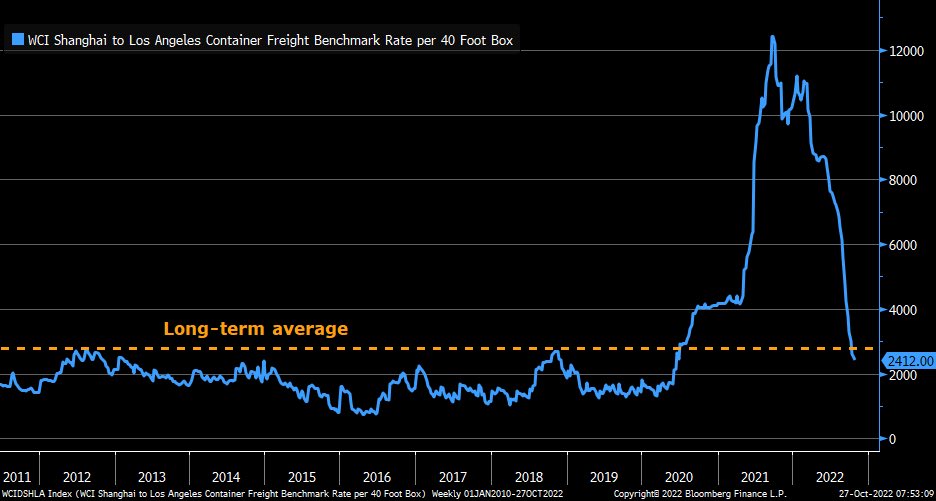

Simply remarkable: shipping rate for 40-ft container from Shanghai to Los Angeles has slipped below long-term average (going back to 2011, full series), putting to bed notion that shipping rates are still elevated relative to entire pre-pandemic era

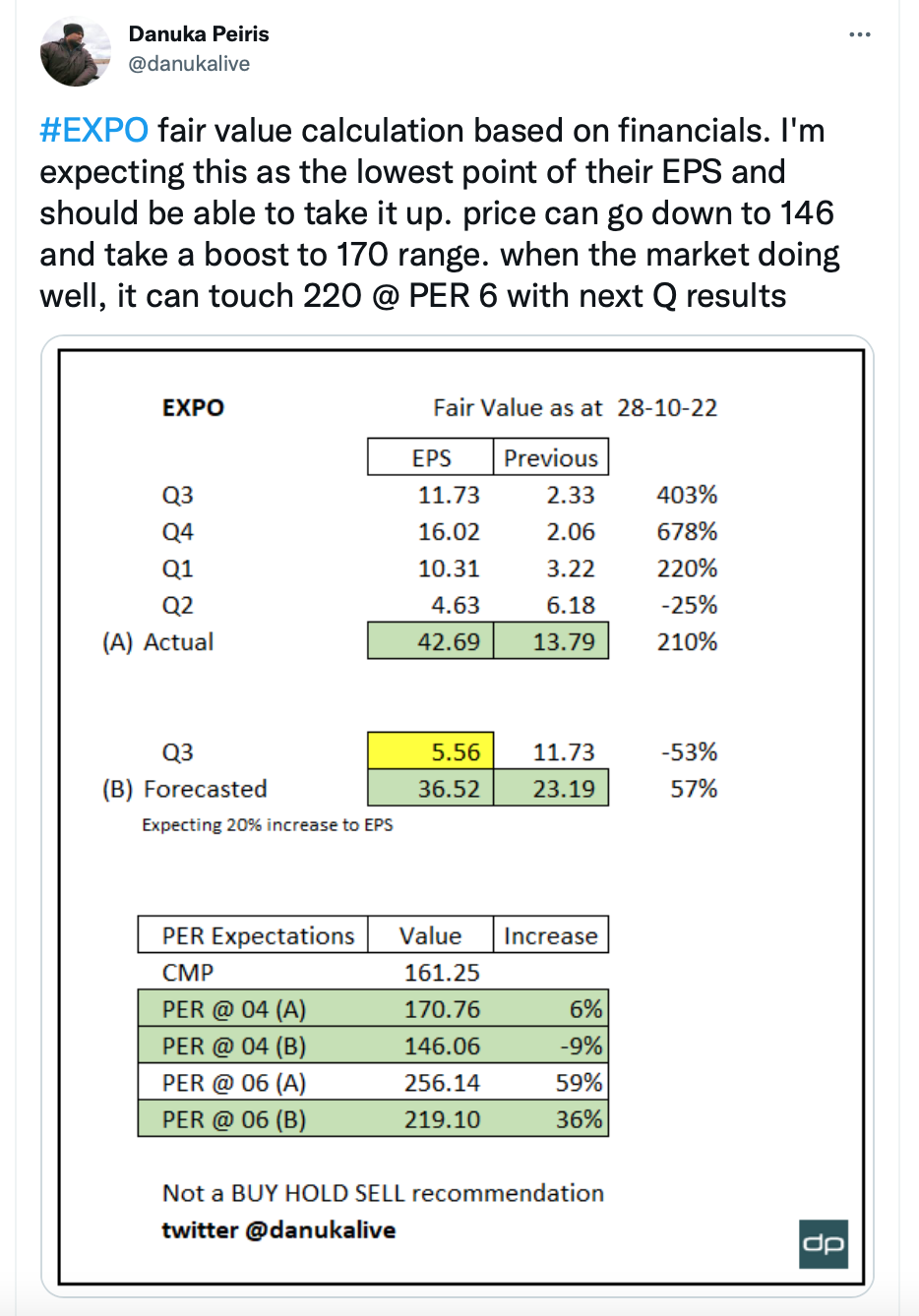

Latest Valuation/Earnings Update

https://twitter.com/danukalive/status/1586031753600569344?s=20&t=nSadjgIId-qvIZGZiUc99g

Expected PER

DeepFuckingValue wrote:Find below PE based valuations of EXPOLANKA done on the basis of latest earnings to determine whether company is good or bad to buy at the current price levels.

PE Expectations are often depended on prevailing interest rates. Higher the interest rates fund will tend to shift towards debt instruments unless shares start trading at matching PE Ratios.

As a result of current TB rates being 33% p.a, stock market investors expect target buying companies to have PER of 3X or less. 100/33 = 3

If the interest Rates were at 25%p.a then PER Expectation would be 4X or less. 100/25 = 4.

In case if TB Rates reach 50% then investors would be looking for companies with a PER of 2X or less. 100/50 = 2

At 3 X PER, EXP is worth only LKR 145/=

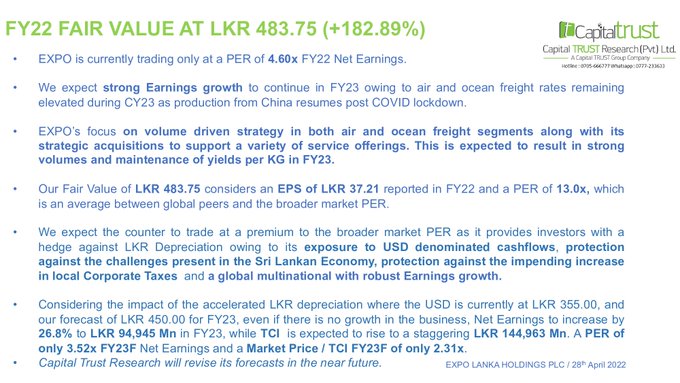

Recommendation given Capital Trust in April 2022

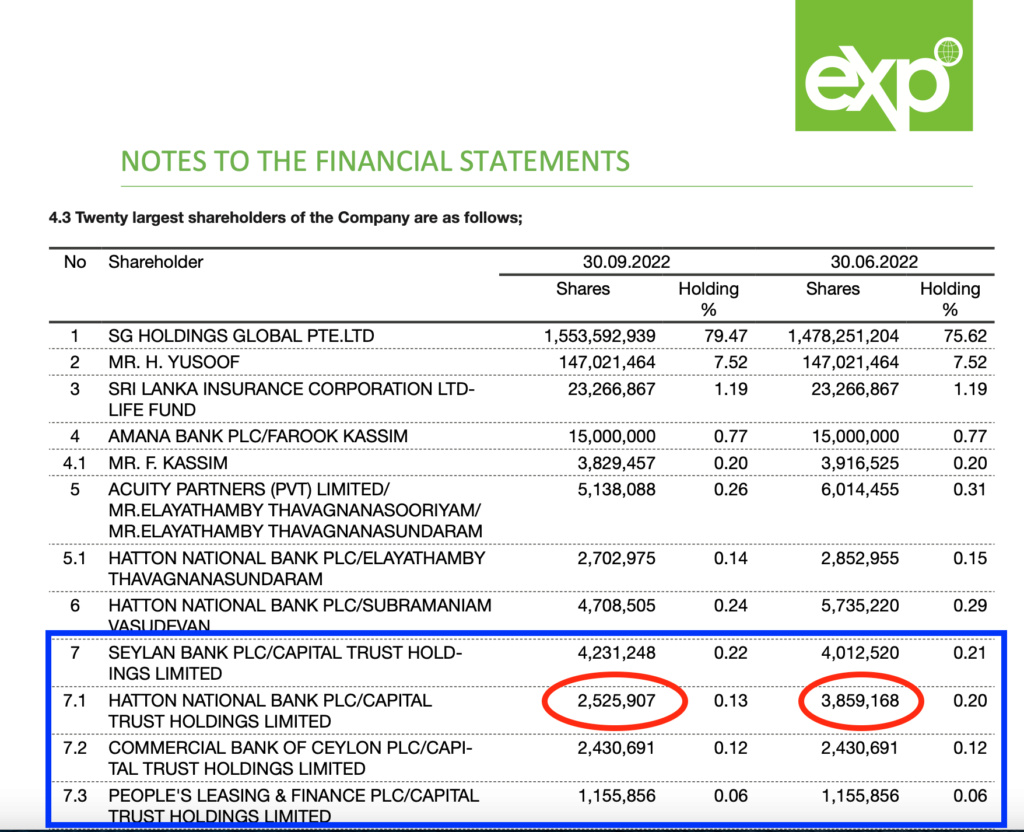

Latest Shareholdings

More than 1.2mn Shares of #EXPO divested by Capital Trust during last 3 months.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home