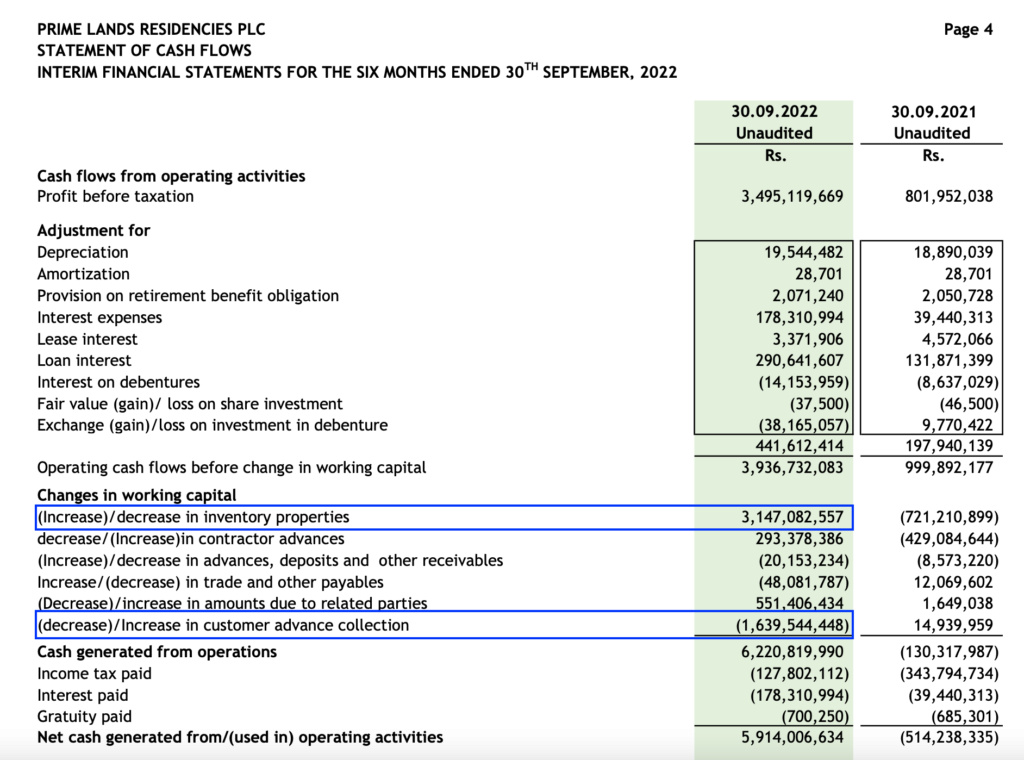

It is important to note that current day investors are well are aware of various accounting gimmicks done by company owners to show accounting profits without any cash benefits to show performance and to secure bank borrowings.

Eg. Higher inventory valuations to show phenomenal profits at LWL.

https://www.srilankachronicle.com/t62799-lanka-walltiles-lwl

Therefore PLR and its sales team will now face the daunting task of turning these fake sales into real cash in future and to rebuild investor confidence after the failed IPO pricing.

Latest Cashflow Statement

Performance Indicators

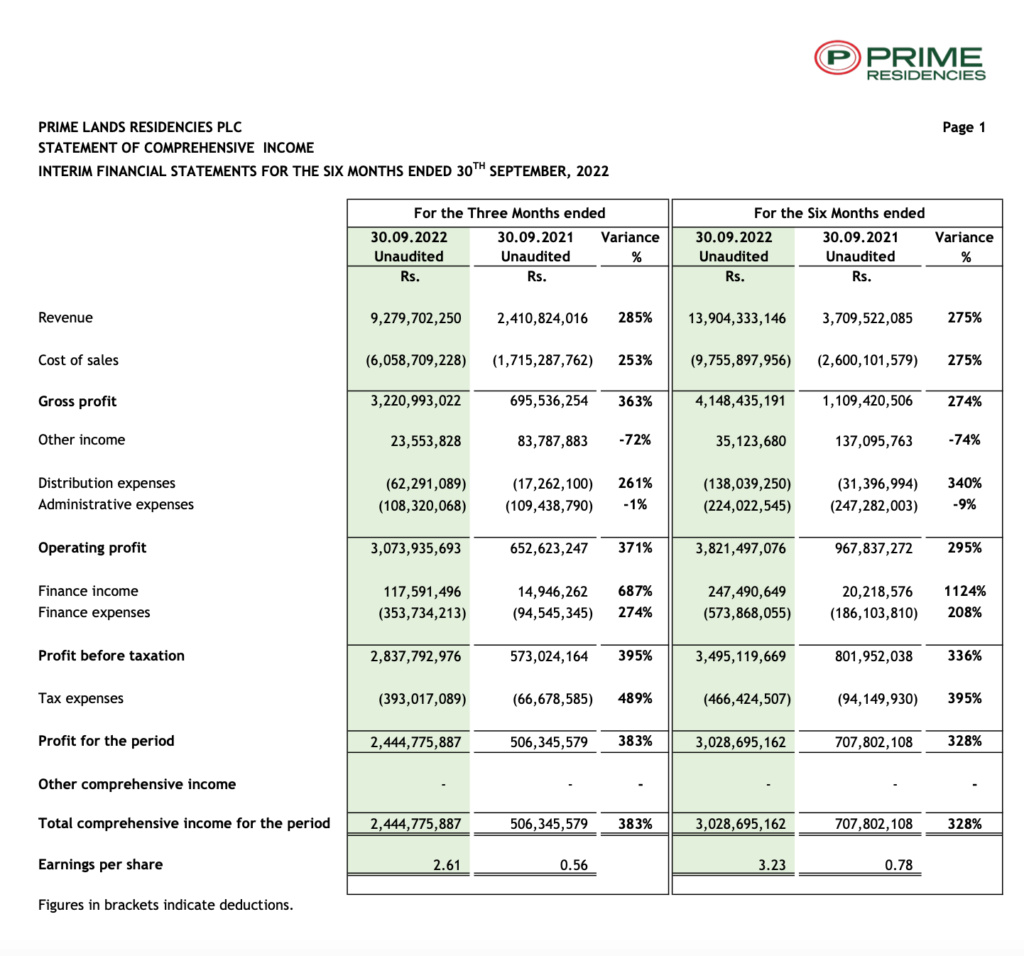

Prime Lands Residencies (PLR) - Latest Results

2Q EPS: LKR 2.67

1H EPS: LKR 3.23

Trailing Full Year EPS: 4.31

Current Market Price LKR 7.20

PER: 1.6X

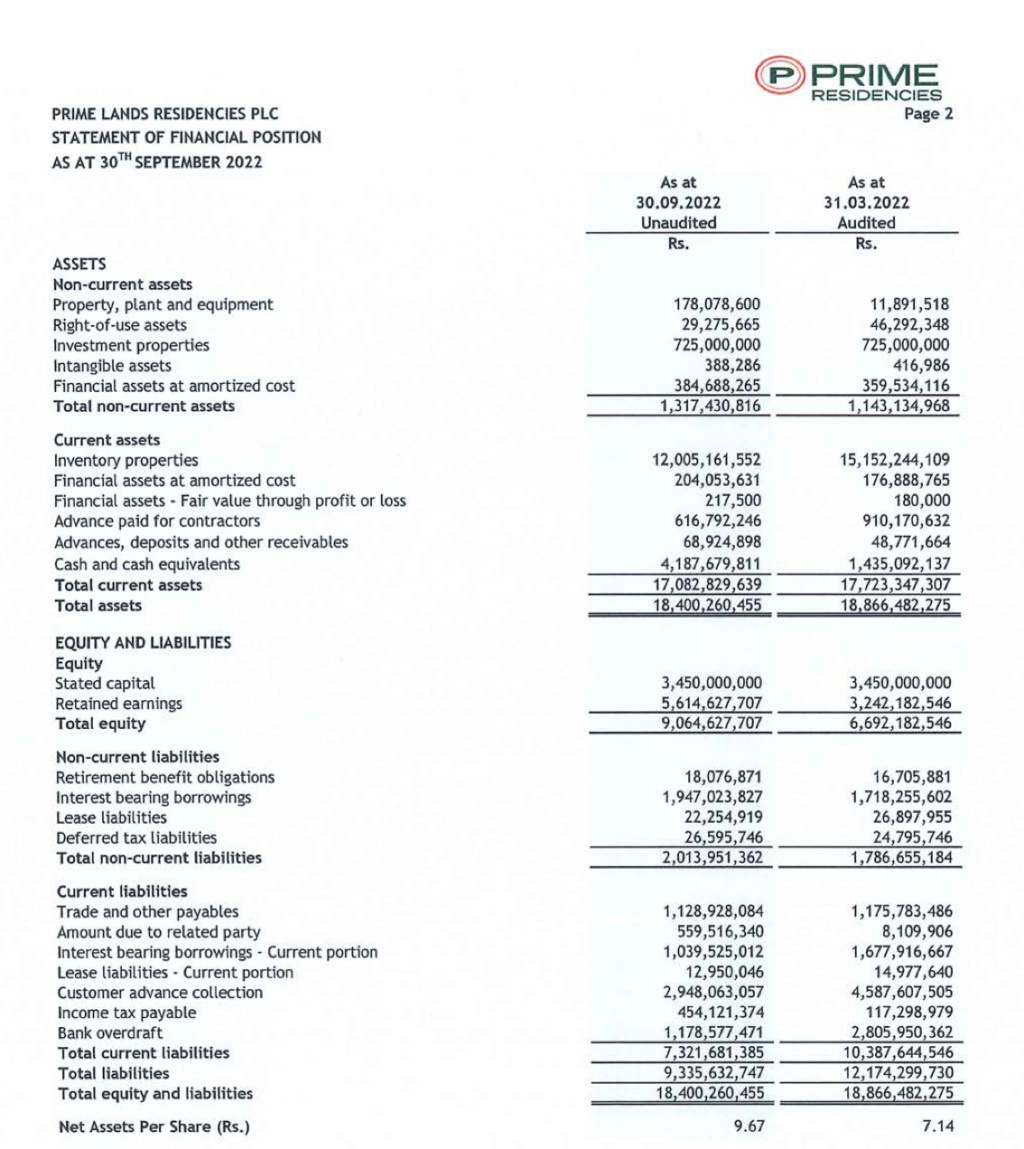

Net Asset Value Per Share (NAVPS): LKR 9.72

PBV: 0.74

Latest Asset Position of PLR

Latest Earnings

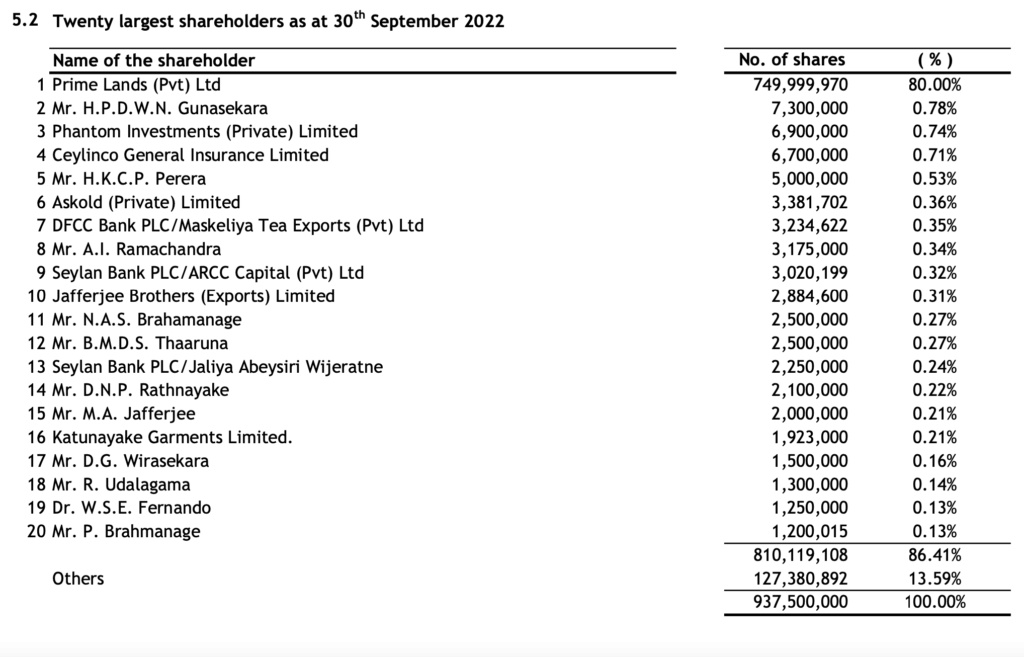

Top 20 Shareholders

https://cdn.cse.lk/cmt/upload_report_file/2279_1668139489772.pdf

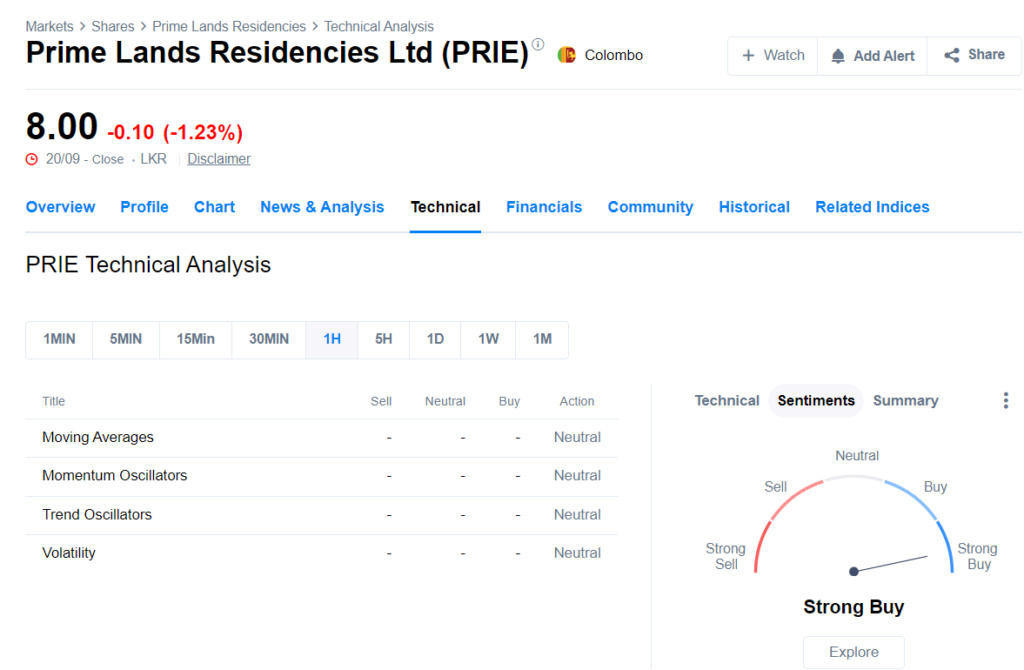

Technical Analysis of PLR

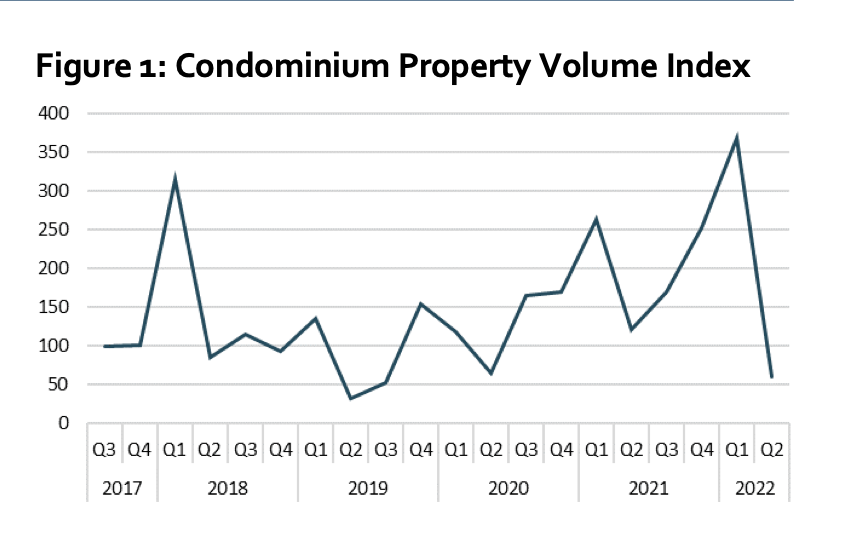

Condominium Market Survey : 2nd Quarter of 2022

According to the information collected through the Condominium Market Survey1 conducted by the Central Bank of Sri Lanka, sale of new condominiums has witnessed a sharp decline during Q2, 2022 as shown in the Condominium Property Volume Index. The index which measures the trend of number of new condominium sales, declined by 51 per cent compared to the corresponding period of 2021, while recording a significant decline of 84 per cent on Quarter-on-Quarter. The notable increase in bank interest rates has hindered the affordability of credit among potential condominium buyers. At the same time, the uncertain economic conditions that loomed during the quarter due to the energy crisis have also played a major role in delaying purchase decisions among buyers.

https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/statistics/real_estate_market_analysis_2022_q2.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home