Prime Lands Residencies Limited

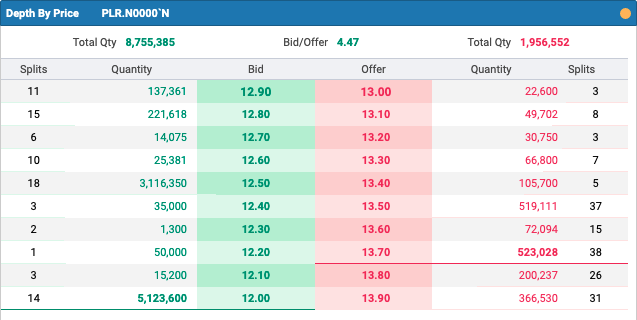

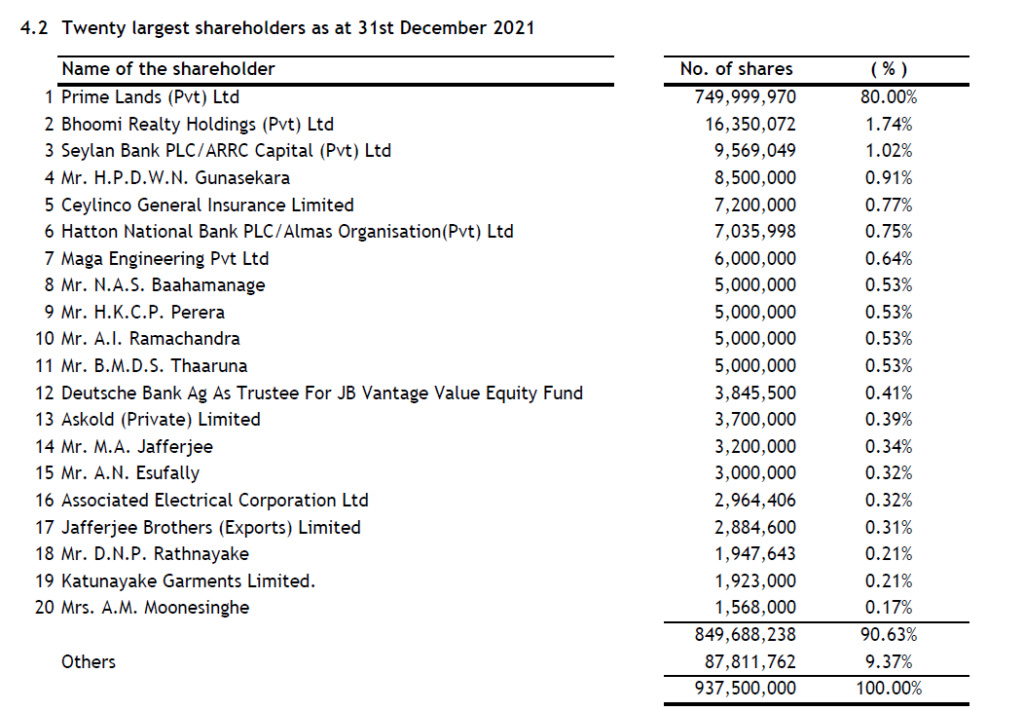

- IPO Issue - 100Mn or 187.5Mn at 10.40

- Opening Date - 11 May 2021

- Current Issued capital is 750Mn share among 4 Directors. Those shares are suspend for 6 month from date of Listing.

- IPO Proceeds to be used for Purchase of Land in Meegoda (333Mn), Settlement of Import Loans (188Mn), To cover Construction cost (1,428 Mn)

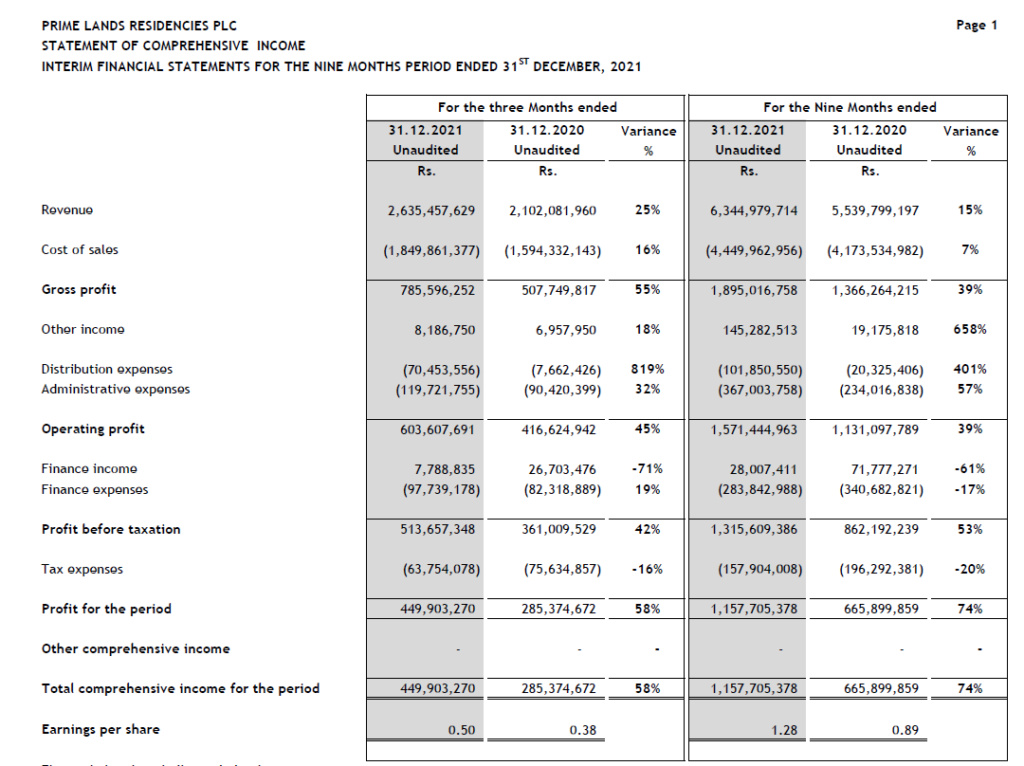

Financial Details

- EPS as of 31 Jan 2021 is LKR 0.99 (10 Months)

- 12 Month expected EPS LKR 1.3

- Latest DPS (2019) is LKR 0.30

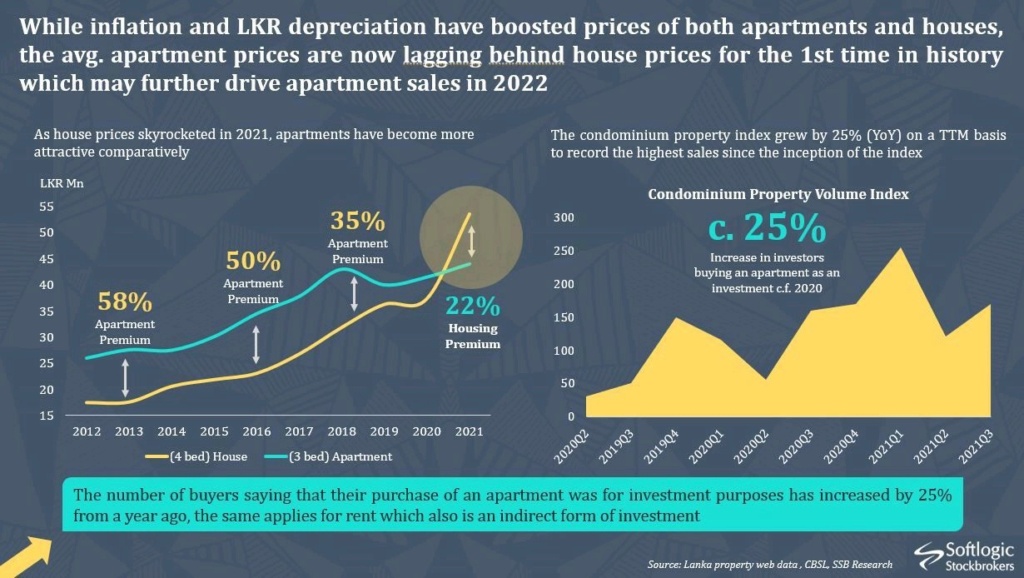

Future Prospects

- Sold Property value - 27 Bn

- Work in Progress - 34 Bn

- Projects in Planning - 16 Bn

- Prime Land has 3.4 Bn worth of Apartment to sell in next few years which are completed.

- Prime land has 9 Bn revenue to recognised in Coming years from already sold apartment. GP Margin is around 25%

- Prime land has 24 Bn worth of Apartments under construction and all such apartment to be completed 90% in 2022.

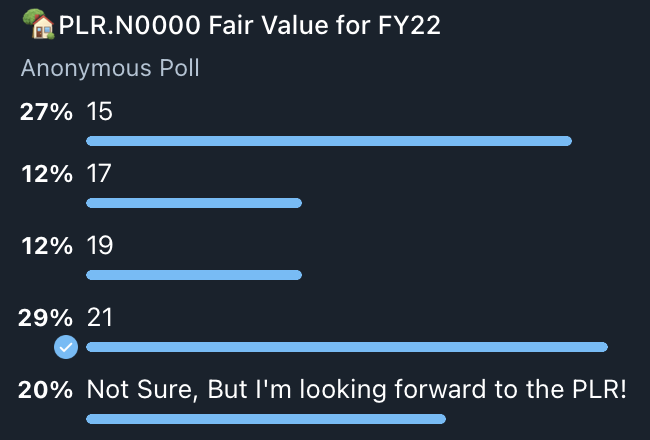

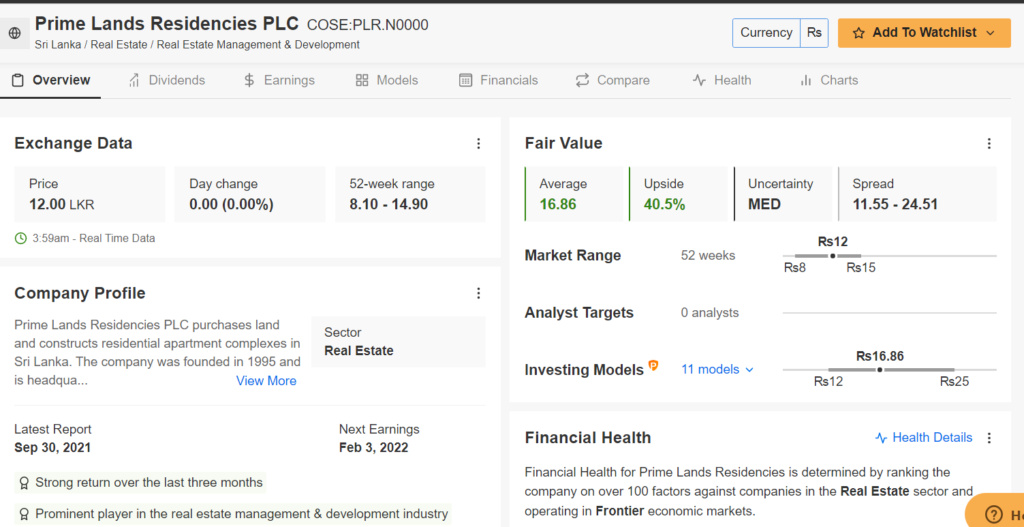

Valuation as per Prospect

Discounted CF - LKR 15.82

PE Actual - LKR 16.34

PE Expected - LKR 20.02

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home