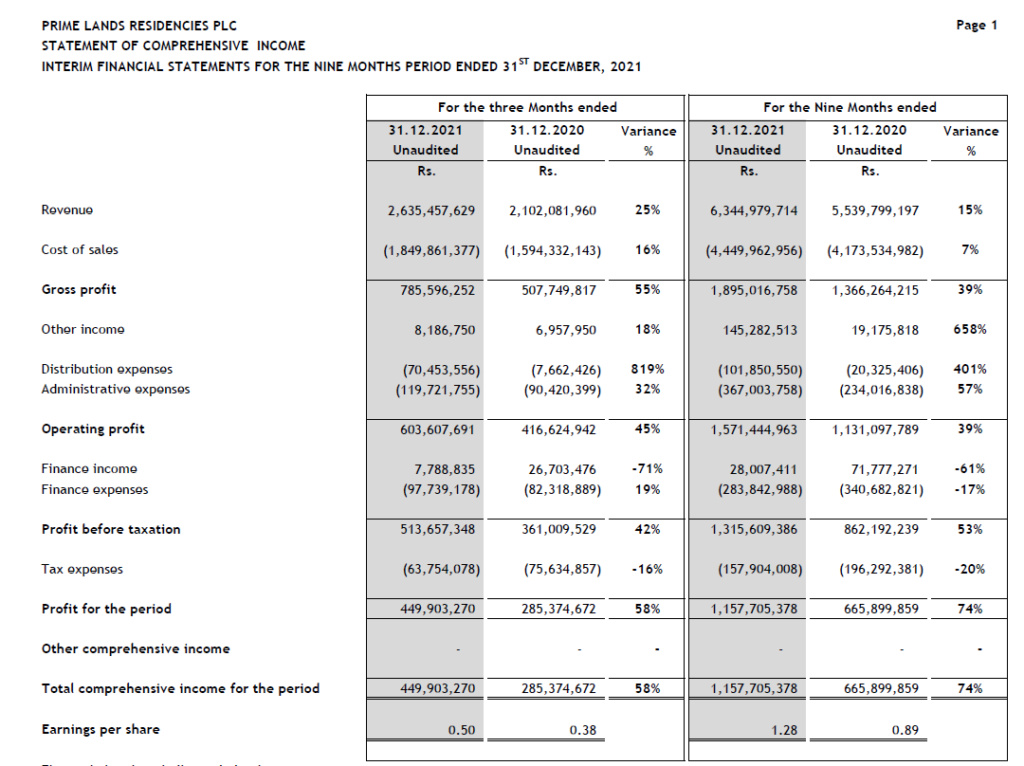

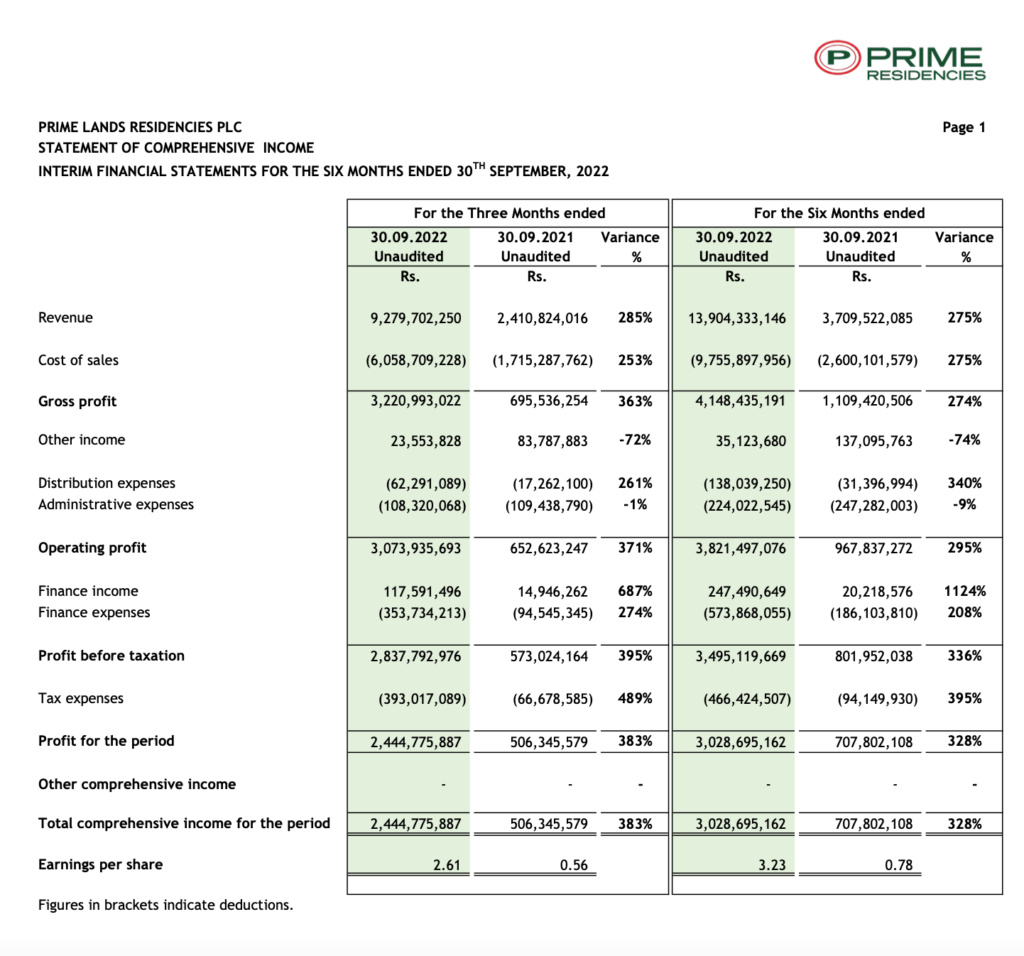

74% Increase in Nine-Month Profitability compared to last period!!!

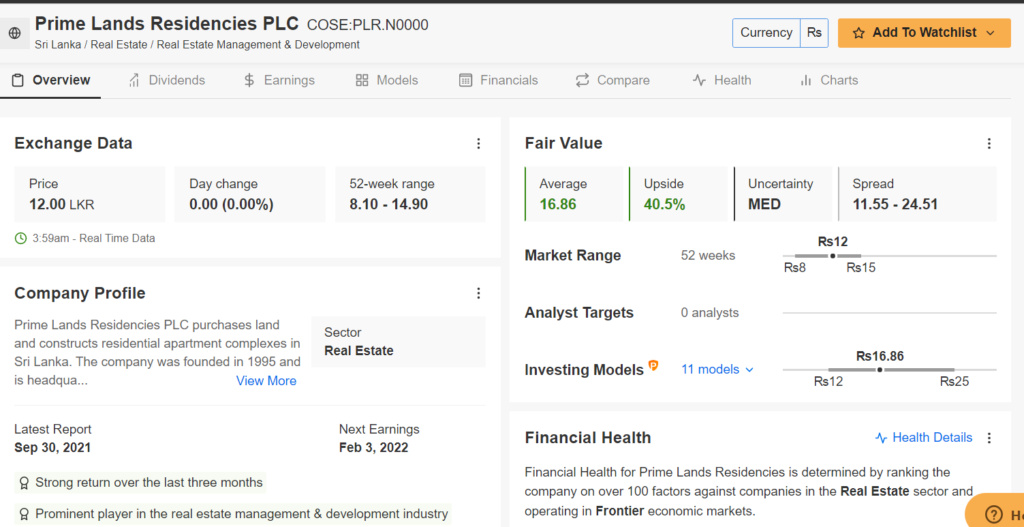

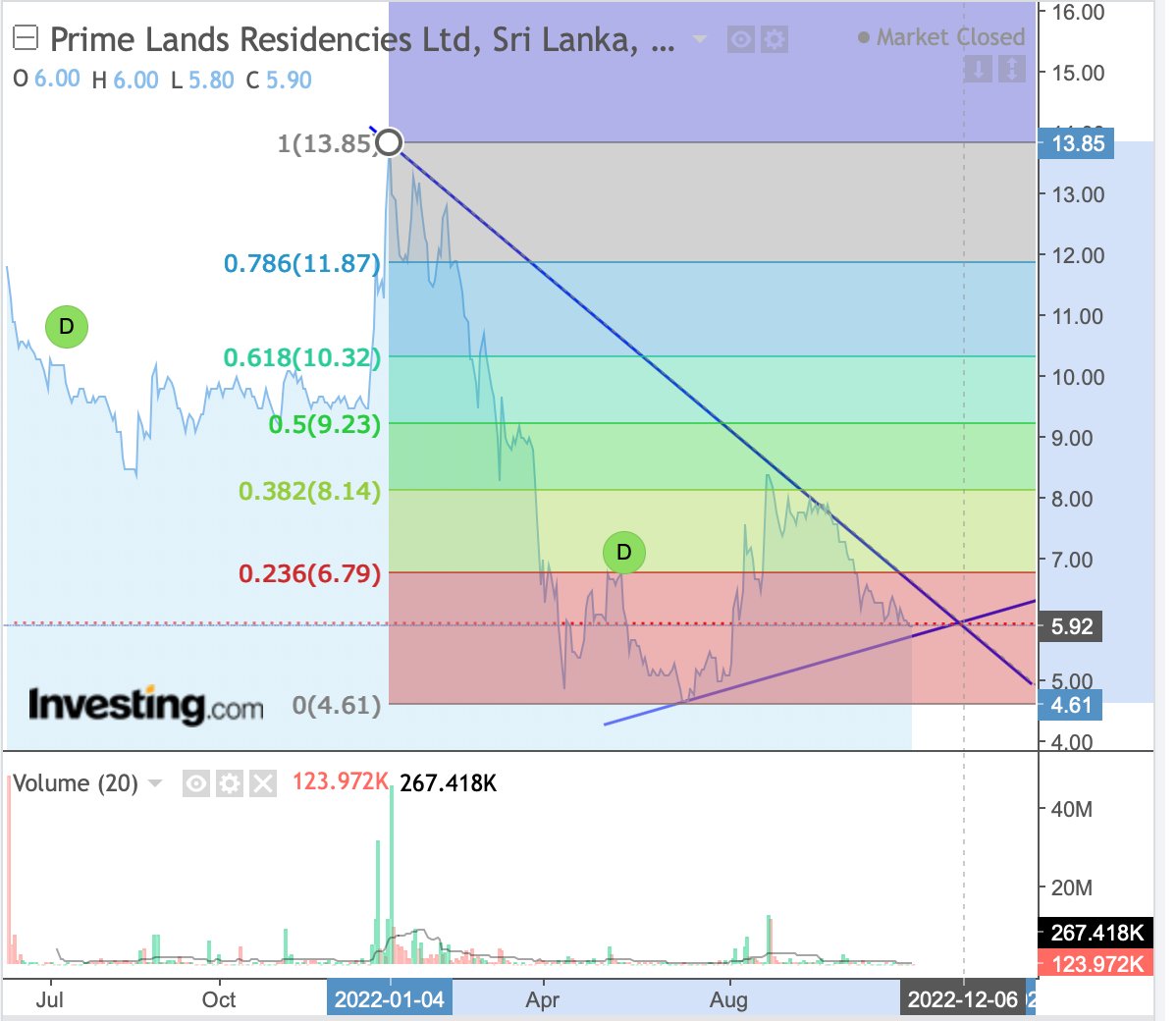

Weekly Technical Indicators

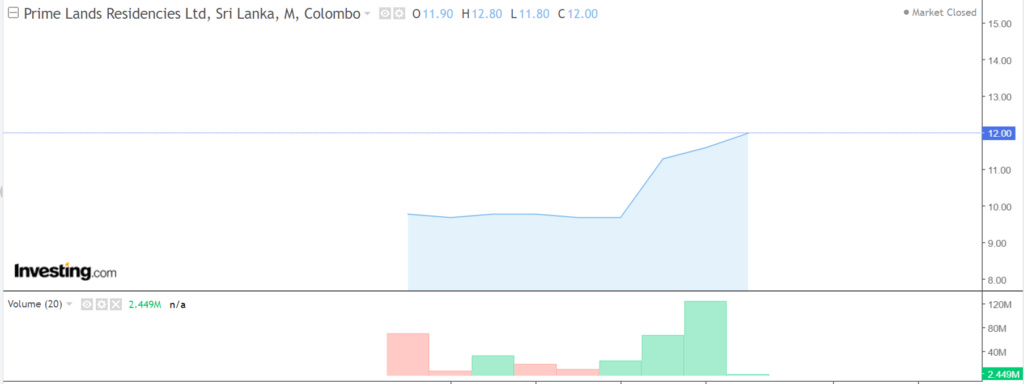

Summary:STRONG BUY

Moving Averages:STRONG BUYBuy (11)Sell (1)

Technical Indicators:STRONG BUYBuy (

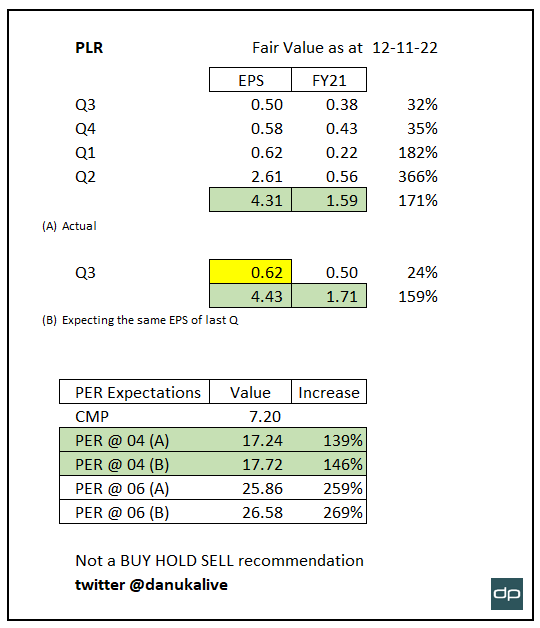

Continued growth in shareholder sentiment.

Last edited by Swissinvest on Thu Feb 03, 2022 9:41 am; edited 1 time in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home