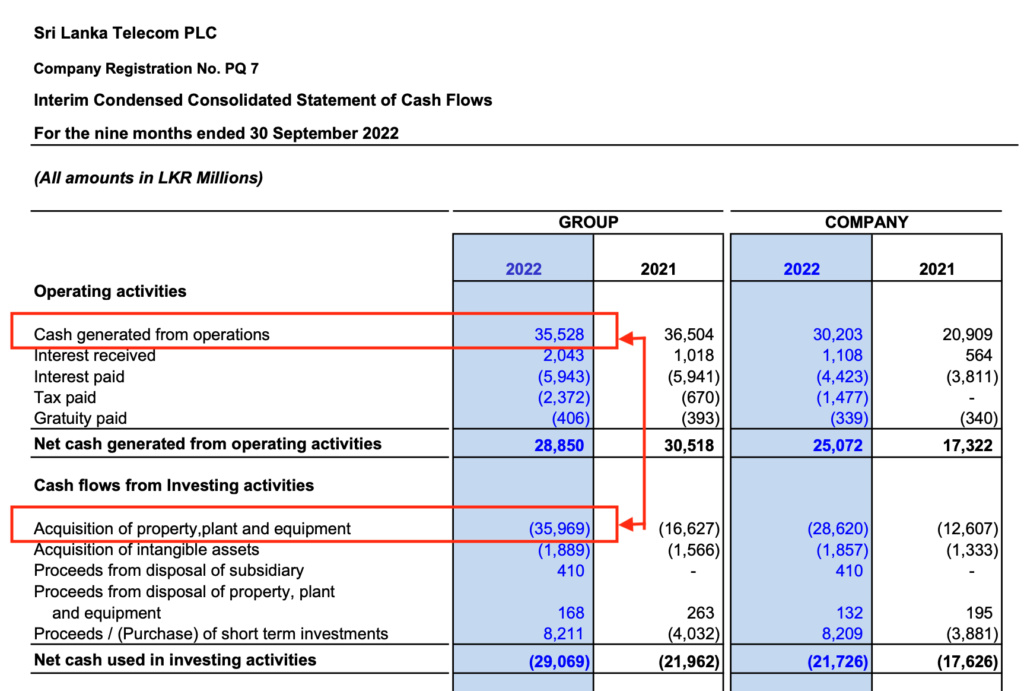

Sri Lanka Telecom (SLT) has invested in excess of LKR 35.5bn in property plant and equipments during last 9 months ended 30th Sep 2022, whilst net cash generated from operation was only LKR 28.8bn. This indicate that SLT has spent all but considerable amount of cash generated from the operations in purchasing assets to upgrade and maintaining its network.

Key investments planned for 2022 included the optical fibre network, 4G network expansions with 5G capabilities along with Mobitel, international cables, multi- cloud platform expansions and carrier neutral data centres. The Company is also pursuing opportunities to unlock the value of its extensive landbank, through monetising these assets to fund expansion of the core business.

Cash Flow Movement

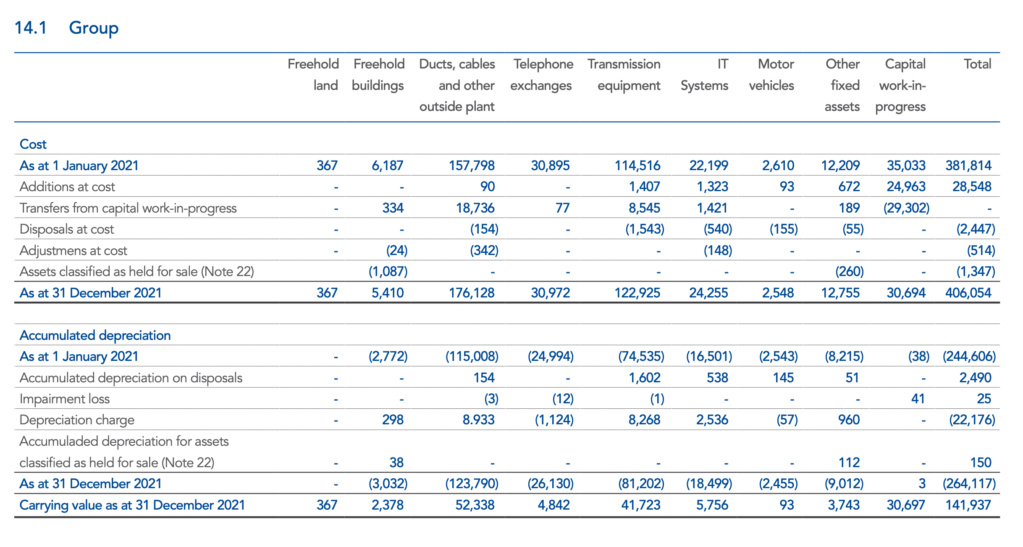

Breakdown of Fixed Assets

Find below Sri Lanka Telecom (SLT.N0000) - Breakdown of Fixed Assets as at 31 December 2021 prior to acquisition of LKR 35bn assets during last 9 months.

Despite the uncertainty and turbulence that prevailed throughout the year, the Group adopted a long-term view to value creation, continuing to direct investments towards enhancing technology, connectivity and capacity. Key investments made during the year included expansion of the FTTH network, aligned with our aspirations of providing premium fibre broadband technology to 2 million households by 2023. To date over 65,000km of fiber has been laid out, with a further 5000km expected in 2022.

SLT also enhanced their 4G network and started pre-commercial roll-out of our 5G networks to offer fixed wireless and mobile broadband solutions.

The Group also invested in new data centres and multi- cloud platforms during the year. Increased migration to cloud-based platforms and multimedia consumption led to unprecedented demand for bandwidth, which in turn required continued investments in expanding the core, broadband and IP networks. Given the increased demand on the international network, SLT also expanded its global footprint, which is facilitated through submarine and undersea fibre optic cable systems. Through these investments, SLT hope to offer holistic services across all industry verticals and customer segments, including B2B, B2C and B2G.

SL to raise $ 8 bln by selling valuable assets

The Government is hoping to raise US$8 billion from the lease or sale of valuable public assets to bolster rapidly dwindling foreign reserves, the report of a newly-appointed economic advisory committee has revealed.

Among the main items in the list were the long term leases of Katunayake International Airport for $2 billion, Mattala Airport for $300 million and Ratmalana Airport for $400 million.

Arrangements have been made to hand over the Colombo North Port Development Project for an investment of $600 million while Colombo Port City lands will be leased out at a total of $4 billion.

Accordingly, Sri Lanka Ports Authority has planned to do a feasibility study for the Colombo North Port Development Project focused on expanding capacity of container handling while serving all other port services expected from industry.

Further shares of Sri Lanka Telecom will be sold at a price of $500 million and Sri Lanka Insurance Corporation shares for $300 million.

Divestment of non-strategic state-owned assets has been suggested as a part of the government’s multi-pronged plan in the short-term to improve their operational and financial efficiency while increasing the country’s reserves position.

https://www.sundaytimes.lk/220417/business-times/sl-to-raise-8-bln-by-selling-valuable-assets-479663.html

Restructuring/Sale of Sri Lanka Telecom

Yesterday, in Parliament he presented the 77th budget of independent Sri Lanka for the year 2023. “The urgency of restructuring the most fiscally significant State-owned enterprises (SOEs) was reiterated several times during the last six months.” As committed to in the interim budget, a unit has now been established at the Ministry of Finance with the specific task of restructuring SOEs.

“Initially, measures will be taken to restructure Sri Lankan Airlines, Sri Lanka Telecom, Colombo Hilton, Waters Edge, and Sri Lanka Insurance Corporation (SLIC) along with subsidiaries, the proceeds of which will be used to strengthen the foreign exchange reserves of the country and strengthen the rupee,” he said.

As a result, a government official stated that the government intends to collect between USD 2 and USD 3 billion by transferring these government firms to the private sector as part of this restructuring strategy.

Sri Lanka Telecom is already a listed company and Malaysia’s UT Group already owns 49%. Reports say that they are ready to sell their shares if the State ownership falls into the hands of another investor.

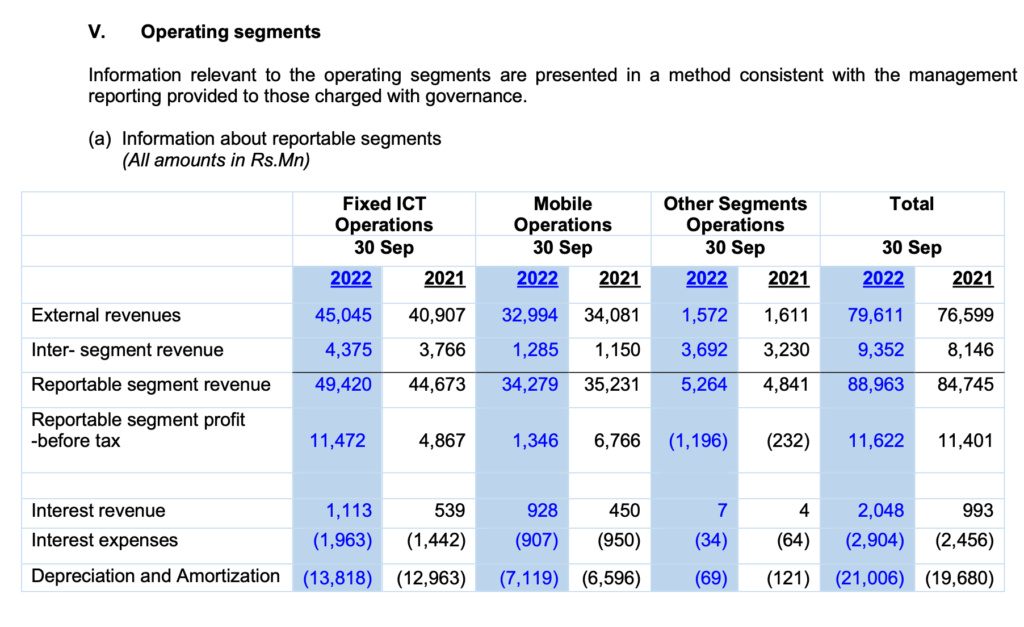

Sri Lanka Telecom - Performance of the Key Segments

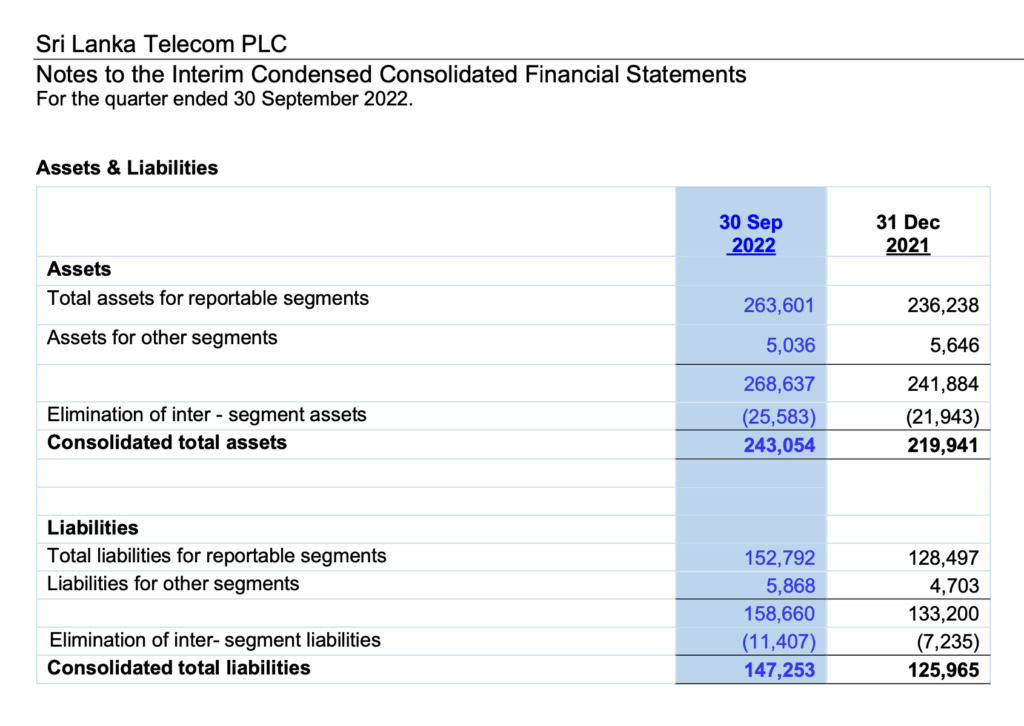

Fixed Assets Vs Liabilities

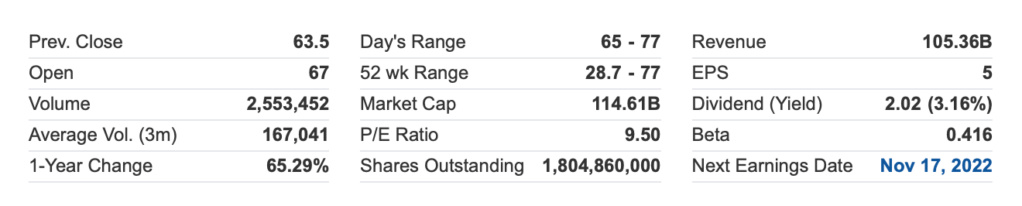

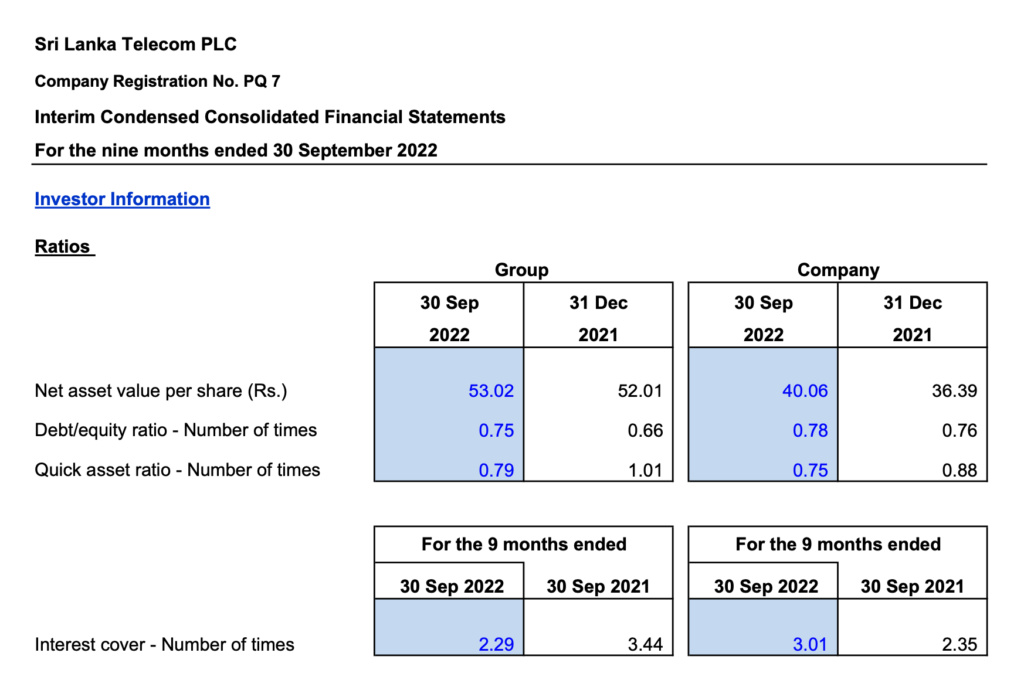

Key Performance Indicators

Sri Lanka Telecom PLC reported earnings results for the third quarter and nine months ended September 30, 2022. For the third quarter, the company reported sales was LKR 26,674 million compared to LKR 26,653 million a year ago. Net income was LKR 1,428 million compared to LKR 3,231 million a year ago. Basic earnings per share from continuing operations was LKR 0.79 compared to LKR 1.79 a year ago.For the nine months, sales was LKR 79,611 million compared to LKR 76,599 million a year ago. Net income was LKR 6,049 million compared to LKR 9,180 million a year ago. Basic earnings per share from continuing operations was LKR 3.35 compared to LKR 5.09 a year ago.

https://cdn.cse.lk/cmt/upload_report_file/390_1667985224625.pdf

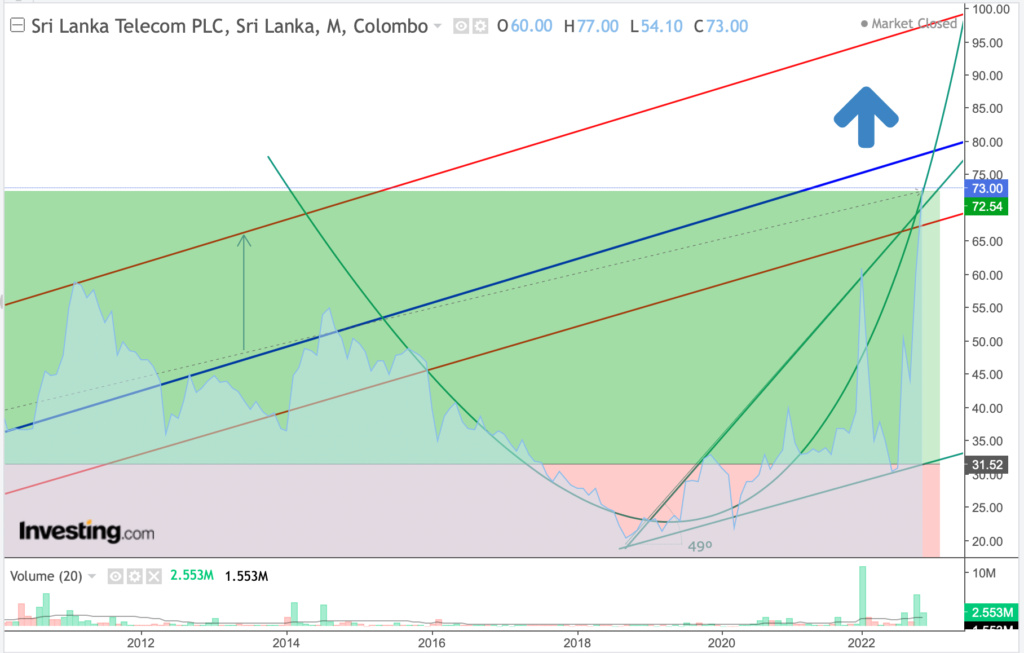

Share Price Movement

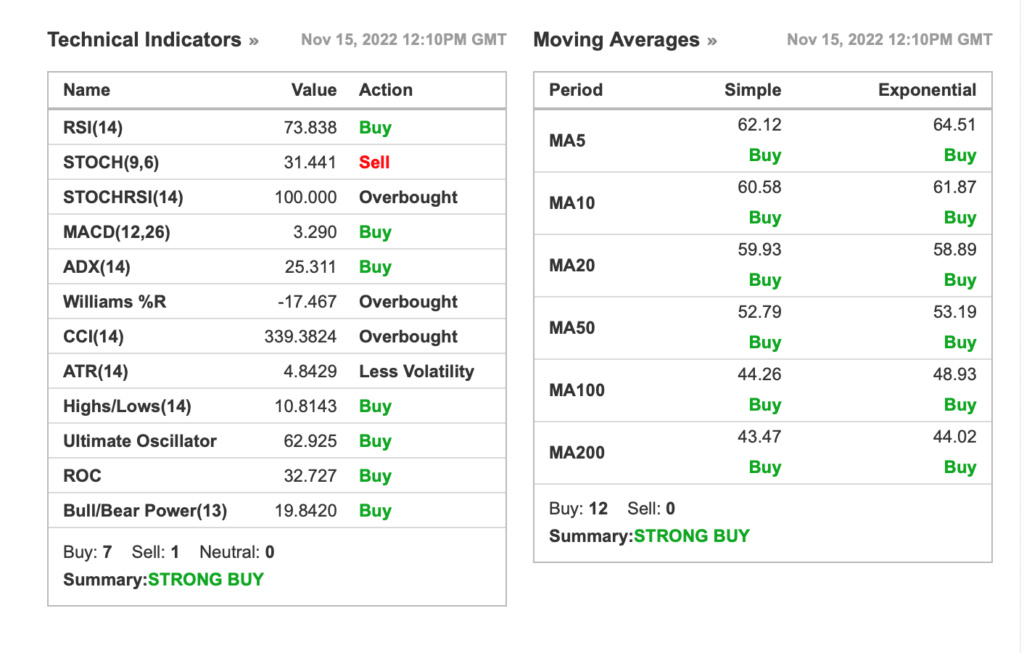

Technical Analysis

https://www.investing.com/equities/sri-lanka-telecom-sltl

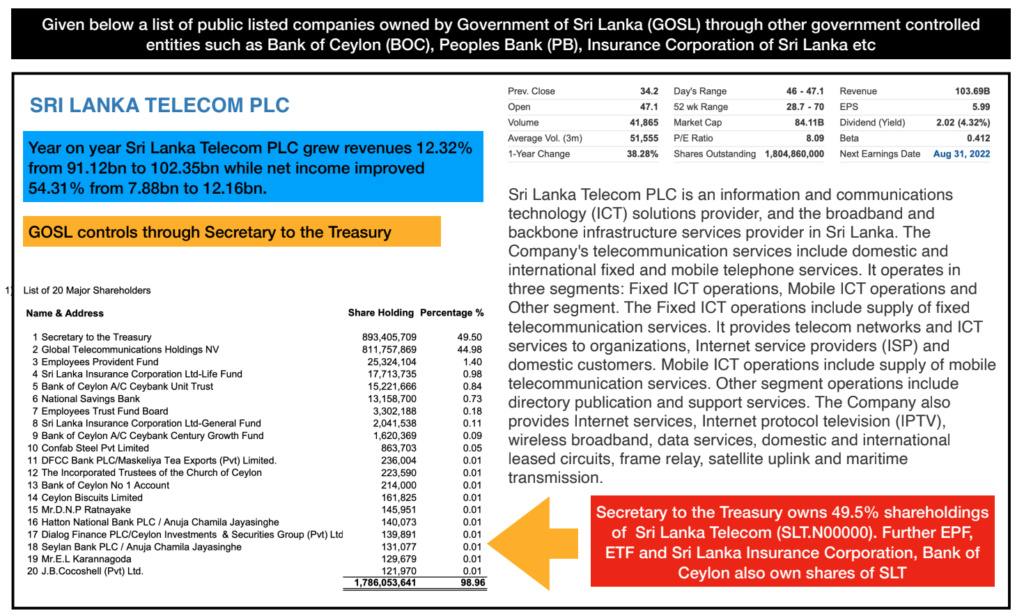

Top 20 Shareholders

Expected Divestment Price

Amount expected to generated by the GOSL from the sale (Estimated): USD 500mn (LKR 182.5bn)

No of Shares owned by Secretary to the Treasury: 893mn Shares

Price Per Share: LKR 204/=

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home