CSE Regulators lackadaisical approach in taking appropriate action to suspend trading of some listed companies that has reported serious loss of capital for many years despite deadlines issued to these companies by the CSE is causing concern among the investors.

This delayed action by the regulators is likely to cause loss to investors and further debacle to Colombo Stock Exchange as similar to what transpired in the case of Vanik Incorporation, Touchwood and Magpel Exports to name a few.

Investors lost millions of rupees due to delays of the CSE in delisting the Vanik Incorporation and Touchwood Investments PLC on a timely manner.

More recently Crypto Exchange FTX was declared bankrupt causing concern about the crypto trading which is likely to affect other exchanges as well.

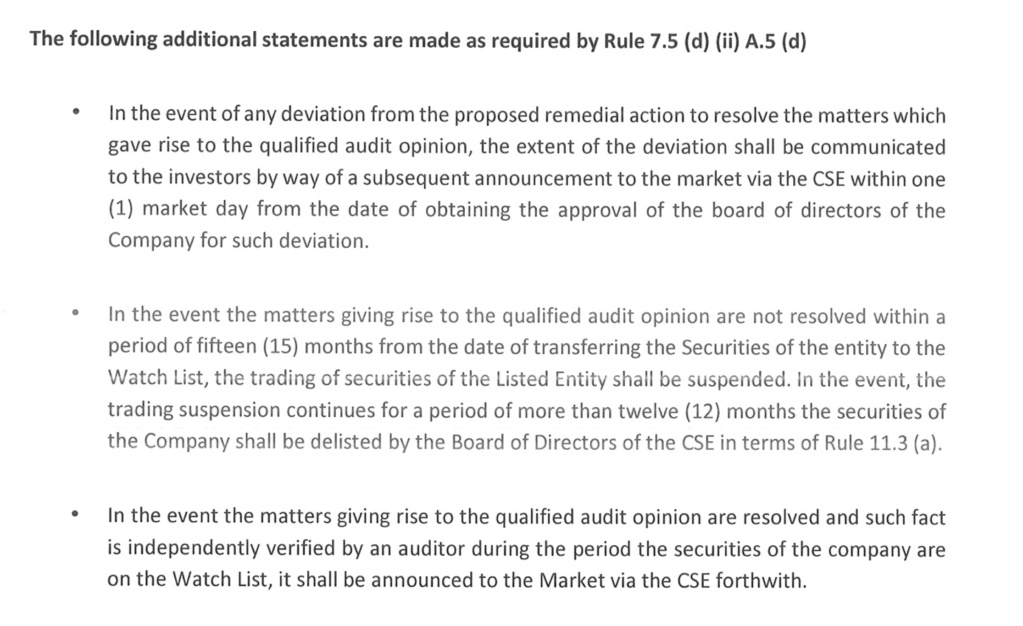

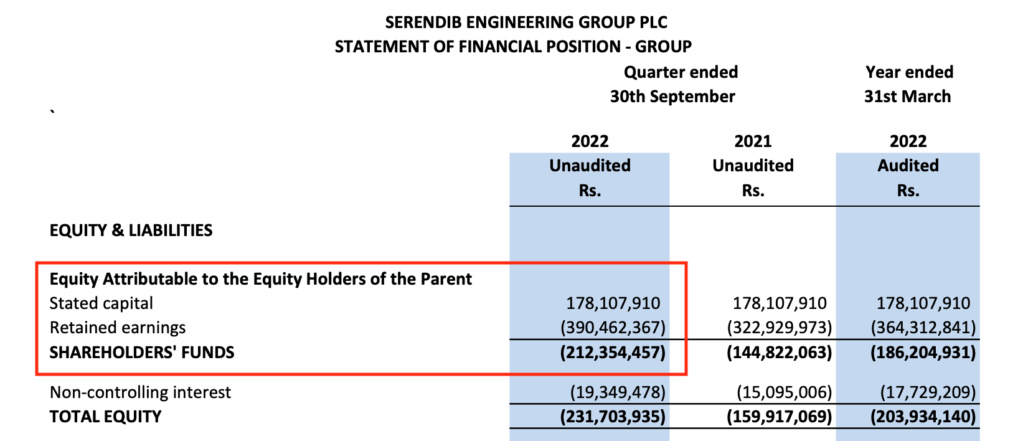

As given below in the case of Serendib Engineering PLC and Asia Capital PLC, directors of the company is taking the regulator for a joke by repeated issuing the same excuse letter even after completion of 12 months despite statutory decline issue by the CSE.

Letter issued by Serendib Engineering PLC on 7th September 2021.

https://cdn.cse.lk/cmt/announcement_portal_prod/Letter%20to%20CSE%20-%2007-09-2021_1814892250717938.pdf

Same letter issued by Serendib Engineering Group PlC on 8th November 2022.

https://cdn.cse.lk/cmt/announcement_portal_prod/SEGP%20-%20CSE%20Letter%2008.11.2022_22741538083838.pdf

No action taken by CSE against the Serious Loss of Capital at Serendib Engineering Group PLC

Latest Corporate Results of Serendib Engineering Group PLC (IDL.N0000): As at 30 September 2022

https://cdn.cse.lk/cmt/upload_report_file/624_1668158690621.09.2022.pdf

No action taken by CSE against the Serious Loss of Capital at Asia Capital PLC

Latest Corporate Results of Asia Capital PLC (ACAP.N0000): As at 30 September 2022

https://cdn.cse.lk/cmt/announcement_portal_prod/Public%20Float%20as%20at%2030.04.2020_3075447041918234.pdf

The Company’s net assets stand at LKR (341,329,000) which is below the 50% of its stated capital. This situation has triggered a serious loss of capital as at 30th September 2022 in terms of section 220 Of the Companies Act No 07 of 2007. The Board of Directors has paid much attention to this matter subsequent to the balance sheet date and subsequent to a preliminary discussion with the auditor and the Indipendent consultants of the Company have identified assets wherein the company holds a minority stake that could be liquidated in order to restructure the balance sheet. Consequently the Directors have had discussion with owners of the majority stake of the identified assets who in principle are willing to exercise their first right of refusal subject to an independent valuation and board approvals. Information gathering to facilitate the independent valuation is in progress. The Board expects, once substantial information is available, to provide a plan in terms of section 220 Of the Companies Act No 07 of 2007 to the shareholders of the Company.

https://www.srilankachronicle.com/t62815-asia-capital-plc-serious-loss-of-capital-confidence#405851

Solvency Test as per the Companies Act of Sri Lanka

SOLVENCY TEST

- A company will be deemed to have satisfied the solvency test, if: (a) it is able to pay its debts as they become due in the normal course of business; and (b) the value of the company's assets is greater than: (i) the value of its liabilities; and (ii) the company's stated capital.

SECTION 57

57. (1) A company shall be deemed to have satisfied the solvency test, if—

(a) it is able to pay its debts as they become due in the normal course of business; and

(b) the value of the company’s assets is greater than —

(i) the value of its liabilities; and

(ii) the company’s stated capital.

(2) In determining whether a company satisfies the solvency test, the board—

(a) shall take into account the most recent financial statements of the company prepared in accordance with section 151 of the Act ;

(b) shall take into account circumstances the directors know or ought to know which affect the value of the company’s assets and liabilities ;

(c) may take into account a fair valuation or other method of assessing the value of assets and liabilities.

Duty of Directors: Section 220 of the Companies Act of Sri Lanka

https://www.parliament.lk/uploads/acts/gbills/english/3776.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home