- Softlogic Holdings PLC (SHL) stock market trading suspended by the CSE due to non submission of accounts.

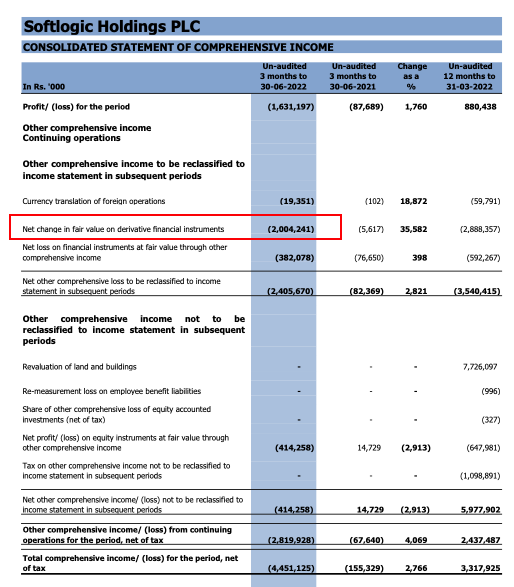

- SHL group losses exceeds LKR 4.4bn during the Quarter ended 30th June 2022.

- Net Change in the Fair Value of derivative financial instruments exceeds LKR 2bn

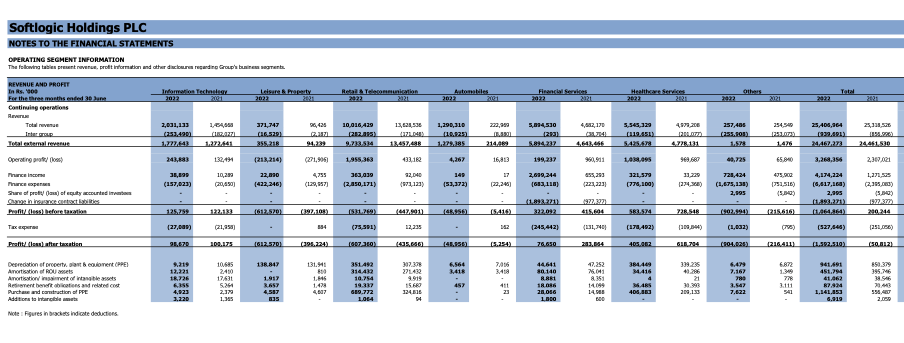

- Import restrictions continue to affect retail segment of SHL.

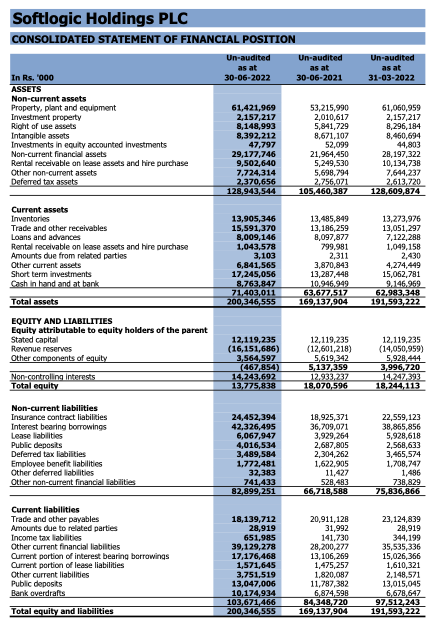

- Total SHL Group Liabilities exceeds LKR 200bn with over LKR 42bn interest bearing liabilities.

- Shareholders funds declined more than LKR 5bn within last 12 months from LKR 18bn to LKR 13bn.

- Net Asset Value per share of SHL is less thanLKR 12/= whilst share last traded at LKR 16/=

- Loss of Investor trust and confidence in the company due to non compliance of listing rules

Most economies globally are affected by the West and East engaging in dangerous brinkmanship- politics, while SL faces an acute FOREX shortfall, precipitating a fuel and gas supply shortage with the resultant effect of supply-chain disruptions, inflation, increased capital costs and imposition of unbearable duties and taxes to moderate the socio-economic imbalance - the operating business climate is at its historic worst.

It is noteworthy, that both the Healthcare sector and the Insurance arm of the group are more resilient under these challenging environments. Accordingly, business viability requires leadership entailing unavoidable long-term decisions to be made at the right time. Maintaining the status quo no doubt can become a challenge.

While drumbeats of war between superpower nations are distantly heard, with global recession hitting from all corners, we cannot be looking through glasses of doom and gloom but must instead take constructive measures to reengineer our business model to ensure the group withstands the multiplicity of these challenges.

In this light, we must become more adaptive and respond with speed to the challenges that this crisis demands and reset our thinking to become both inward- and outward-looking at the same time

While overseas investors look at the option of domestic investments, they are also confident that the quality businesses we operate on the ground can be replicated rewardingly in other countries.

As such, we have already set into motion the establishment of a new apparel factory in local partnership, and, in this way, not only will we meet the new local demand creating a local brand presence thereby relying less on imported fashion articles to sustain our retail fashion operation, but we will also set into motion operations overseas to export the surpluses and thereby earn the much-needed FOREX for the country. Similarly, our expansion in the modular furniture factory is also geared to meet export demand while the local assembly plant in ACs and Washers will preserve FOREX outflows.

Notwithstanding this, in the Retail, Healthcare and Insurance businesses we are exploring opportunities with the same dynamism to benefit from investing in markets outside the shores of Sri Lanka in collaboration with our foreign equity partners. In retail, we were close to sealing a private equity investment of a substantial amount but this is held in abeyance pending return of the country’s economic sanity.

Softlogic is an asset rich group, and we are mindful that capital buffers are entrenched in those assets, which will be optimized to sharpen our business strategy.

-Sgd-

Ashok Pathirage Chairman

15 August 2022

https://cdn.cse.lk/cmt/upload_report_file/1075_1660560332388.pdf

The Retail Sector was most impacted. Nonetheless, in-depth analysis will show that despite the import restrictions in place due to ongoing FOREX crisis precipitated by the dollar shortage, two sub-sectors were adversely affected - the lucrative mobile phone business, and to a lesser extent, Consumer Electronics. The promising features of Fashion Retailing, QSR and Supermarkets have performed commendably well to ward off the punishing effects of decompressed consumer spending following the fuel and gas crisis which brought the country down to its knees. The latter sub-sector’s business operations, however, saw to higher operating profit and EBITDA generation, a core measure of business sustainability. The other two core-sectors – Healthcare and Financial Services – the group’s primary cash flow generators, performed well, albeit lower YoY financial achievement, following the travel disruption and Government’s temporary closure of non-essential services, which encouraged WFH reflecting a partial lockdown on the city due to the fuel crisis.

No doubt, financial performance has been influenced by the extraordinary crisis which beset the economy due to both global and domestic factors. Surging inflation consequent to the depreciation of the Rupee and the decision by CBSL to deploy traditional monetary tools such as interest rate hikes to tame inflation, cast a cloud of uncertainty over the long-term direction of capital flows. This action generally has the effect of discouraging expansion and decompressing growth momentum.

https://cdn.cse.lk/cmt/upload_report_file/1075_1660560332388.pdf

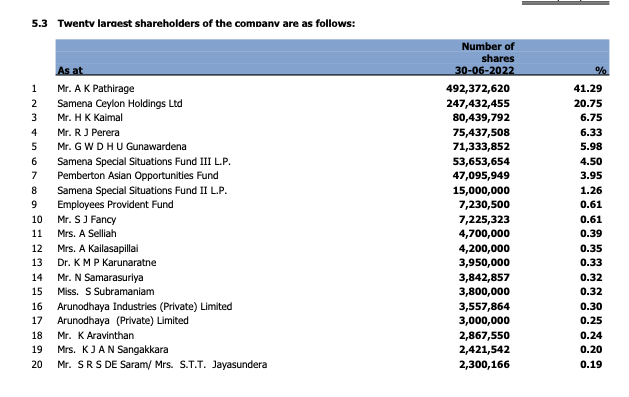

Top Shareholders

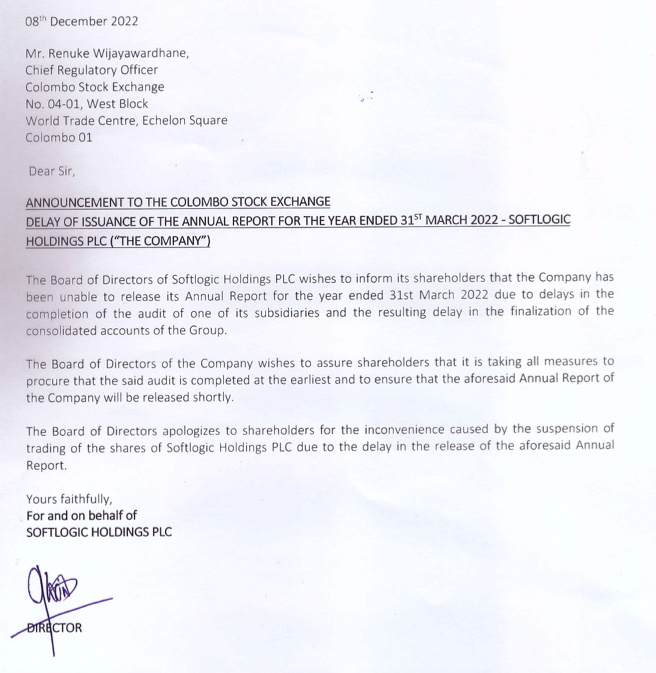

Trading suspension

https://cdn.cse.lk/cmt/announcement_portal_prod/Scan%20f001_19141202030357255_19141951317223346.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.