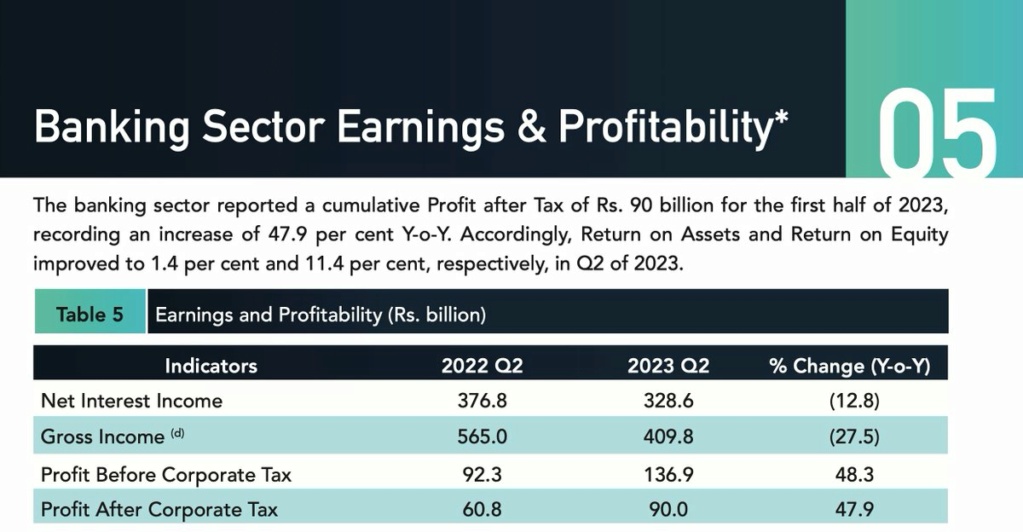

The Banking Sector reported Net Interest Income of Rs. 328.6 billion for the Q2 of 2023, recording a decline of 12.8 % YoY whilst Gross Income reported a decline of 27.5% YoY. Increased Corporate taxes yet to have the full affect on the Profit after Tax of the Banking Sector.

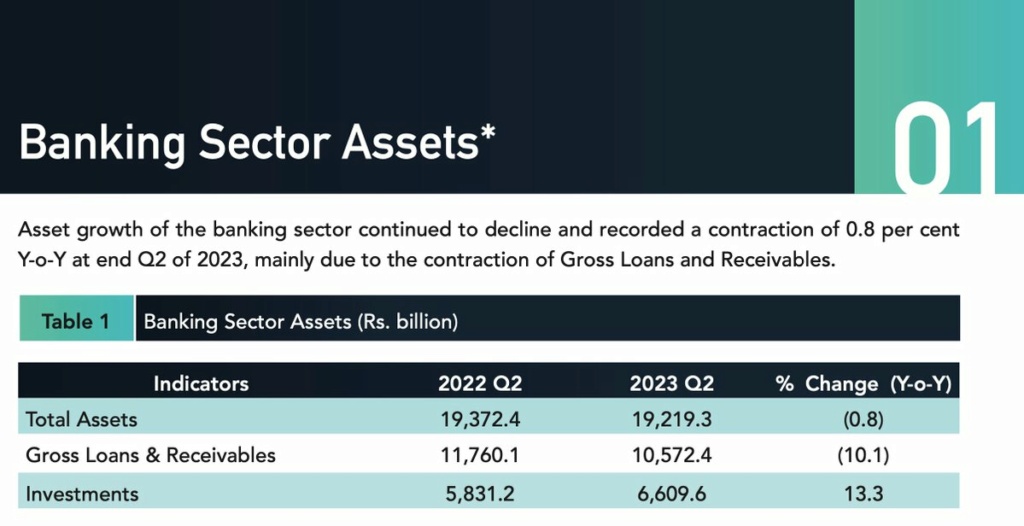

Asset growth of the banking sector continued to decline and recorded a contraction of 0.8 per cent Y-o-Y at end Q2 of 2023, mainly due to the contraction of Gross Loans and Receivables.

Foreign Currency Operations (Credit, Investments, Borrowings, and Deposits) of the banking sector (in Rupee terms) contracted on a Y-o-Y basis, mainly due to appreciation of the Sri Lankan Rupee.

Finance Companies Sector

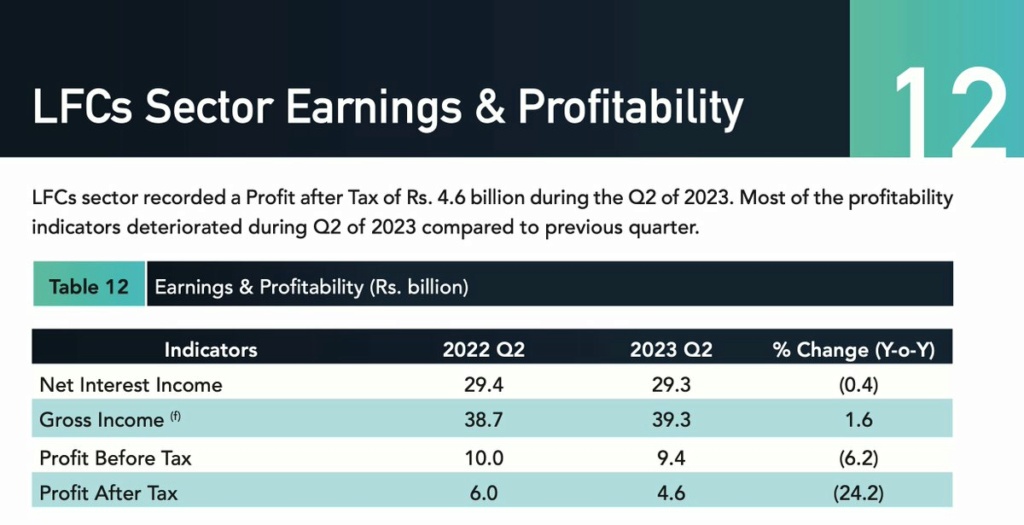

LFCs sector recorded a Profit after Tax of Rs. 4.6 billion during the Q2 of 2023. Most of the profitability indicators deteriorated during Q2 of 2023 compared to previous quarter.

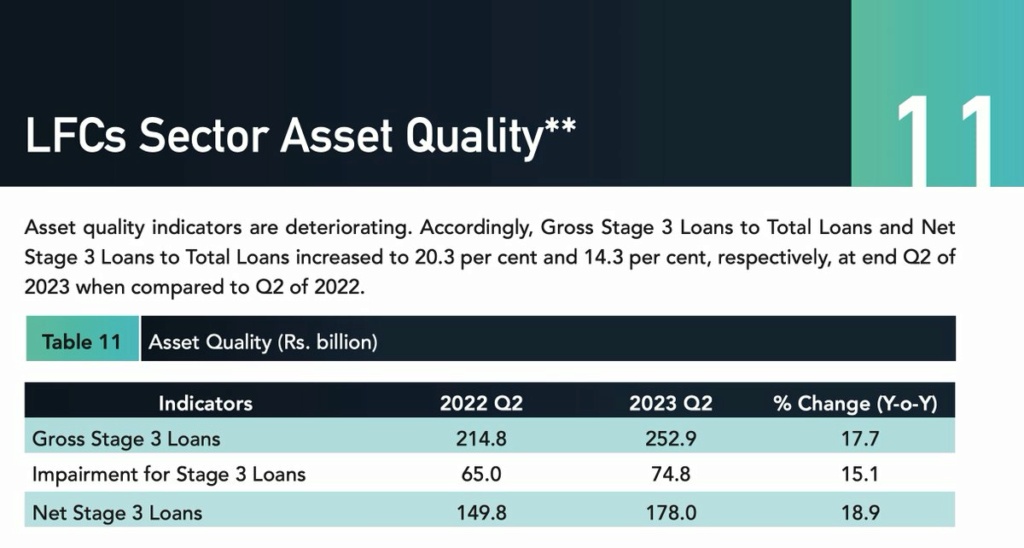

Asset quality indicators are deteriorating. Accordingly, Gross Stage 3 Loans to Total Loans and Net Stage 3 Loans to Total Loans increased to 20.3 per cent and 14.3 per cent, respectively, at end Q2 of 2023 when compared to Q2 of 2022.

Download Full Report: https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/publications/financial_soundness_indicators_2023_q2.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home