When the policy rate falls, bank profits can decrease even if the net interest margin still increases.

The effect of policy rate cuts on bank lending and risk-taking depends on how the low interest rate environment affects banks’ ability to raise external financing. When interest rates are low, easing monetary policy relaxes banks’ external financing constraint less than when interest rates are high. This reduces the stimulus to bank lending and induces banks to take more risk. There are indeed side effects of monetary stimulus at the zero-lower bound (ZLB).

Monetary policy in a low or negative interest rate environment

Since 2014, the European Central Bank (ECB) and other central banks have been pursuing a negative interest rate policy (NIRP). The ECB has reduced its deposit facility rate step by step from 0% to -0.50%. The NIRP has spurred an intense debate among both policymakers and academics about its benefits and potential drawbacks.

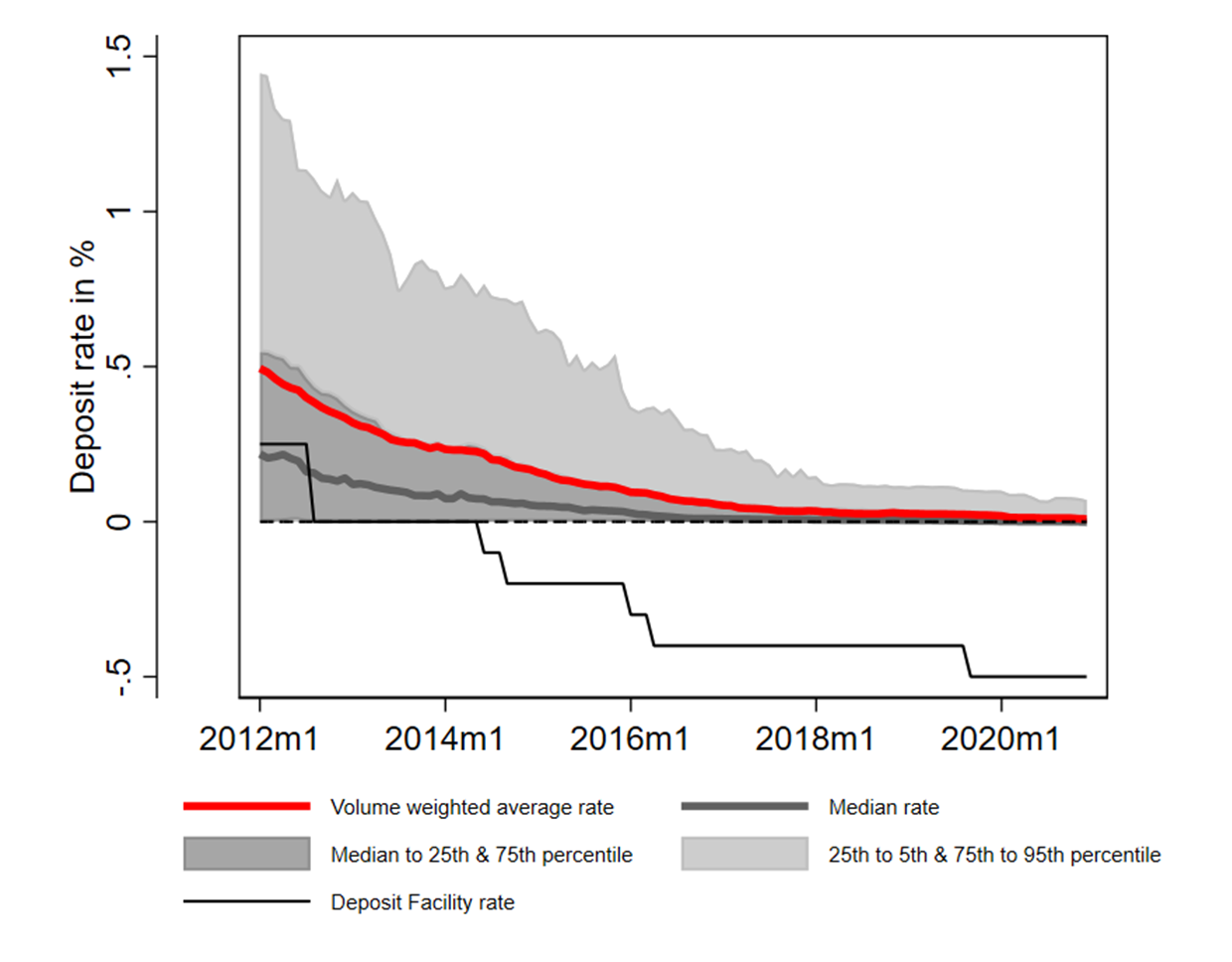

The concerns about low and negative rates are that they may be less effective at stimulating lending, while also stimulating bank risk-taking. The controversy about monetary policy in a low rate environment hinges on the existence of a zero-lower bound (ZLB) on interest rates (Coibion et al., 2012). In particular, there is a ZLB on most deposit rates: banks are reluctant to pass negative rates onto their depositors, especially households (Figure 1).[[size=14]2][/size]

Figure 1

Hard ZLB on overnight household deposit rates

Notes: The data are from the ECB’s datasets on individual MFI Interest Rates (iMIR) and individual Balance Sheet Items (iBSI). The m1 indicates the first month of a year (e.g., 2012m1 stands for January 1, 2012).

In a low or negative interest rate environment, it becomes harder for banks to pass on the reduction in the policy rate to their depositors. This means a policy rate cut translates into a lower interest rate margin and reduces the net worth of banks. This reduction in bank net worth leads to a contraction in lending as banks attempt to avoid violating regulatory constraints (Brunnermeier and Koby, 2018; Ulate, 2021). In addition, a policy rate cut may also induce banks to lower their underwriting standards (Dell’ Ariccia et al., 2014) and to engage in ''search for yield'' behaviour (Martinez-Miera and Repullo, 2017).

In our recent paper (Heider and Leonello, 2021), we present a simple conceptual framework to show how a policy rate cut affects both bank lending and risk-taking in a low or negative interest rate environment versus a high interest rate environment.

Conceptual framework

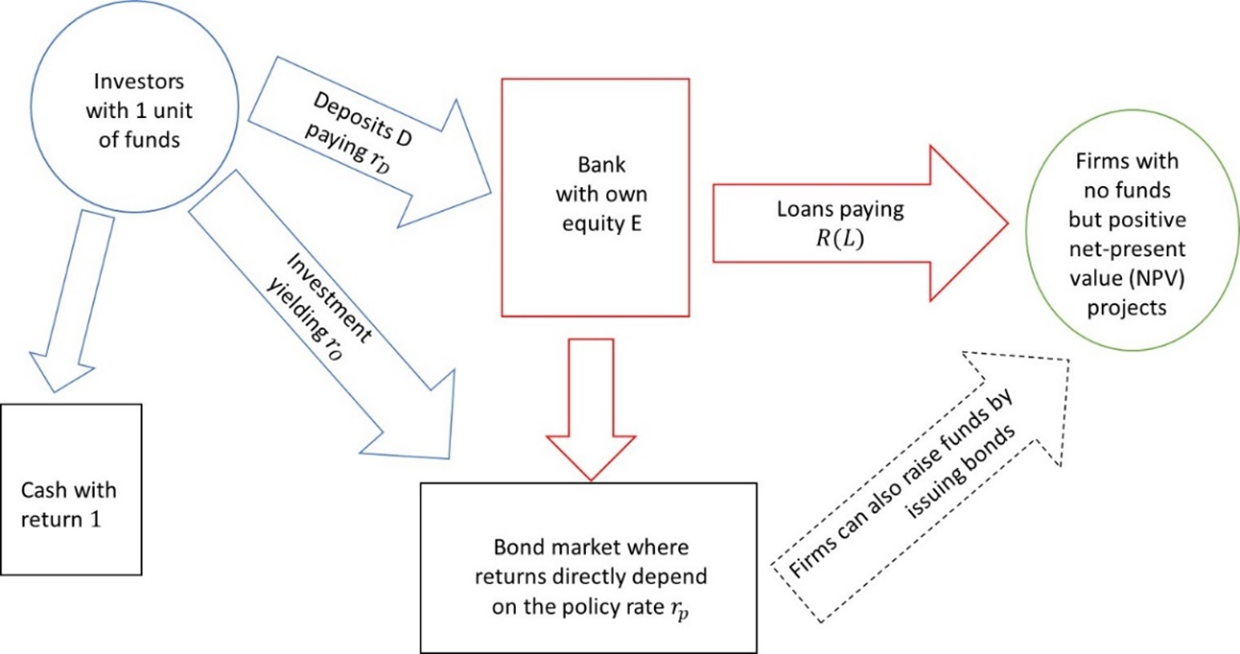

Our analysis is based on a partial-equilibrium model. Banks attract deposits from outside investors and provide loans to firms (Figure 2). As an alternative to issuing loans, banks can invest in bonds. Similarly, investors can either invest in bonds or hold cash instead of depositing it with a bank. Allowing investors to hold cash also introduces a hard ZLB on retail deposit rates. The substitutability between loans, deposits and bonds is the channel through which the policy rate affects loan and deposit rates.Figure 2

The economy

Notes: The different variables (e.g. the deposit rate or loan return R(L) refer to the model in Heider and Leonello, 2021).

The conceptual framework is centred on an external financing constraint faced by banks as is common in models of the macroeconomy that feature financial frictions.[[size=14]3] Following Holmström and Tirole (1997), the constraint hinges on the banks having incentives not to monitor loans already granted. Loans are risky. They need to be monitored ex post, i.e. after being granted, to reduce the probability of the borrower defaulting. Ex post monitoring is also necessary because depositors would not entrust their funds to the bank otherwise. But it is costly and unobservable to outsiders, so banks with limited liability accrue a private benefit from shirking on monitoring. This implies that only a fraction of the loan return (the “pledgeable return”) can be paid to outside investors as banks need to earn a rent that compensates them for costly monitoring. In order to maximise funding from depositors, banks contribute equity of their own, as this “skin in the game” is a credible signal that the banks’ borrowers are creditworthy.[4][/size]

To analyse bank risk-taking, we add an ex ante screening problem to the ex post monitoring problem. By investing time and money in screening borrowers carefully ex ante, i.e. before lending to them, banks can select better borrowers and increase the probability of loans being repaid. Banks therefore take more risks when they reduce their screening effort. Outside investors are in fact willing to invest in banks that screen less, if they receive a higher return on their investment.

Reversal and risk-taking

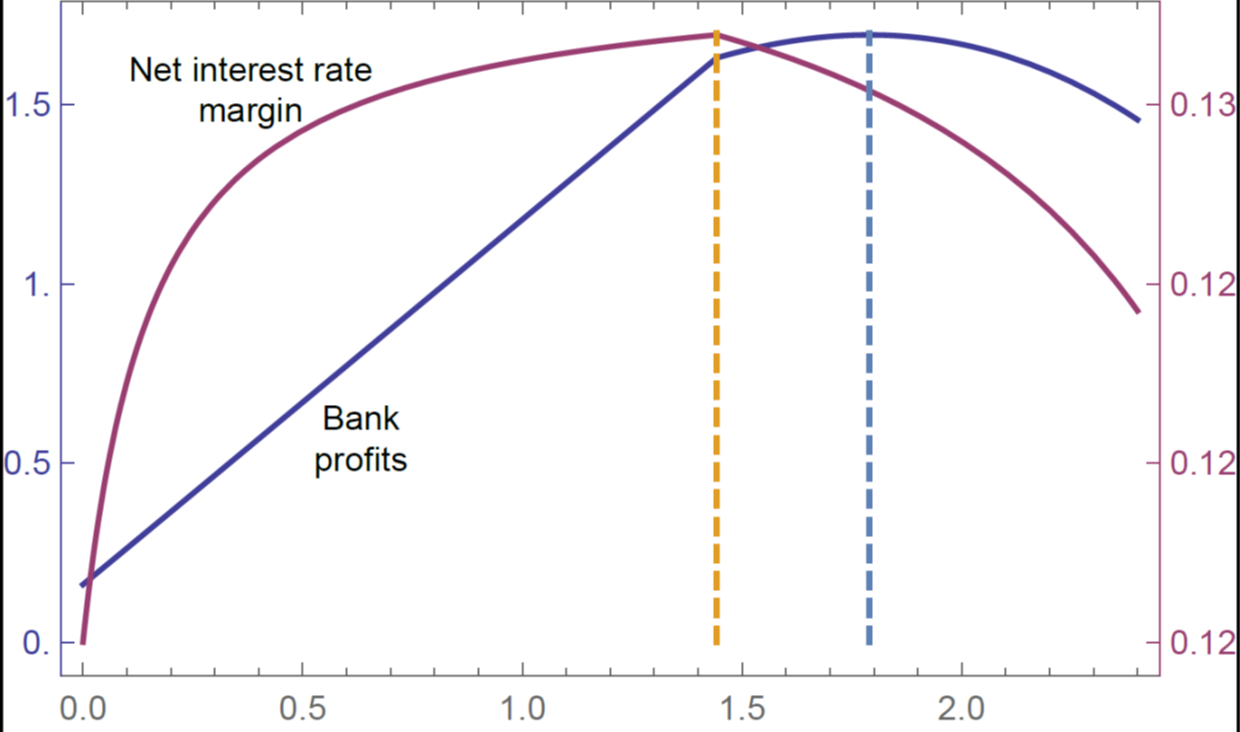

In our framework, a policy rate cut affects bank lending through the external financing constraint. This characterises how much credit banks can supply given their equity. Its exact measure, i.e. bank leverage, is determined by an “equity multiplier”, which depends directly on deposit and loan rates. A reduction in the deposit rate increases the equity multiplier, thus allowing banks to expand credit. By contrast, a lower loan rate translates into a lower pledgeable return, thus decreasing the equity multiplier and making it more difficult for banks to raise external funds.Reversal occurs when a cut in the monetary policy rate reduces lending instead of increasing it (Brunnermeier and Koby, 2018). Reversal happens when the positive effect of a rate cut on lending via lower deposit rates is weak compared to the negative effect via lower loan rates (Figure 3).

The reversal rate hinges on the existence of a ZLB on retail deposit rates. This weakens the pass-through of a lower policy rate to the cost of funding for banks so that, when rates are low, it is weaker than the pass-through to loan rates.[[size=14]5][/size]

Figure 3

At low policy rates, further cuts stimulate lending less and may eventually reduce lending (reversal)

Notes: The figure illustrates how bank lending, denoted with L* changes with the policy rate . The level of the policy rate at which lending is maximal identifies the reversal rate.

Reversal is related to – but not directly triggered by – reduced profits from a contraction in the net interest margin at the ZLB. This argument, which is often found in existing discussions, does not take into account the fact that the net interest margin is split into a “non-pledgeable” rent retained by the bank and a pledgeable part transferred to outside investors. The net interest margin therefore overstates the benefit from lending: in certain situations, bank profits – and, in turn, lending – decrease with the policy rate, even though the net interest margin still increases (Figure 4).

Figure 4

When the policy rate falls, bank profits can decrease even if the net interest margin still increases

Note: The blue line represents bank profits, while the purple line shows the net interest rate margin. In the interval between the blue dashed line and the yellow dashed line, a lower policy rate reduces bank profits but still increases the net interest margin.

How exactly does monetary policy influence banks’ risk-taking?[[size=14]6] Banks take more risk when the cost of prudent behaviour, e.g. costly screening, outweighs the benefit.[7] The benefit of prudent behaviour is captured by the ability to lend and earn the rent for intermediating. Prudent banks can attract more outside financing, leverage up more and accrue more profits. Therefore, monetary policy affects risk-taking through its effect on the lending volume.[/size]

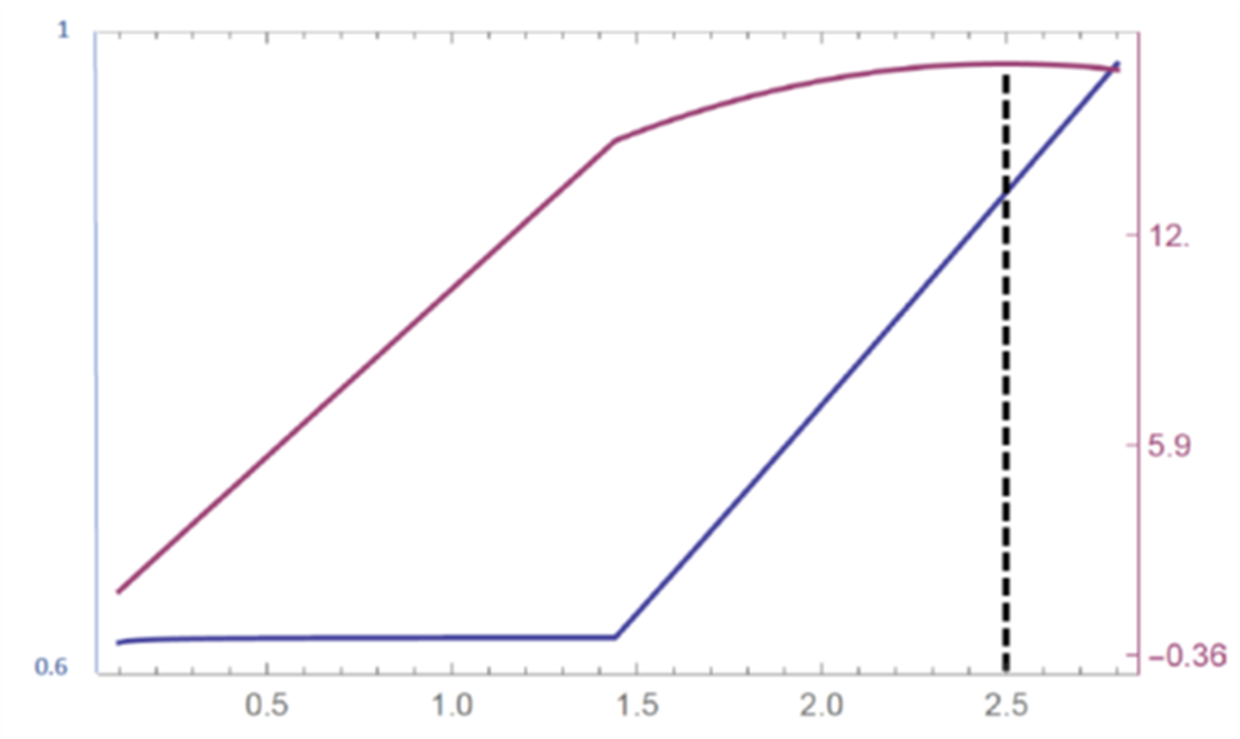

When a policy rate cut makes it more difficult to expand lending, banks find it less attractive to screen borrowers. This implies that when the policy rate falls below the reversal rate, a policy rate cut leads to increased risk-taking. However, monetary policy may also induce increased risk-taking above the reversal rate (Figure 5). This occurs when banks have market power. With market power, an increase in the lending volume reduces the loan rate, which then further reduces the benefit from screening.

Figure 5

A lower policy rate reduces bank screening – increasing risk-taking – and this may or may not coincide with less lending

Notes: The blue line represents the optimal level of screening, while the purple line shows the lending volume. The dotted vertical line identifies the reversal rate.

Conclusion: central banks and banking supervisors should exercise caution

Our research suggests that there are potential side effects of monetary stimulus in a low interest rate environment: reduced lending and increased risk-taking by banks. As a result, it is important for central banks to take financial stability considerations into account when deciding on monetary policy, since there may be conflicts in the long run between price stability and financial stability. Moreover, our modelling framework suggests that the competitive nature of lending and deposit markets needs to be taken into account when assessing these trade-offs.

https://www.ecb.europa.eu/pub/economic-research/resbull/2021/html/ecb.rb210921_1~990bfeaab7.en.html

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home