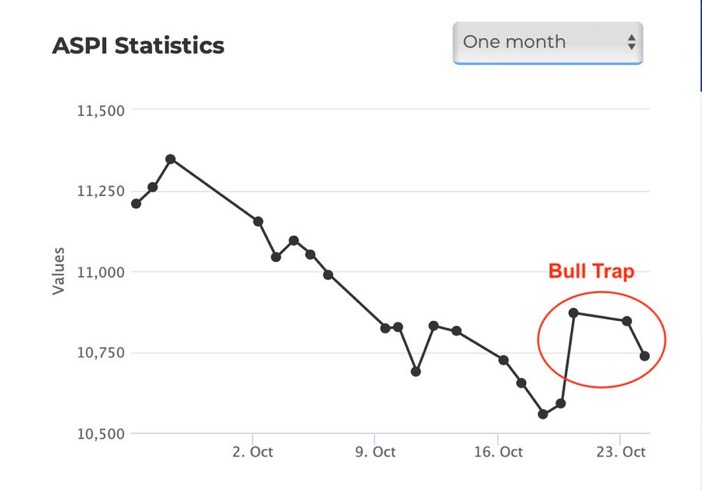

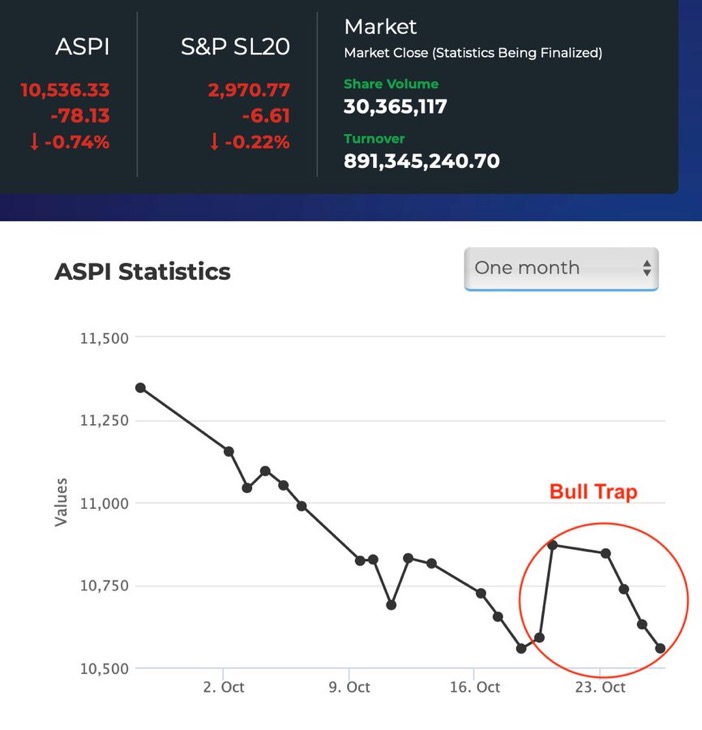

- Downtrend has been identified and noticed in an around ASPI 11,500 levels due to deteriorating market and macro economic conditions.

- Stock Market was hyped by few individuals (HNWI) with vested interest which resulted in ASPI being pushed above 10,000 levels in July 2023. (‘DDO Hype’)

- Given the current economic conditions a strong down trend can be identified due to many factors.

- Higher consumption and lower productivity during Nov/Dec seasonal period is expected to affect the Exchange Rate, Inflation and in turn the stock market.

- Sri Lanka Tourism not expected to recover until 2024/25 despite recording higher tourist arrivals in 2023 mainly due to rising operational and financial costs with additional capital expenditure for refurbishment due to long closure during Covid 19 Pandemic.

- Most Corporates expect lower quarterly earnings in Q2/Q3 mainly due to, low productivity, high administrative and interest costs in addition to exchange rate instability and increasing taxes.

- Despite favourable Domestic Debt Optimization (DDO), the Banking sector is engulfed with several issues including lower credit growth, falling Treasury Bill revenue, falling interest rates in addition to current non performing loans in excess of 12% and overall tax burden 57%.

- Upcoming elections in 2024 and resultant political uncertainty likely to affect the Stock Market sentiments and inflow of foreign investments.

- Uncertainty resulting from ongoing Israel war against Hamas which may escalate in to a full scale war also may have an effect on the financial markets around the world.

Considering above factors it is prudent to assume that the stock market will decline to pre 'DDO Hype' level ASPI 9400 on or before March 2024. Above observations have been further confirmed by the technical charts.

Above chart and analysis are not financial advice. Do your own research before trading or investing.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home