would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

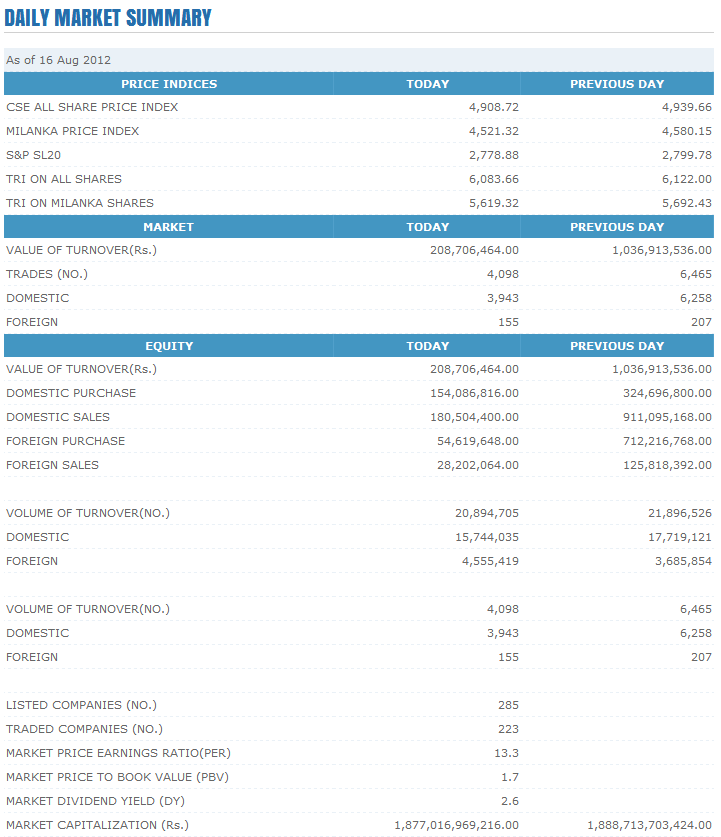

Re: Trade Summary Market - 16/08/2012 Thu Aug 16, 2012 4:02 pm

Re: Trade Summary Market - 16/08/2012 Thu Aug 16, 2012 4:02 pm

LBT:Market Thursday Thu Aug 16, 2012 4:30 pm

LBT:Market Thursday Thu Aug 16, 2012 4:30 pm

Last edited by sriranga on Fri Aug 17, 2012 4:02 pm; edited 1 time in total

Re: Trade Summary Market - 16/08/2012 Thu Aug 16, 2012 7:19 pm

Re: Trade Summary Market - 16/08/2012 Thu Aug 16, 2012 7:19 pm

Re: Trade Summary Market - 16/08/2012 Fri Aug 17, 2012 1:00 am

Re: Trade Summary Market - 16/08/2012 Fri Aug 17, 2012 1:00 am

worthiness wrote:slstock,

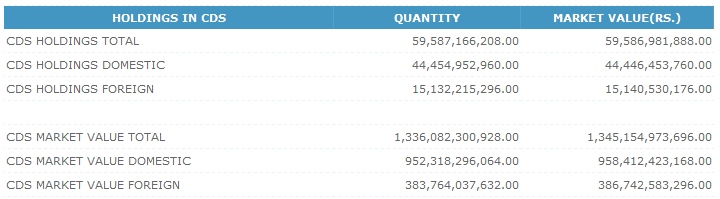

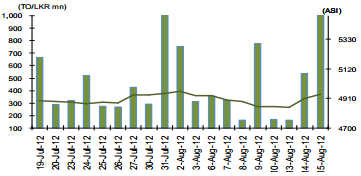

If looked into past 2 months data, it is very clear that foreign buying is much higher accumulating enormous cash flow in, while the value of domestic selling is very high than the buying ability.

What would happen to market if there is a reversal trend in foreign buying behavior? I wish it would not happen. In case, if it happens could it be covered by

domestic buyers? Honestly saying this is mystery that an expert can figure it out.

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum