smallville wrote:Dileepa,

Can u also include or make some alterations in ur simulator to have the following, if its possible;

1) Enter initial investment and date quantity

2) Cash in hand and averaging to have "NO" value in case no more cash infusion

3) to have a buy/sell price box if we buy/sell omiting the signals of the system

Thanks for the suggestion.

1) & 2) is possible.

Need some time to think about 3) as it involves a lot of what if scenarios.

Will update this later.

smallville wrote:

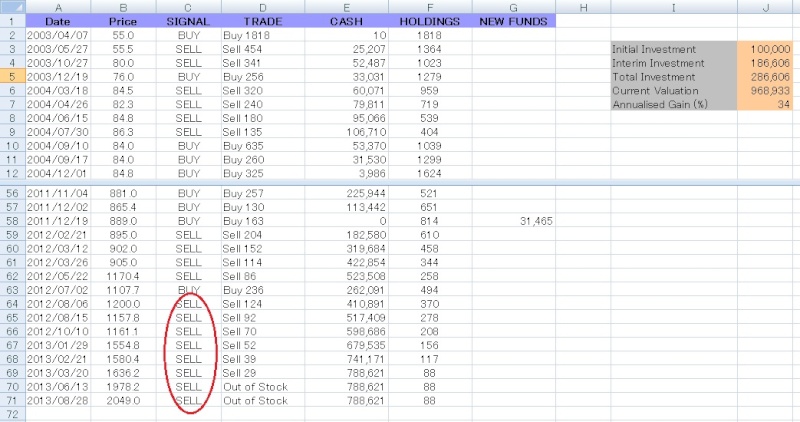

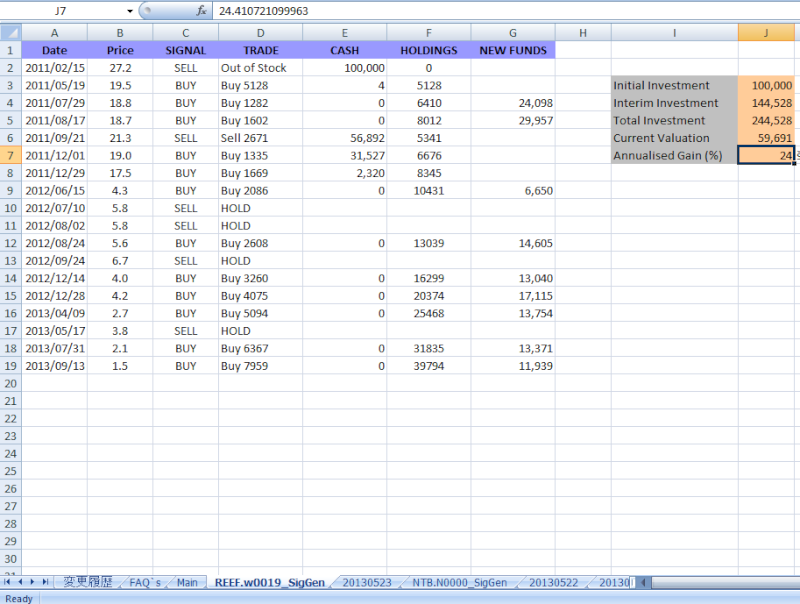

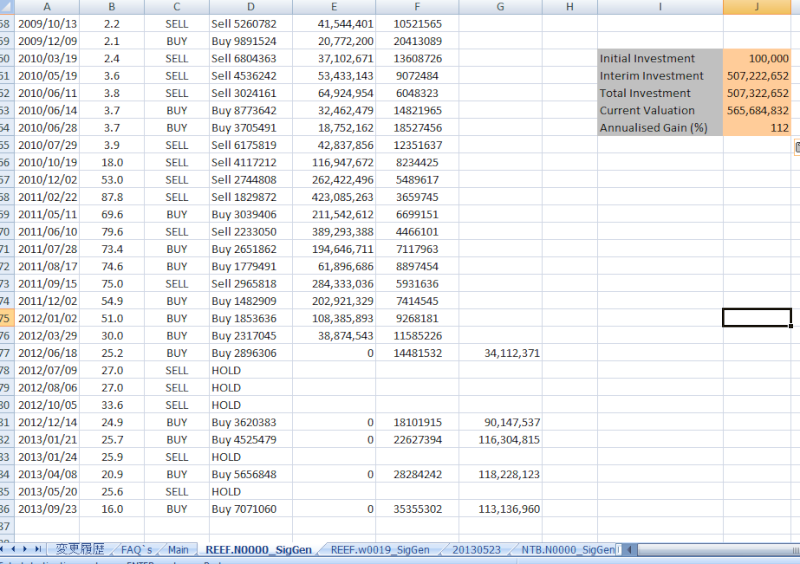

For some counter like REEF (I just checked it cuz of hype..) the strategies are not working.. May I know what buy/sell strategy (50 day MA vs 14 day, MACD - RSI - SAR combined, etc..)

Have u tested different strategies to diff counters?

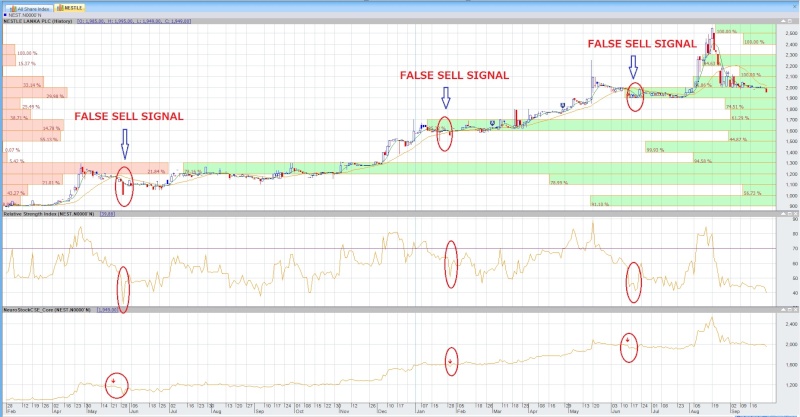

Yes I'm aware of the problem.

It is very difficult to have a universal signal generator.

As we discussed here ↓ it is better to test different strategies and identify which works for what

http://forum.srilankaequity.com/t23436-rsi-as-per-yahoo#140358

Signal generator in DFN sniffer use a combination of MA, RSI & some machine learning.

If you are interested, here is a sample code for DFN without machine learning part.

//------------------------------------------------------------Start

DataArray LMA = MovingAverage(Close, 20, Simple); // Simple 20 day MA of close price

DataArray SMA = MovingAverage(Close, 5, Simple); // Short Moving Average

DataArray LMAyest = ref(LMA,-1); // Long MA of yesterday

DataArray SMAyest = ref(SMA,-1);

DataArray LMA_2;

DataArray SMA_2;

DataArray LMAyest_2;

DataArray SMAyest_2;

DataArray LMA_3;

DataArray SMA_3;

DataArray LMAyest_3;

DataArray SMAyest_3;

DataArray BuyP;

DataArray Buy_L;

DataArray Buy_N;

DataArray SellP;

DataArray BarCount;

DataArray BuyBarCount;

DataArray SellBarCount;

DataArray Period = 0;

plot(Close,Orange,Solid,1.0); // Daily close price plot

// Sell Signal

if ((LMAyest < SMAyest) and (SMA < LMA)) then

// Search for previous Buy signal and fetch the Buy Price

for(int i = 120; i > 1; i = i-1) do

LMA_2 = ref(LMA,-(i-1));

SMA_2 = ref(SMA,-(i-1));

LMAyest_2 = ref(LMA,-i);

SMAyest_2 = ref(SMA,-i);

if((LMAyest_2 > SMAyest_2) and (SMA_2 > LMA_2)) then

BuyP = ref(Close,-i); // For safety check

end

end

SellP = Close;

end

// Buy Signal

if ((LMAyest > SMAyest) and (SMA > LMA)) then

// Search for previous Buy signal and fetch the Buy Price

for(int i = 120; i > 1; i = i-1) do

LMA_2 = ref(LMA,-(i-1));

SMA_2 = ref(SMA,-(i-1));

LMAyest_2 = ref(LMA,-i);

SMAyest_2 = ref(SMA,-i);

if((LMAyest_2 > SMAyest_2) and (SMA_2 > LMA_2)) then

Buy_L = ref(Close,-i);

for (int j = (i-1); j > 1; j = j-1) do

LMA_3 = ref(LMA,-(j-1))

SMA_3 = ref(SMA,-(j-1))

LMAyest_3 = ref(LMA,-j)

SMAyest_3 = ref(SMA,-j)

if((LMAyest_3 > SMAyest_3) and (SMA_3 > LMA_3)) then

Buy_N = ref(Close,-j);

end

end

end

if (Buy_N < Buy_L) then

BuyP = Buy_N;

else

BuyP = Buy_L;

end

end

end

// Real Signal

drawsymbol((LMAyest > SMAyest) and (SMA > LMA) and (Close < BuyP),BuyArrow,Green,Below); // Buy

drawsymbol((LMAyest < SMAyest) and (SMA < LMA) and ((BuyP*1.1) < SellP),SellArrow,Red,Above); // Sell

//------------------------------------------------------------End

1. Go to Tools -> Indicator Builder from DFN Charting.

2. Copy and past above code.

3. Click Test, Build and Save (Give a name)

4. Right Click on chart area -> Indicators -> Custom Indicators & Select above

Modify the code as necessary.

Ex: To insert a RSI limit so that it will not generate a BUY signal if RSI is above 80,

change the buy signal as follows

drawsymbol((LMAyest > SMAyest) and (SMA > LMA) and (Close < BuyP) and (RelativeStrengthIndex(Close, 14) < 80),BuyArrow,Green,Below); // Buy

You know the code, have fun

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home