i ve been watching the fluctuations of ASI with little analytical knowledge , so i d like to have some expert opinion for further clarifications.

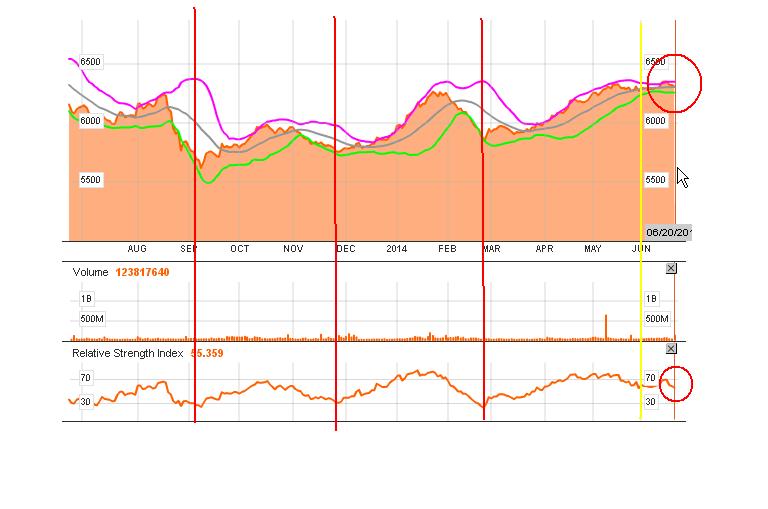

when the ASI was at the bottom it was a nice time to buy and now it has appreciated over a period of time.

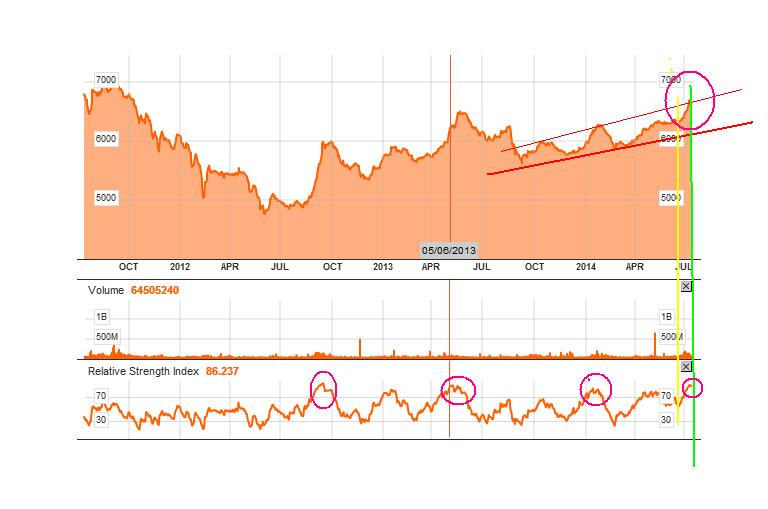

it seems that CSE is having major uptrend with a characteristic fluctuations .so i ve marked it in the chart.

so in upcoming month will it go down to touch the support levels or will it bounce back to the trend soon.

Last edited by Akalanka on Mon Jun 23, 2014 4:39 pm; edited 1 time in total (Reason for editing : RSI added)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home