I wonder whether this will happen to SPEN. IT was around 140 in lat time the ASPI went to 6500. Then ASPI went down to 5800 level and SPEN went to 90's. Still SPEN is in 110+ and dont know whether there will be a chance to go to 140 again.

Registration with the Sri Lanka FINANCIAL CHRONICLE

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc.. All information contained in this forum is subject to Disclaimer Notice published.

Thank You

FINANCIAL CHRONICLE

www.srilankachronicle.com

Home

Home

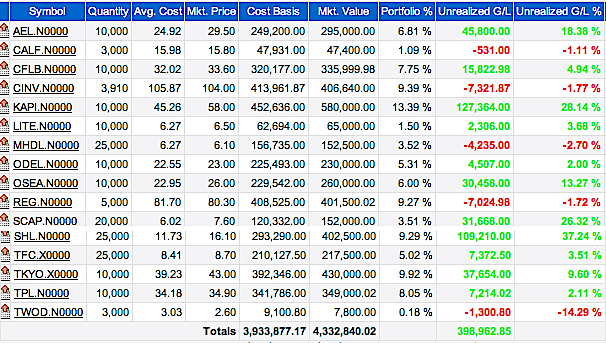

and it show that I can buy up to 7mn I was surprised

and it show that I can buy up to 7mn I was surprised and asked him whether it was correct and he was also not sure and he told me company may have changed their policy (he promised me to give further detail about this on Monday) I invested 1.5mn and according to current status of my account I can buy up to 7mn

and asked him whether it was correct and he was also not sure and he told me company may have changed their policy (he promised me to give further detail about this on Monday) I invested 1.5mn and according to current status of my account I can buy up to 7mn  my broker firm TKS securities

my broker firm TKS securities

අපි කන්නෙ මාලු කටු!...

අපි කන්නෙ මාලු කටු!...

Re-entry below if possible below 7000.

Re-entry below if possible below 7000.