Current Assets = 7823.78Mn

Current Liabilities = 4740.4Mn

Hence positive working capital.

Share holders equity as at 31-12-10 = 12070Mn

Revenue = 9749 Mn

Other Income = 2519.5 Mn (could not find any related data)

-----------------------------

Equity Holders = 2523.56 Mn

-----------------------------

Annualized Equity Holders = 2523.56/3*4 = 3364.75Mn

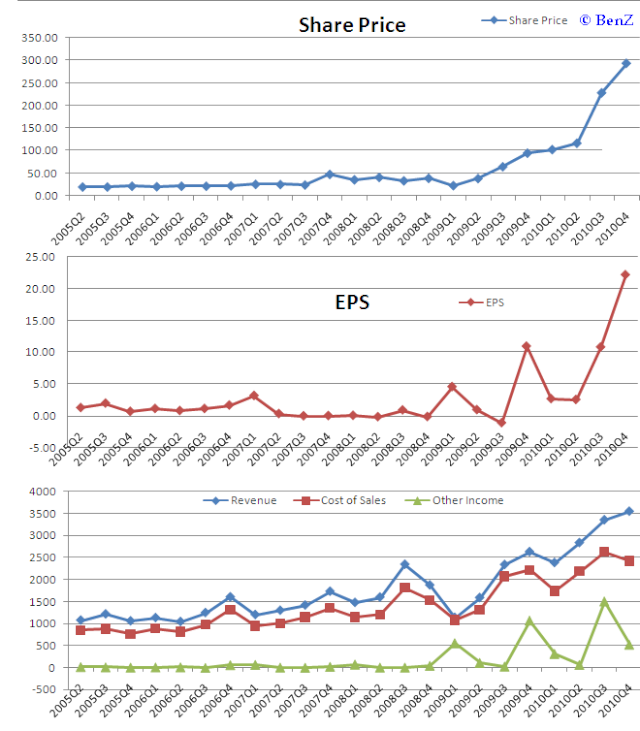

Announced EPS for 9 months = 35.61

Ordinary Shares = 70.875 Mn

Calculated Annualised EPS = 3364.75/70.875 = 47.47

Trading sector PE = 9.10

Sector Valuation - 47.47*9.10 = 431.98/-

Current Price = 380/-

Current PE = 380/47.47 = 8.0

Current ROE = 2523.56/12070 = 20.9%

Looks very under valued to me..

Browns Future plans include entering areas such as; Forestry, Hotels & Eco-tourism and Real estate development. This would eventually result in additional revenue being generated for the company. Also Galoya plantations project can be considered as a future investment as it will start suger production in 2011. The PP which raised 4.1 Bn rupees also included in cash flows.

Since Last Qtr profits = 1219.1 Mn, if we take the growth rate as 10% over the qtr = 1341 Mn. Then the Annulaised earnings would be 3864.57.

Then the projected EPS = 3864.57/70.875 = 54.53.

Hence Projected valuation over a 10% qtr PAT growth = 496.2/-

But the only problem I found was to identify the other income figure, cuz if we take it out.. theres nothing much as a gain..

But this is a good med-long term hold considering the growth of the company and industry as well.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home