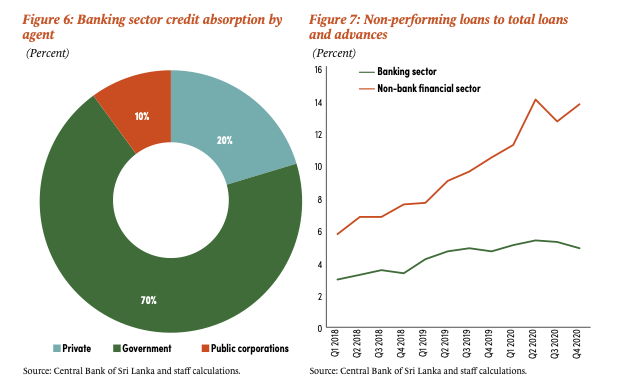

The pandemic likely exacerbated pre-existing financial sector vulnerabilities, although the full impact of COVID-19 cannot yet be observed due to regulatory relaxation. Non-bank financial institutions were already weak before the crisis. Problems of Licensed Finance Companies (LFCs) and Specialized Leasing Companies (SLCs) grew in 2020 with rising Non-performing loans (NPLs) (Fig- ure 7), tighter liquidity, and weak financial performance.

To support the sector, CBSL relaxed regulatory requirements further and improved LFCs’ access to a special liquidity facility under the deposit insurance, managed by the CBSL. While the aggregate capital adequacy indicators of LFCs seemed to have improved after June 2020, the NPLs and earnings indicators show increased stress, especially for LFCs. The adverse impact of COVID-19 on the financial sector requires policy measures to preserve the sector’s stability, while maintaining the flow of credit in the economy

Prolonged regulatory forbearance could eventually hurt financial sector resilience. According to CBSL’s solvency stress tests,4 the banking sector is less resilient due to the COVID-19 pandemic, and several banks need to raise capital. A stress testing conducted by the World Bank confirms these results. The analysis is based on the Financial Soundness Indicators pub- lished by the CBSL as of end-September 2020. It includes two baseline scenarios and one stress scenario for NPL growth and assesses the potential impact on the capital adequacy of banks and LFCs by Q4-2021 (for different segments): (a) Scenario 1 (low NPL growth) assumes that NPLs will grow at the average NPL growth rate of the past two years (2018 – 2019); (b) Scenar- io 2 (high NPL growth) assumes that NPLs will grow at a rate equal to the average positive rate of growth during that period; and (c) Scenario 3 (stress scenario) uses a shock of 2 standard deviations to long-term NPL growth since Q1-2008.

The results are as follows:

• Banks: Licensed Specialized Banks (LSB) breach the minimum Capital Adequacy Ratio (CAR) (12.5 percent) under Scenarios 1 and 2. Under Scenario 3, Licensed Commercial Banks (LCBs) and Specialized Banks breach their minimum Tier 1 capital ratio (8.5 percent) and minimum CAR (12.5 percent).

• Non-bank financial institutions: Under Scenarios 1 and 2, LFCs breach minimum total CAR (11 percent). The SLCs only breach their minimum total capital adequacy require- ments (11 percent) under Scenario 3. In that scenario, LFCs also breach their minimum Tier 1 capital ratio (7 percent).

Given rising vulnerabilities, some measures could be considered to preserve financial sector resilience. Rising NPLs will weaken the lenders’ risk appetite and eventually constrain credit growth to the private sector. This is confirmed by the CBSL credit supply and demand survey: banks forecasted a contraction of credit supply in 4Q 2020 in the face of rising NPLs after the expiration of debt moratorium. Higher NPLs and financial losses will place increas- ing pressure on the profitability and capital of banks in the medium-term. Several mitigating measures could be considered to preserve the resilience of the financial sector, including:

• Strengthen supervisory readiness and develop a sound exit strategy from the COVID-19 induced regulatory forbearance regime. As COVID-19 related measures are temporary, an exit strategy is needed, taking into account the economic outlook, expected demand for credit, lenders’ credit supply capacity, and the potential impacts of the withdrawal of for- bearance measures on the financial position of lenders.

• Accelerate the modernization of the financial sector related legal framework. This includes improving key financial sector laws (Banking, Securities, Insurance, Financial Business, Payments and Settlements, Bankruptcy, Secured transactions, Credit Authority) to modernize financial sector infrastructure, enhance financial regulation and supervision, establish a sound crisis and resolution framework, streamline consumer protection, and foster the development of new products and the adoption of modern technologies.

https://thedocs.worldbank.org/en/doc/15b8de0edd4f39cc7a82b7aff8430576-0310062021/original/SriLanka-DevUpd-Apr9.pdf

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.