Prime Lands Residencies PLC (

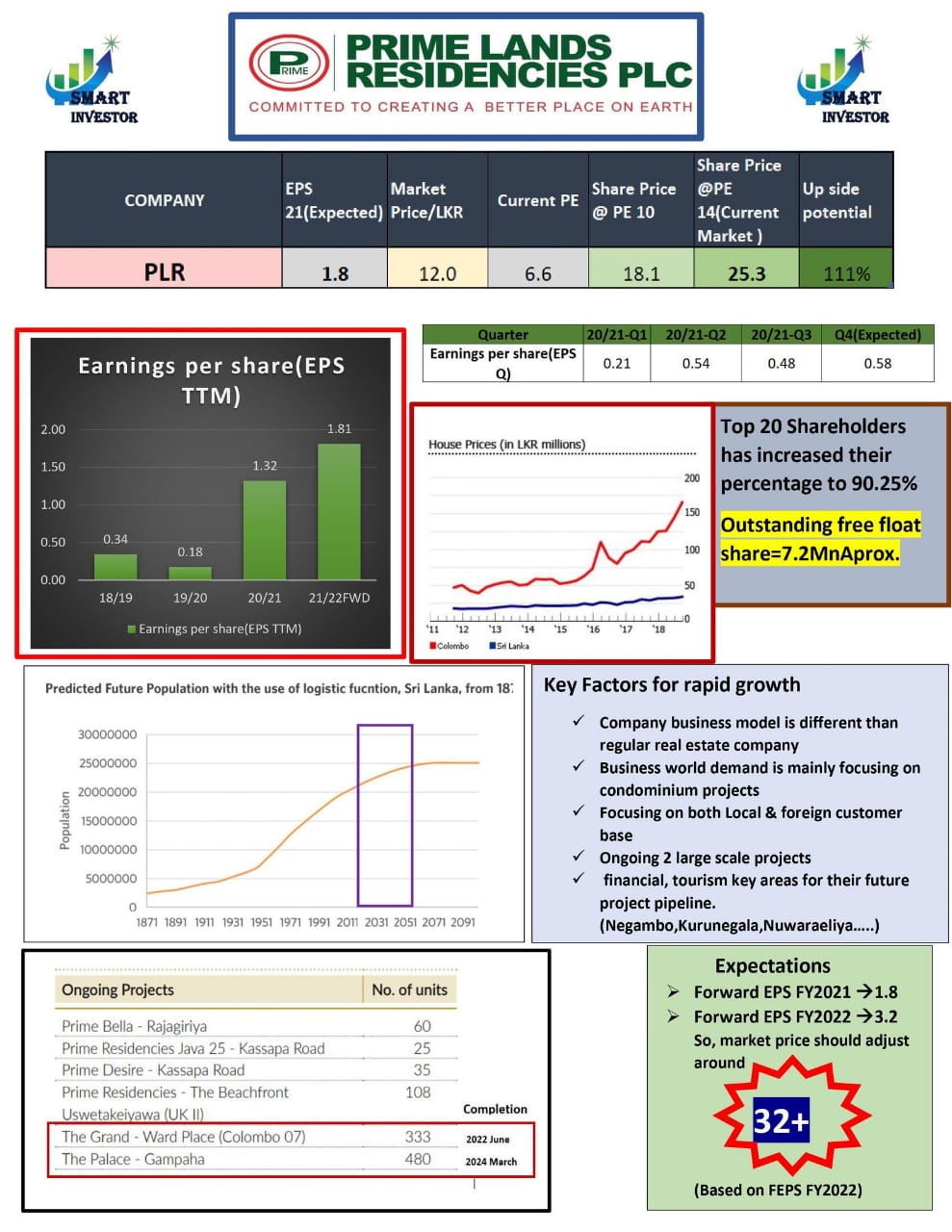

PLR) future profitability and growth is mainly dependent on the company ability to sell current properties and to embark on new development projects in the backdrop of current economic crisis faced by the country. Increase in cost of construction due to import restriction and high labour costs coupled with lower demand for apartments from the domestic buyers due high interest cost and reduction in the purchasing power of the apartment buyers is likely to result in lower than expected growth during next quarter.

Prime Group has ongoing and completed projects with a portfolio of 29+ individual housing projects, land projects spread across 18 districts in the country and 41+ apartment projects located in Colombo and the suburbs.

Prime Lands Residencies PLC has been rated by the Independent Rating Agency ICRA (Subsidiary of Moody’s Investors Service) from [SL] A- (stable) to [SL] A (stable) in April 2022. Upgrading the credit rating during a time when the industry is facing adverse head winds from both the macro and micro environment is exceptional.

According to the information collected through the Condominium Market Survey conducted by the Central Bank of Sri Lanka, the drop in sale of new condominiums observed during Q2, 2022 continued in the Q3, 2022 as well.

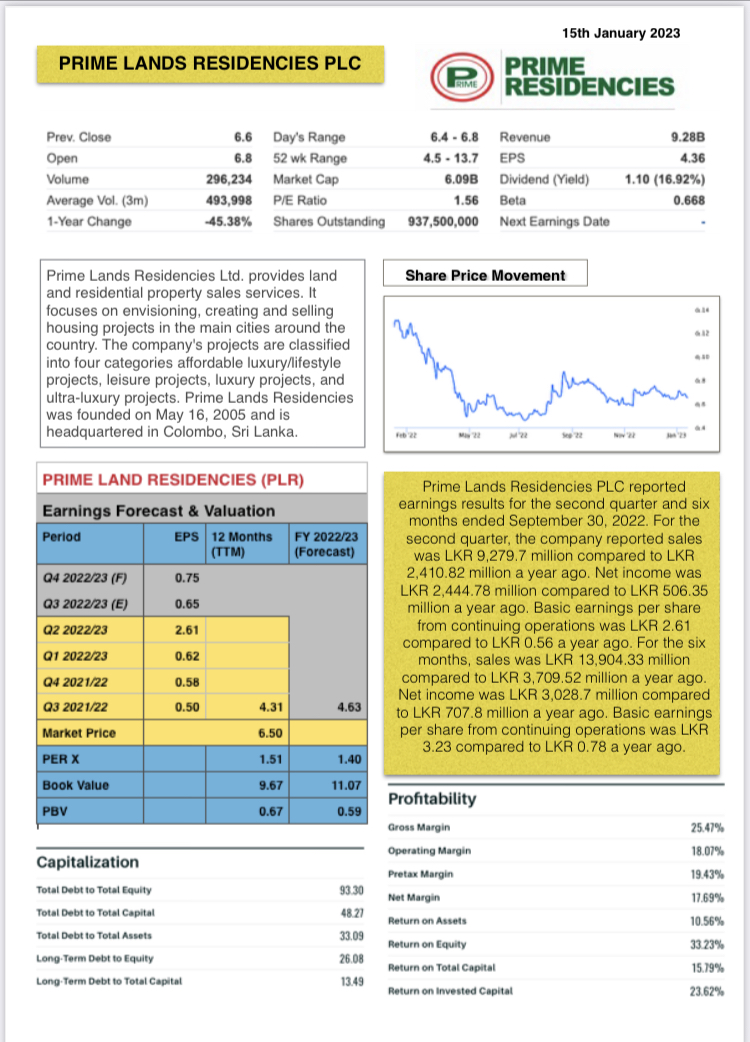

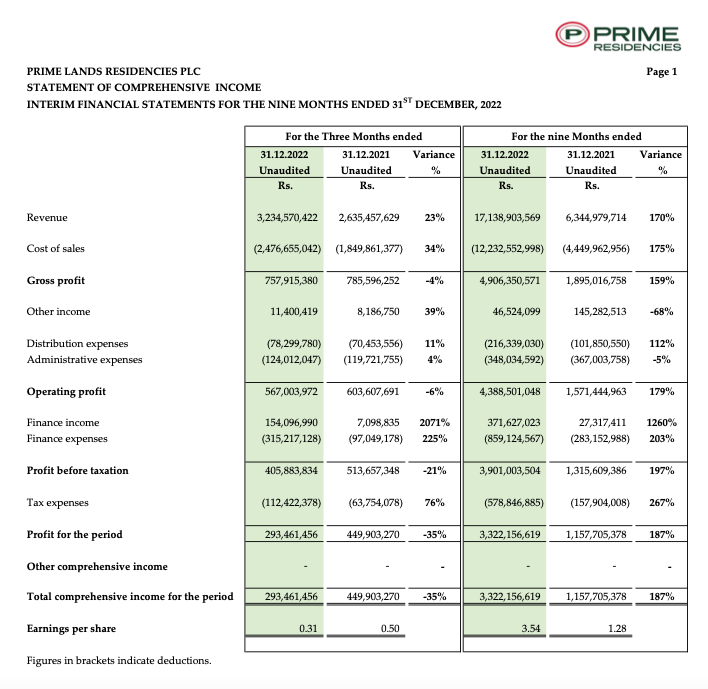

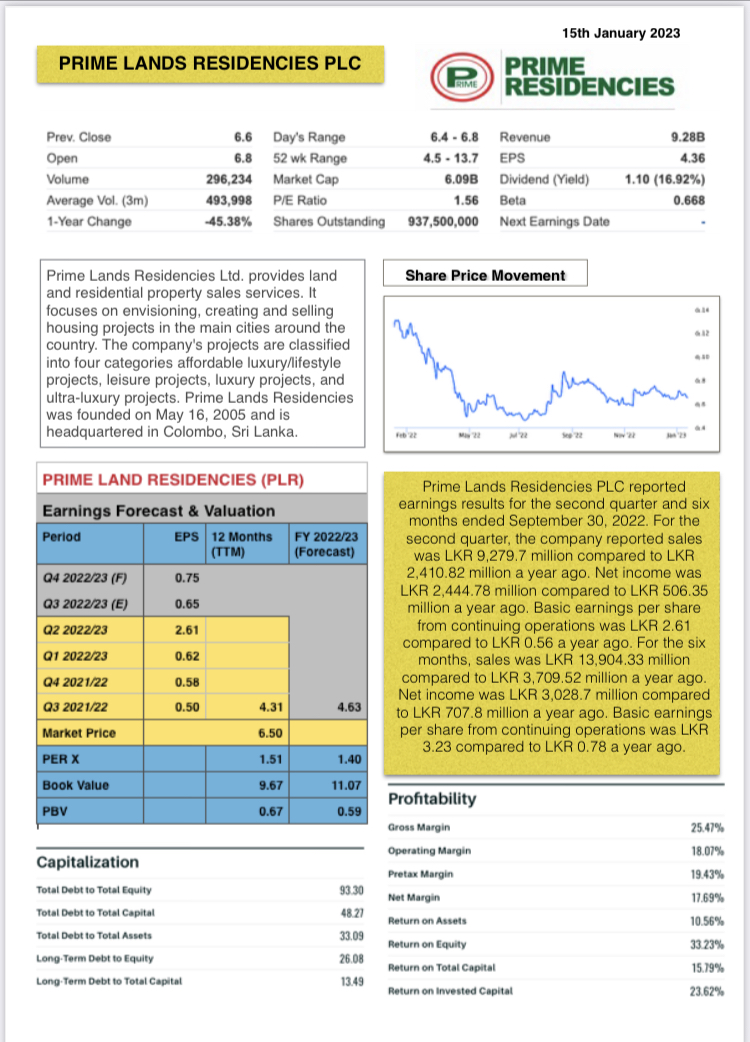

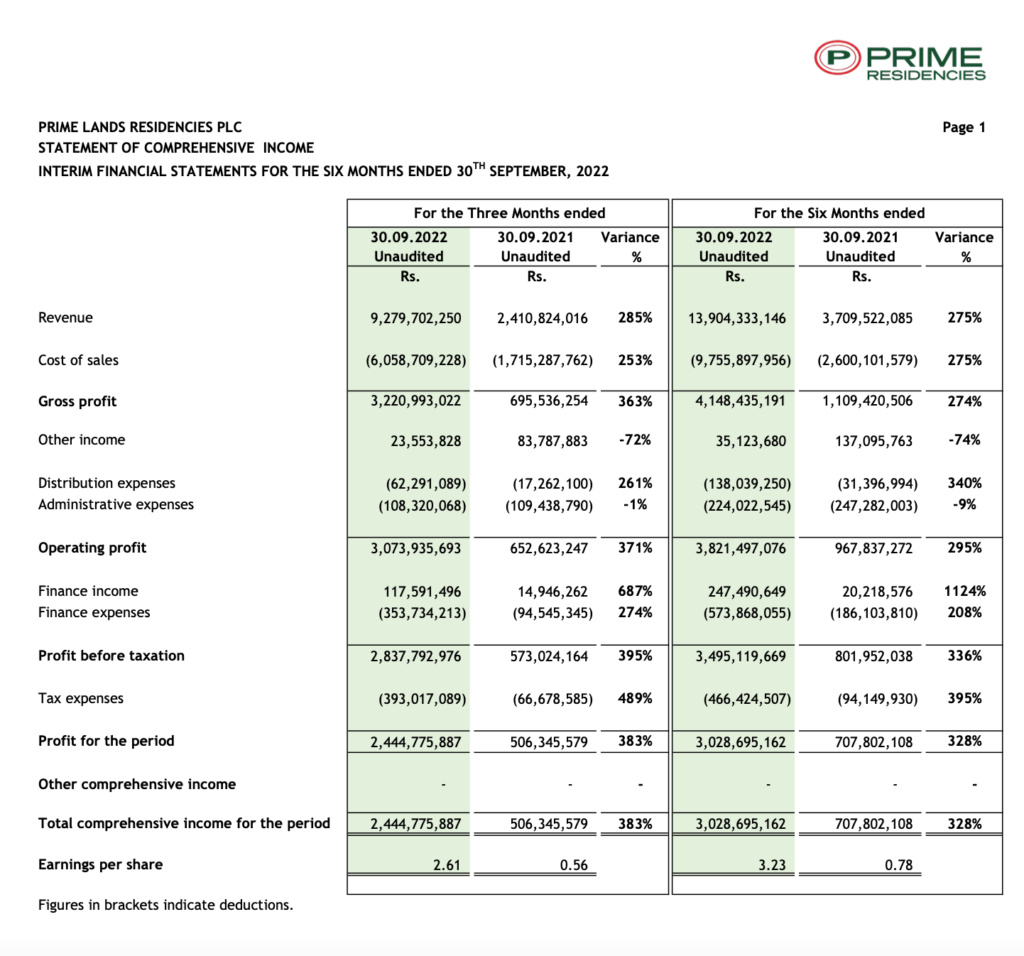

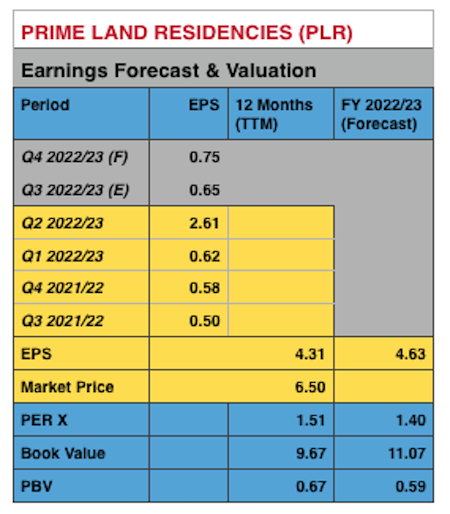

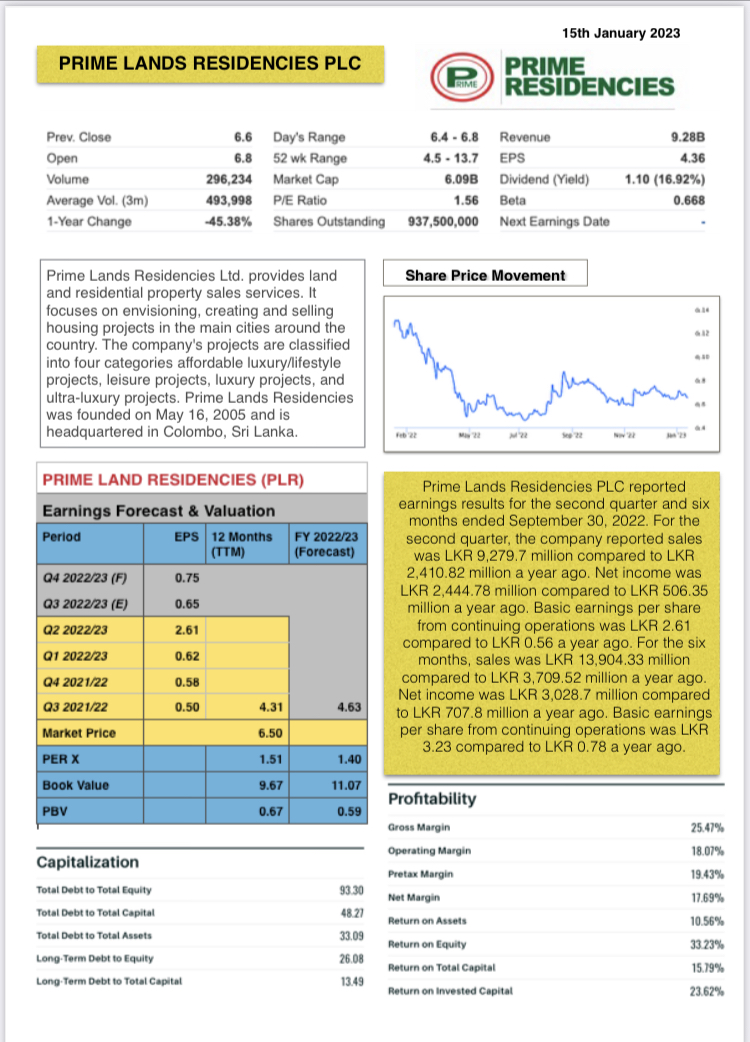

For the quarter ended 30th September 2022, Prime Land Residencies PLC (

PLR) reported an exceptional earnings of LKR 2,441mn or LKR 2,61 per share due to extraordinary increase in sales from LKR 4,624mn in 1Q22 to LKR 9,279mn in 2Q22. This is mainly as a result of the sales and profits generated from handing over of 2 key projects in Colombo during the quarter. However this has resulted in a decrease of inventory properties of the company by LKR 3,147mn and further decrease of LKR 1,639mn in customer advance collection during the quarter ended 30th September 2022.

Further as per the latest financial statement, the cash and cash equivalents balance of

PLR as at 30th September 2022 was LKR 3,009mn or LKR 3.21 per share which would be more than sufficient cash for the company to declare dividends to its shareholders in 2023.

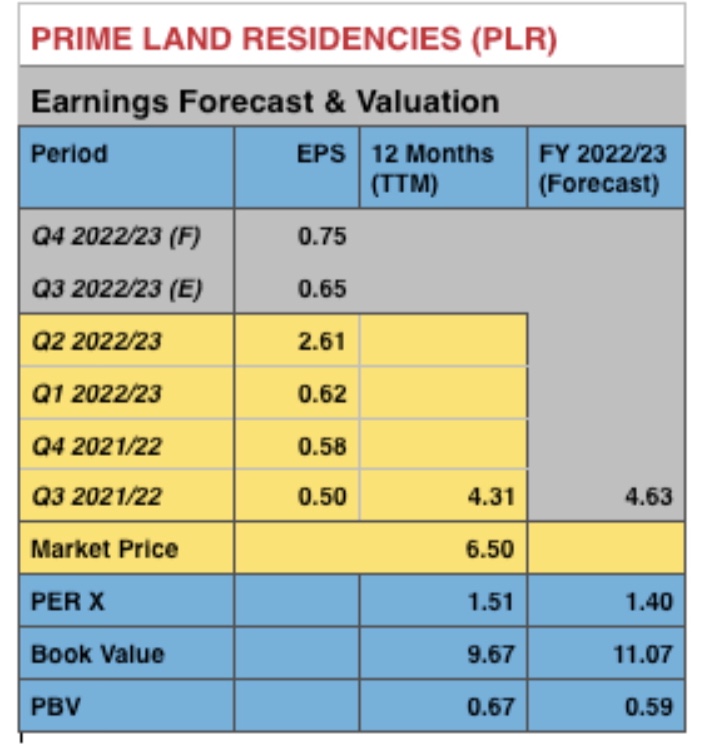

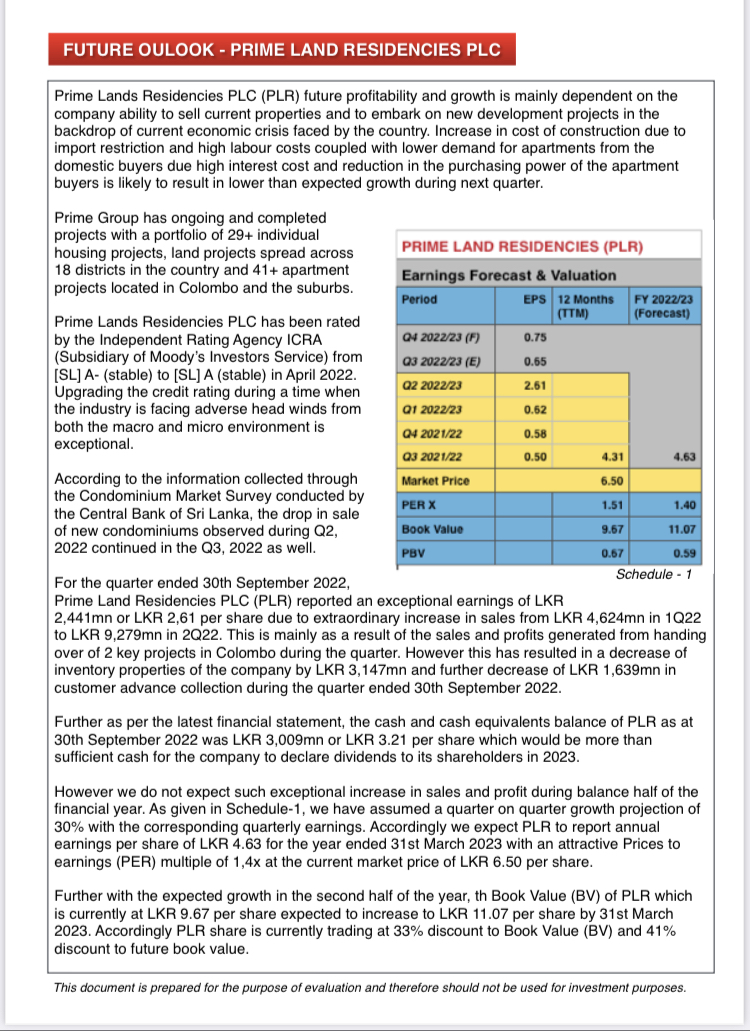

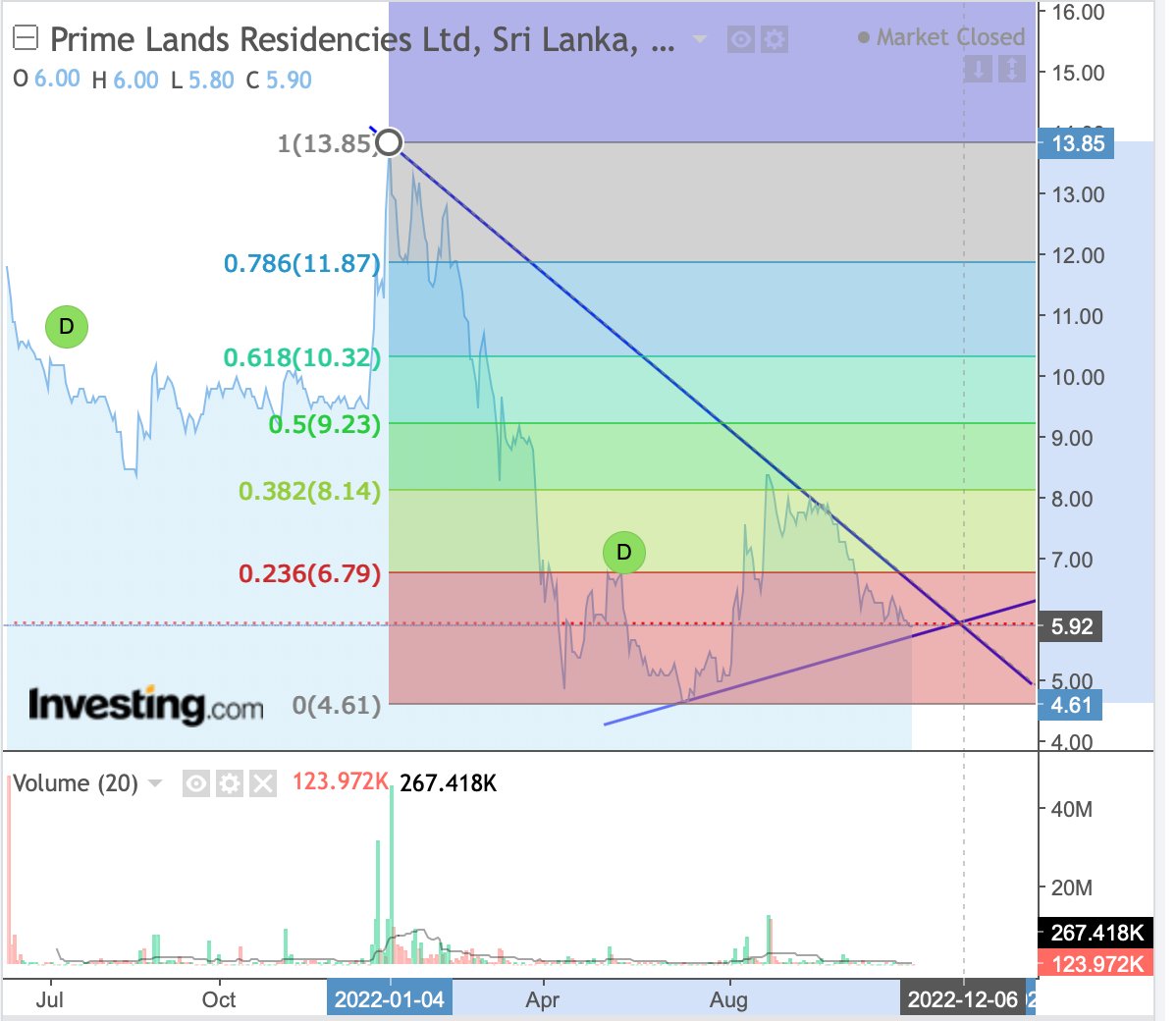

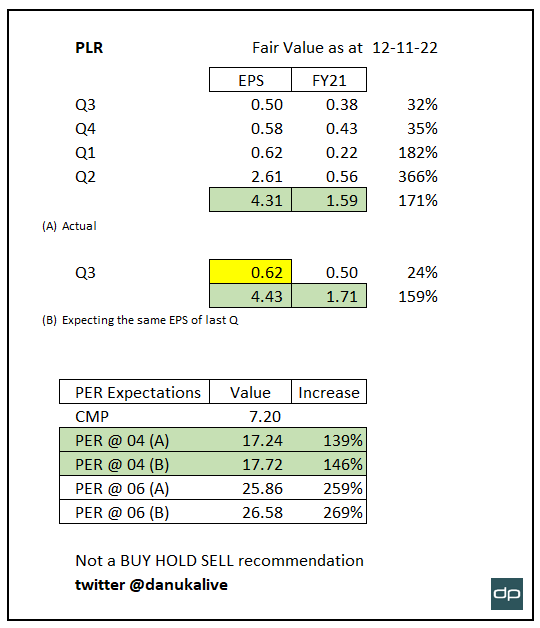

However we do not expect such exceptional increase in sales and profit during balance half of the financial year. As given in Schedule-1, we have assumed a quarter on quarter growth projection of 30% with the corresponding quarterly earnings. Accordingly we expect

PLR to report annual earnings per share of LKR 4.63 for the year ended 31st March 2023 with an attractive Prices to earnings (PER) multiple of 1.4x at the current market price of LKR 6.50 per share.

Further with the expected growth in the second half of the year, th Book Value (BV) of

PLR which is currently at LKR 9.67 per share expected to increase to LKR 11.07 per share by 31st March 2023. Accordingly

PLR share is currently trading at 33% discount to Book Value (BV) and 41% discount to future book value.

This document is prepared for the purpose of evaluation and therefore should not be used for investment.

Download Link: https://easyupload.io/6sg7gb

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

Prime Land Residencies.pdf

Prime Land Residencies.pdf