1. Namunukula (NAMU) plantation

NAMU last quarter EPS is - RS 23

LAST 6 months EPS- 40

So full year we can expect minimum 93 EPS

Forward EPS - 93

Forward PE - 2.8

TP @ PE 5 - 465

TP @ PE 6 - 558

TP@ PE 7-651

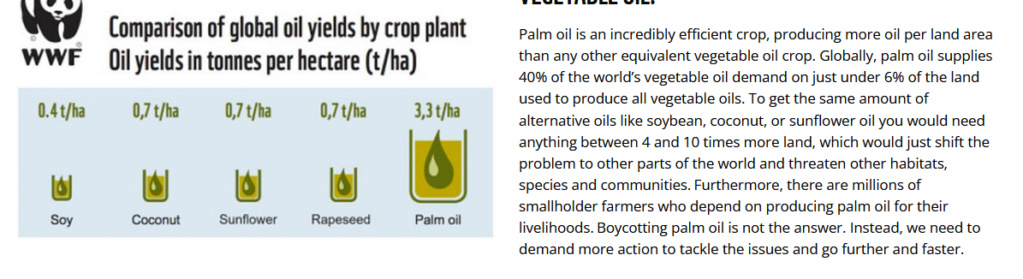

Namunukula (NAMU) plantation consist of 34% oil palm and oil palm prices are sky rocketing these days due to low global supply and these elevated prices will not reduce in near terms.

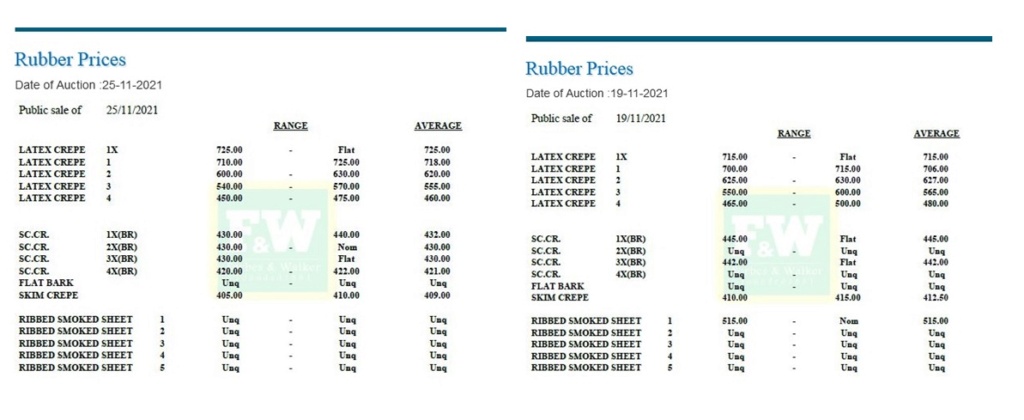

If you see the charts you can clearly see that prices have gone up further after September. Therefore we can expect next quarter EPS would be much higher than this quarter.

In addition to this Namunukula (NAMU) plantation has 21% rubber rubber prices are high and further increase in future due to restriction imposed due to import banned on rubber. It also consist of 7% cinnamon and also prices are good. In a separate post I stated this share as a mulibagger and achieve 480 RS target.

https://www.srilankachronicle.com/t60340-multibagger-stocks-by-2022-march-31st

That was published before the September result release and after the latest result I am more bullish on this counter. Therefore I expect In a bullish condition this share could achieve 600 Rs price target.

2.WATAWALA(WATA) plantation

WATAWALA(WATA) plantation consist of 73 % OIL PALM and in addition to that it consist of 4 % Rubber and 22% dairy. liquid milk prices are high and government gave lot of incentives to dairy in its recent budget. In last quarter WATA reported EPS of 5.73 and with sky rocketing oil palm prices I expect it to produce higher EPS next quarter. Thus I expect WATA to produce 25 EPS for full year.

Forward EPS - 25

TP @ PE 5 - 125

TP @ PE 6 - 150

https://twitter.com/Cseguidecse

Last edited by cseguide on Mon Nov 15, 2021 11:01 pm; edited 4 times in total

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home