Palm oil, the global vegetable oil

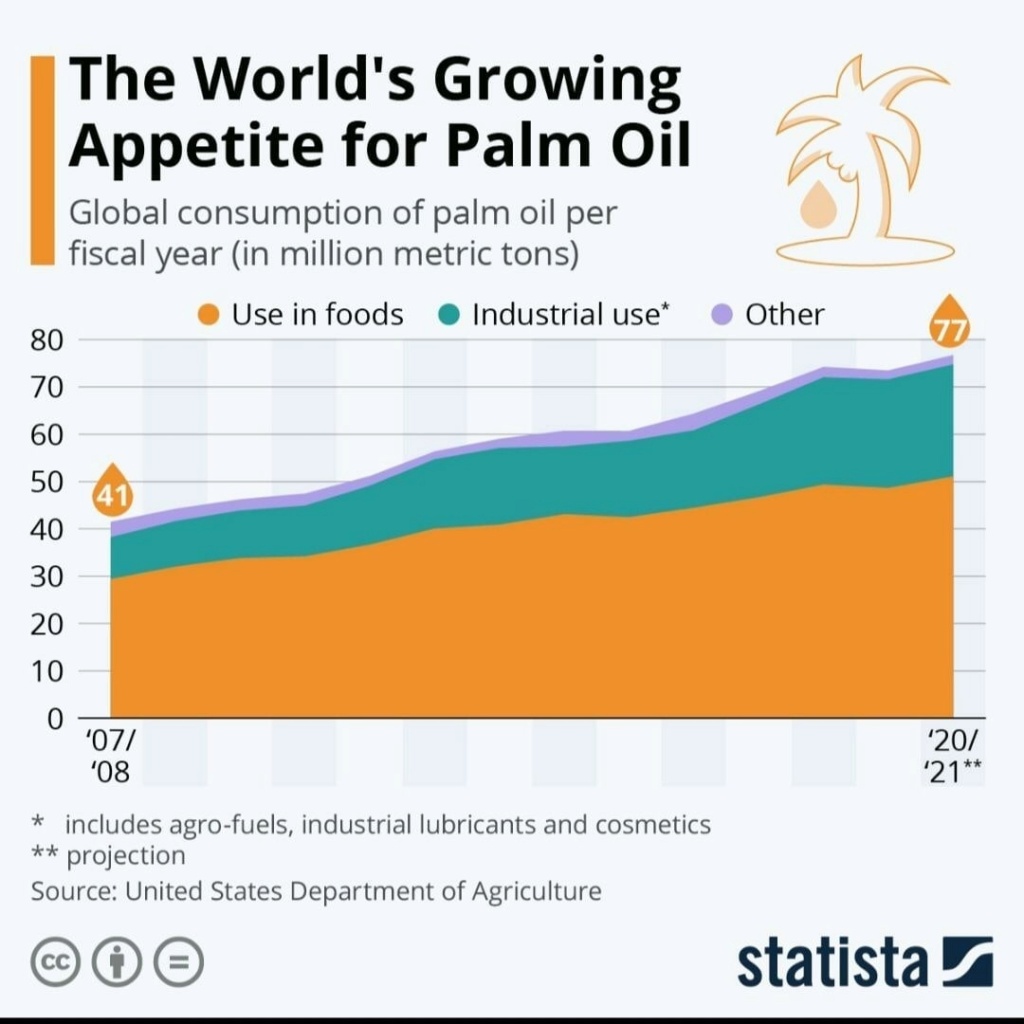

Palm oil supplies 42.3 percent of the global vegetable oil demand utilising only 14.8 million hectares whereas the soy oil which takes second place produces only 29.8 percent of the demand, but utilises as much as 103.8 million hectares. It is the most productive vegetable oil producer, producing, on average, about four tonnes/ha/year.

Productivity and profitability

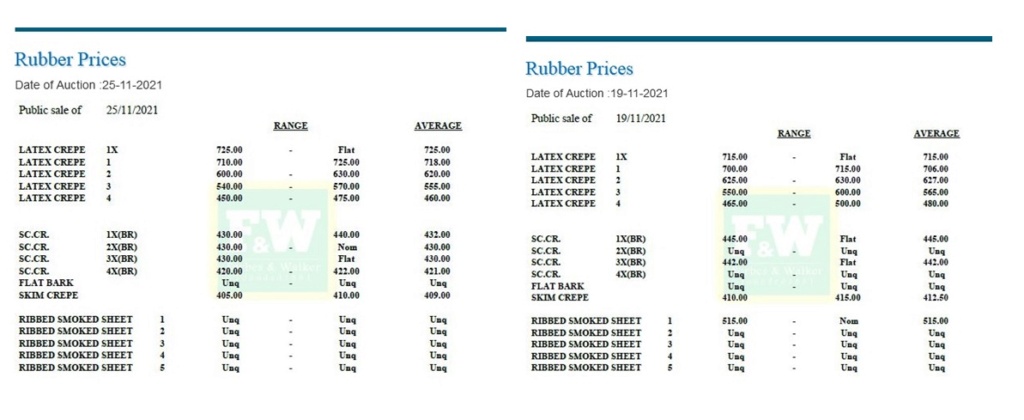

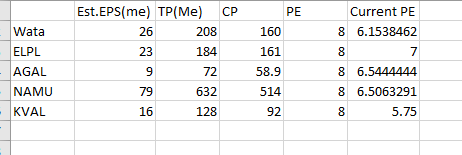

The cost of production of palm oil is the lowest of all plantation crops with the highest profit. The net profit per hectare of coconut, tea, rubber and oil palm is Rs. 175,000, Rs. 88,000, Rs. 80,000 and Rs. 612,000 respectively. In order to make the country self-sufficient in vegetable oils, there is thus justification for conversion of 40,000 to 50,000 ha of less productive rubber lands into oil palm.

After World War II, with the global vegetable oil demand increasing rapidly and conventional oils such as coconut, soy and corn not being able to meet the demand, many tropical countries expanded oil palm cultivations, some even stretching into virgin rain forests. In Sri Lanka, we are only considering diversifying less productive rubber lands.

In the 1960s, Malaysia had the so-called 60:40 land policy for rubber and oil palm, realising the massive economic benefits of the latter. However, about five years later, its government revised the policy to 40:60. And small farmers were incentivised to grow oil palm over rubber through several national projects.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home