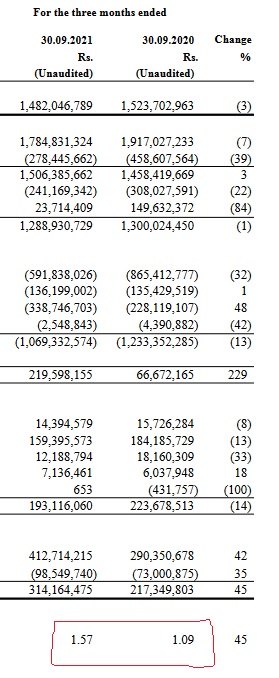

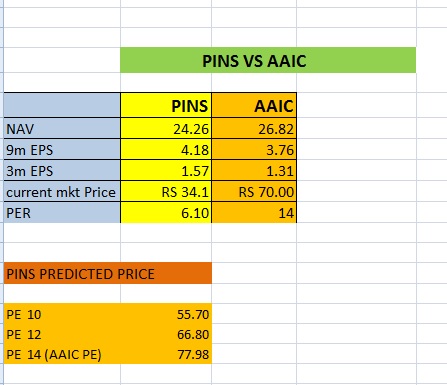

up to November PINS was trading higher price than AAIC and from 30 Th November and on wards we saw AAIC price is increasing steadily due to market attention. But still PINS price is stagnating in the same level. Both counters in the same business and more or less with same fundamentals. (PINS EPS slightly above than AAIC )

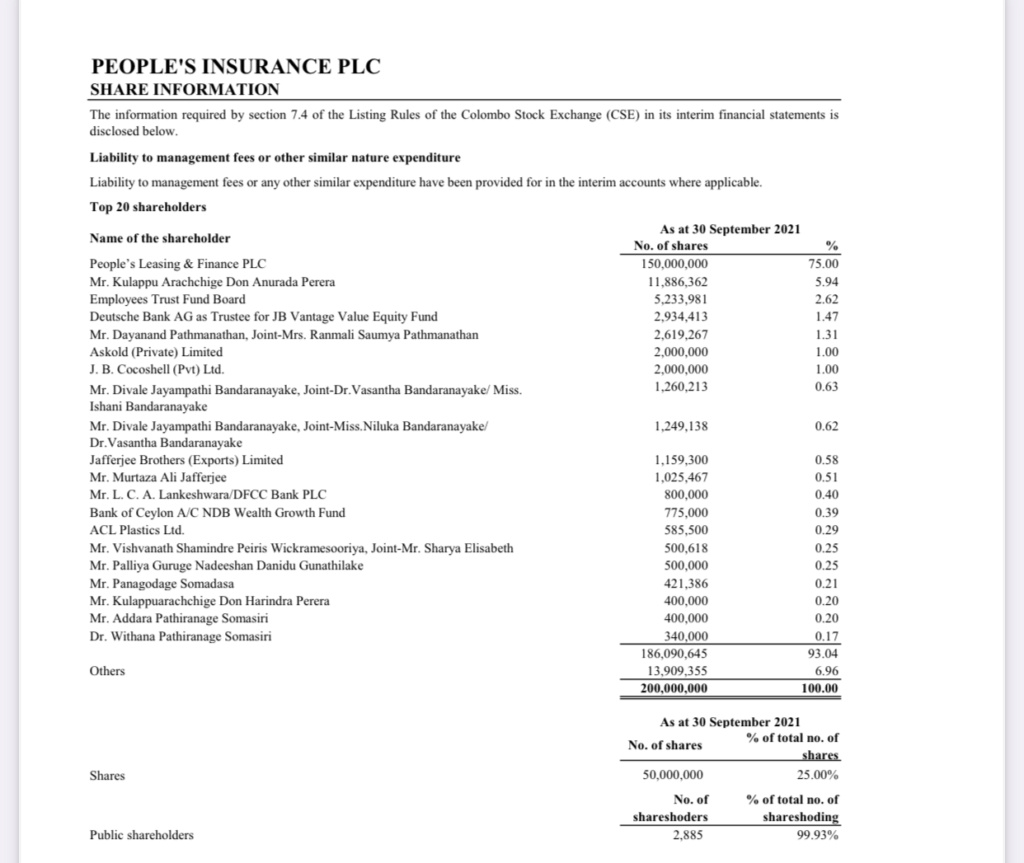

Peoples insurance is a well managed Private company with government backing though Peoples's Bank. Also It pays around 10 % dividend (last time Rs 3.00 ) . Over the years it has increased its dividend per share with consistent growth.

Most of investors love to have PINS in their long term portfolio as a retirement fund because of consistent growth and increased dividend payment over the years with capital gain.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home