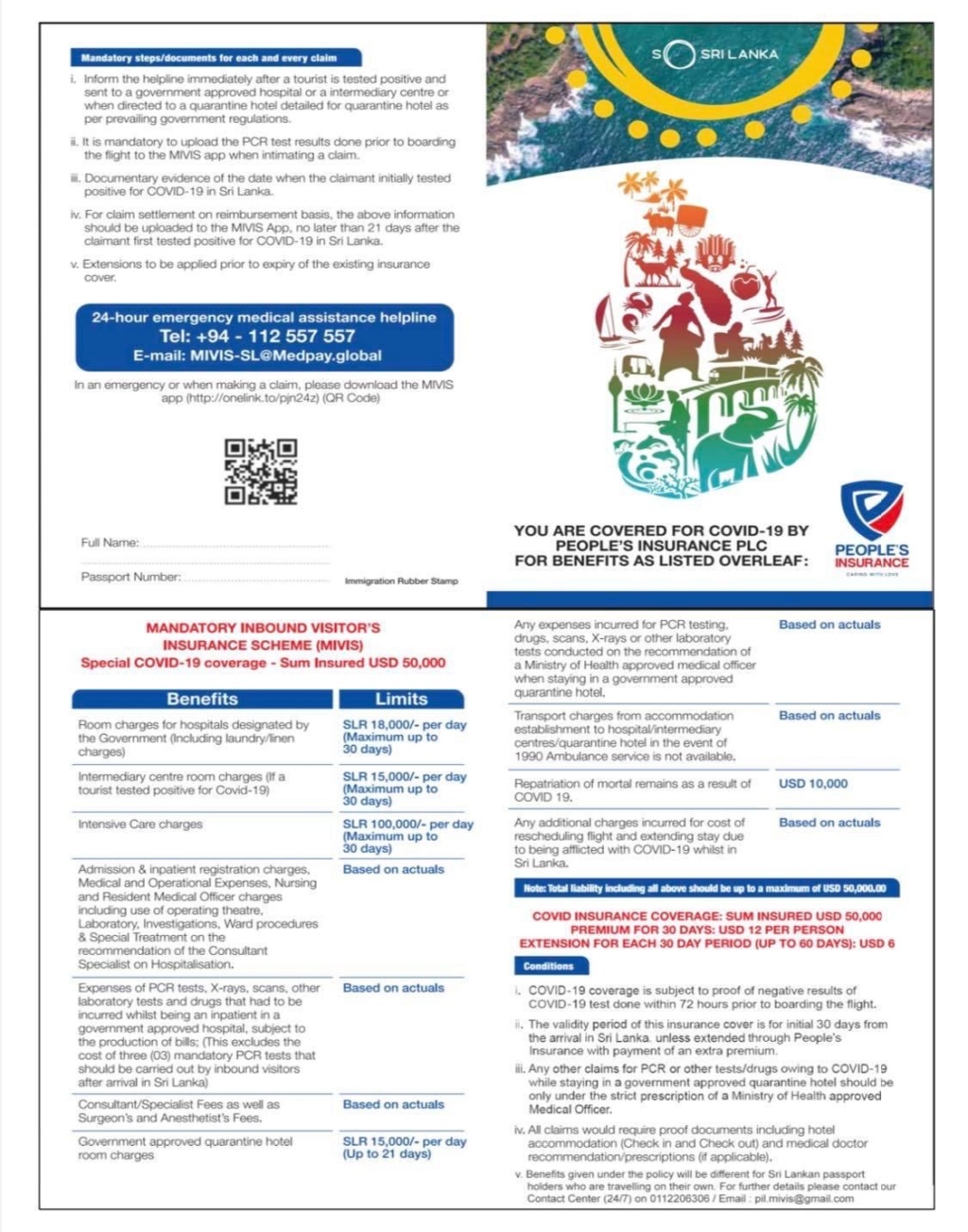

cseguide wrote:earlier there was a restriction that general insurance and life insurance should not carried out by one institution. According to my knowledge this law was recently changed and now they can do both general and life insurance. Better somebody with insurance sector confirm this.K.R wrote:https://island.lk/peoples-insurance-enters-medical-insurance-market-with-the-most-comprehensive-medical-insurance-cover-available-in-sri-lanka/

Are they coming to Life insurance market ?

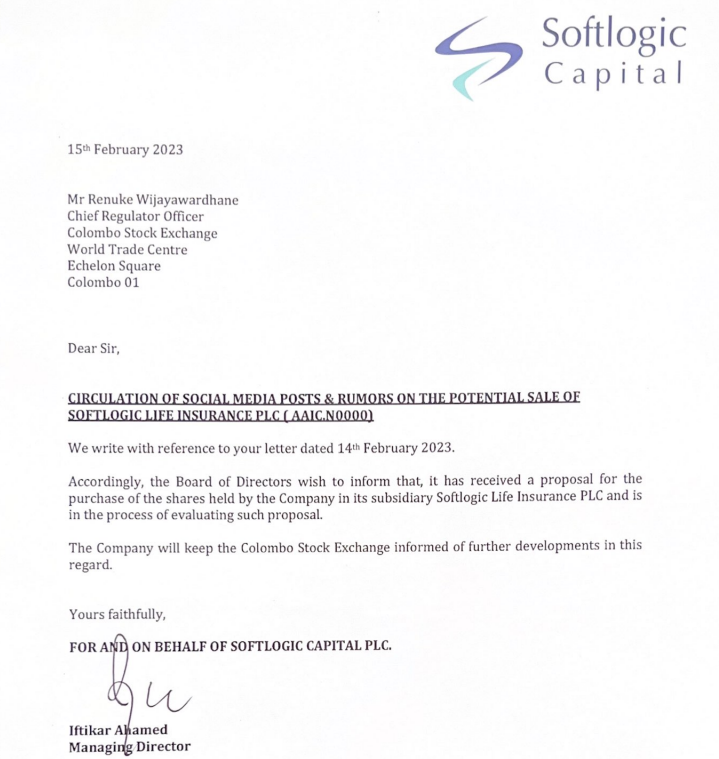

AAIC moved from 30's to 70s very short period of time, will there be a similar journey for PINS?

What will be the fair value of PINS?

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home