http://www.themorning.lk/monthly-target-of-100000-tourists-for-2022/

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Encyclopedia of Latest news, reviews, discussions and analysis of stock market and investment opportunities in Sri Lanka

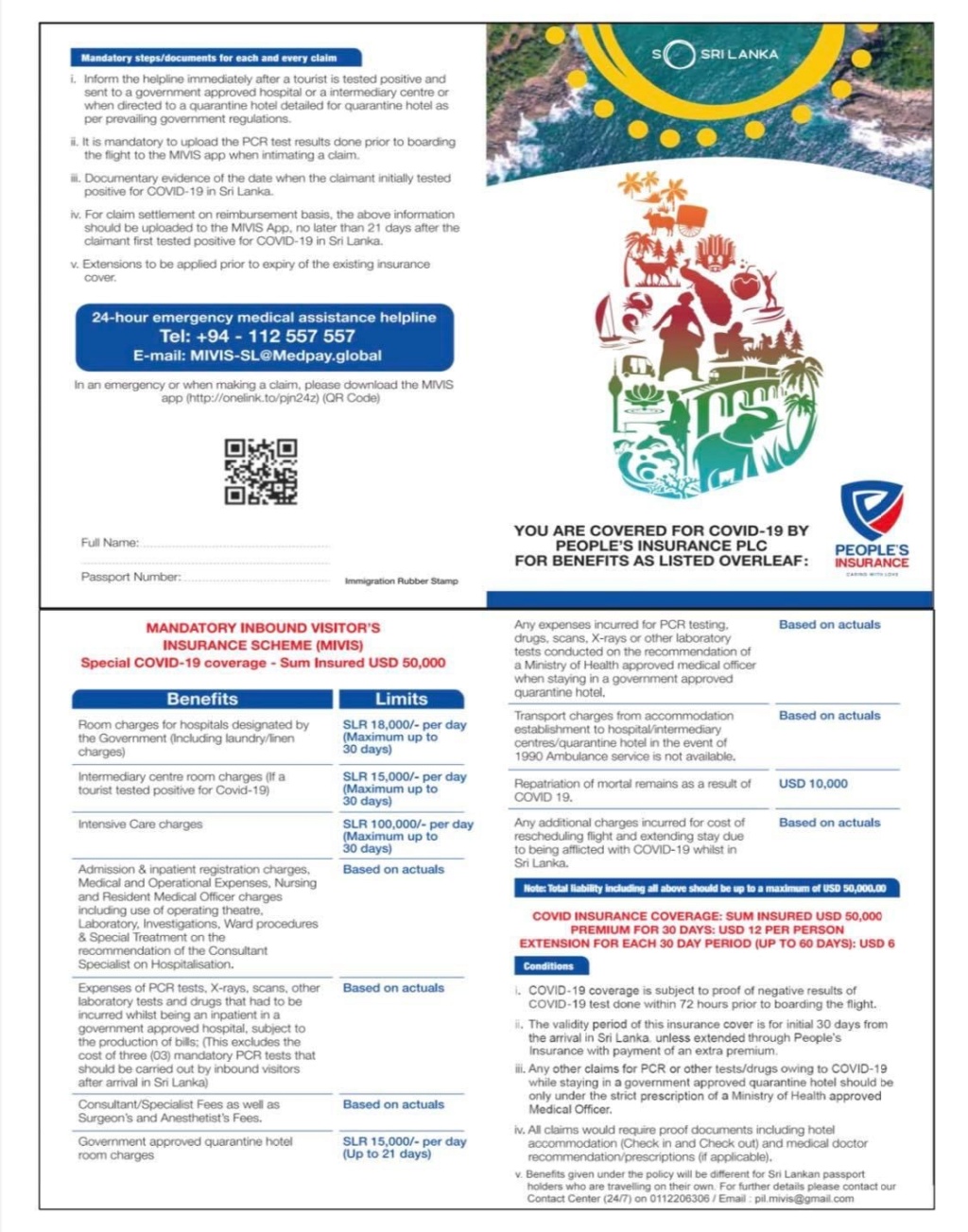

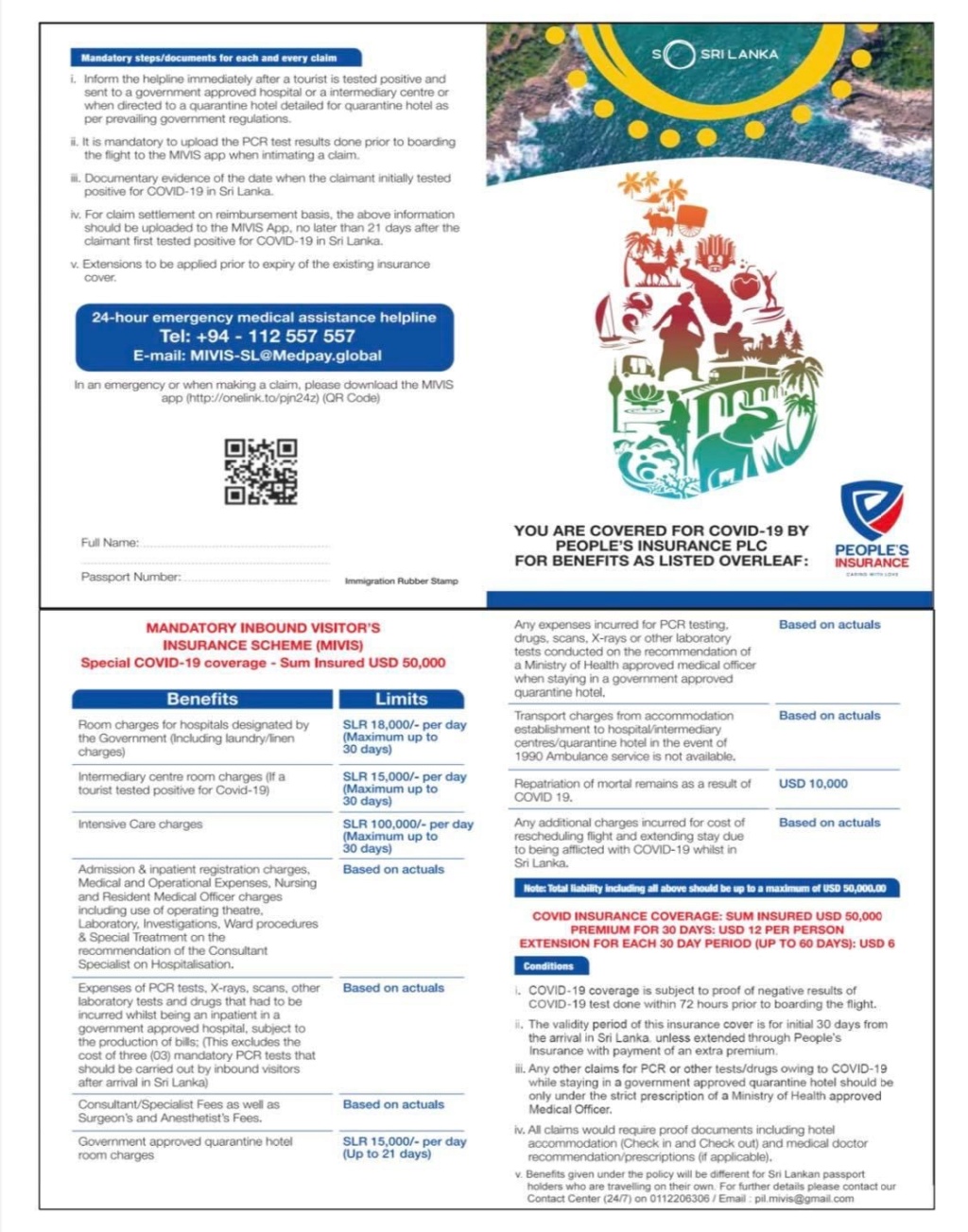

PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Fri Jan 14, 2022 1:40 pm

PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Fri Jan 14, 2022 1:40 pm

ErangaDS likes this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Fri Jan 14, 2022 11:18 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Fri Jan 14, 2022 11:18 pm

Ekanayake90 and LHW like this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sun Jan 16, 2022 10:10 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sun Jan 16, 2022 10:10 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sun Jan 16, 2022 8:58 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sun Jan 16, 2022 8:58 pm

ErangaDS and K.R like this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sun Jan 16, 2022 10:59 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sun Jan 16, 2022 10:59 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Mon Jan 17, 2022 10:22 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Mon Jan 17, 2022 10:22 pm

K.R and Biggy like this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Wed Jan 19, 2022 9:51 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Wed Jan 19, 2022 9:51 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Feb 01, 2022 11:42 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Feb 01, 2022 11:42 pm

ErangaDS wrote:Pins will record 13+ earnings for the FY 2022 if the targets can be met. With the help of new found $ fortune, I believe PINS will trade at higher PER multiples than its peers going forward . (Industry avarage PER 14)

+ Rs 3 dividend(FY2021) can be expected( 50% dividend policy )

K.R likes this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Feb 15, 2022 10:48 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Feb 15, 2022 10:48 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sat Feb 19, 2022 6:12 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Sat Feb 19, 2022 6:12 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Thu Mar 03, 2022 9:38 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Thu Mar 03, 2022 9:38 pm

K.R likes this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Mon Mar 07, 2022 10:05 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Mon Mar 07, 2022 10:05 pm

Ekanayake90 wrote:According to the sources PINS selected through open tender procedure.Out of the $ 12 fee, $ 3 will be taken by the SLTDA, $9 will be insurance premium & targeting $100Mn foreign exchange to the country till 2025

.

.

If this will be materialized , It will add $75Mn to the topline of Peoples insurance PLC(PINS).

K.R likes this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Mon Aug 22, 2022 11:42 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Mon Aug 22, 2022 11:42 pm

Ekanayake90 wrote:Ekanayake90 wrote:According to the sources PINS selected through open tender procedure.Out of the $ 12 fee, $ 3 will be taken by the SLTDA, $9 will be insurance premium & targeting $100Mn foreign exchange to the country till 2025

.

.

If this will be materialized , It will add $75Mn to the topline of Peoples insurance PLC(PINS).

Sri Lanka saw a total of 188,656 tourist arrivals so far and during the first three days of March 9,822 travelers.

.

In terms of imported cases, only 328 foreigners have tested positive for COVID-19.

.

Sri Lanka devalues rupee, expects Rs230 to dollar rate: Central Bank

.

https://economynext.com/sri-lanka-devalues-rupee-expects-rs230-to-dollar-rate-central-bank-91377/

https://www.ft.lk/news/1-147-COVID-19-cases-detected-over-the-weekend/56-731591

https://www.ft.lk/front-page/Sri-Lanka-Tourism-flies-higher-with-Emirates-Airlines-joint-promotions/44-731600

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Aug 23, 2022 7:07 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Aug 23, 2022 7:07 am

K.R and Biggy like this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Aug 23, 2022 9:35 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Aug 23, 2022 9:35 am

K.R likes this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Aug 23, 2022 9:30 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Tue Aug 23, 2022 9:30 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Wed Aug 24, 2022 8:09 am

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Wed Aug 24, 2022 8:09 am

K.R likes this post

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Fri Aug 26, 2022 10:35 pm

Re: PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS) Fri Aug 26, 2022 10:35 pm

FINANCIAL CHRONICLE™ » CORPORATE CHRONICLE™ » PINS - $12" MANDATORY INBOUND VISITOR’S INSURANCE SCHEME (MIVIS)

Similar topics

Permissions in this forum:

You cannot reply to topics in this forum