There has been a lot of conversation about Sri Lanka’s DDO, and the supposed impact on the EPF (as well as other superannuation funds). I’ve personally found most of this conversation lacking in analysis and when analysis has been present, to be woefully lacking in the technical reality of how markets work. In this piece, I’m aiming to set out an analytical basis for the impact of the DDO on the EPF - taking an approach that prioritizes getting an accurate magnitude of the impact over precise figures that lack accuracy.

In pursuit of data before ideology

The EPF is a long-term fund - it doesn’t compound every year

The EPF, being a superannuation fund, is a long term fund. This gives 2 very important points when discussing the impact of the DDO. First, the market value of instruments only really matters at point of purchase. This means losses in the “market value” of the bonds make absolutely no difference to the EPF since it holds its bond to maturity. At the end of the maturity term of the bond, the full face value of the bond is paid back in full regardless of how much the bond price has fallen or risen during the period the bond was held by the EPF. Talking about the “market loss” or “NPV loss” of the EPF, thereby, has no real practical point to it in my view.

However, there is one point at which the market price DOES matter, and that is the point of purchase. If the EPF bought bonds at discount (as it almost definitely did after rates rose in 2022), then there is an additional “capital gain” on the bonds since the EPF gets paid back the full principal of the bond despite having invested less than the principal. Went over this here - https://twitter.com/ChayuDamsinghe/status/1700084753318216156.

Second, the EPF being a long term fund means its investments mature over a long period of time - the pre-DDO bonds had maturities up to 2045 for example. This means, we can’t assume that the full value of the EPF can be compounded each year, because the EPF’s assets don't mature each year (like a 1-year FD or 12-month T-bill).

However, we can take a “coupons reinvested” approach and argue compounding, but as those who’d be involved in markets would know, in reality this doesn’t give an accurate answer. Actual returns and “coupons reinvested” returns are very different, primarily since you can’t necessarily assume that coupons CAN be reinvested at a constant rate. In order to calculate returns of a long-term fund, a more accurate approach is to use a cash-flow analysis, and then secondly add reinvestment of that cash flow. However, if we ASSUME that future interest rates ARE similar to current, then the coupon reinvestment approach can give a reasonably accurate answer - and this seems to be what the CBSL has done in their calculations to get a 4% difference. But as we all well know, in Sri Lanka interest rates hardly remain similar from one year to the next.

What does a cash-flow analysis show for the EPF?

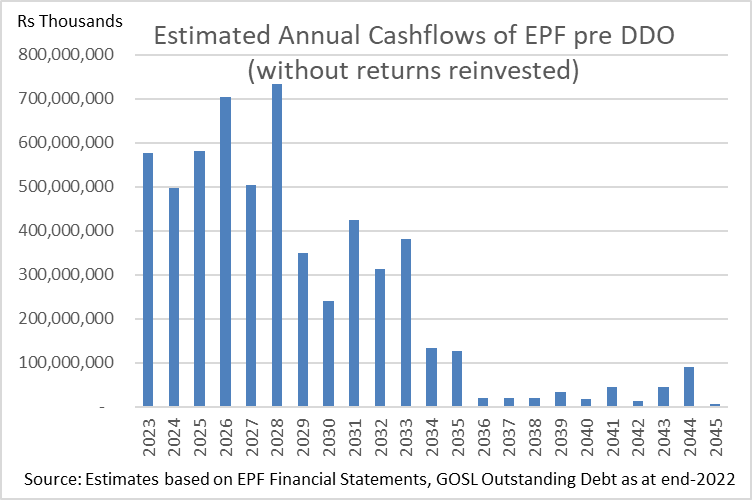

While we don’t have up to date info on the coupon rate per year of the EPF’s current bond portfolio, we do have information on the maturity structure of the bonds’ principal face value as at end-2022. Using this data, and the coupon rate we DO have for the government’s overall bond stock, we can come up with an estimate for the EPF’s current interest rate cash flows. Incidentally, this approach also gives us that the average coupon of the EPF’s bonds were likely around 11-11.5% by end-2022, in line with public statements on the same.Taking this approach, we can come up with the following cash-flow projection for the EPF’s current bond stock.

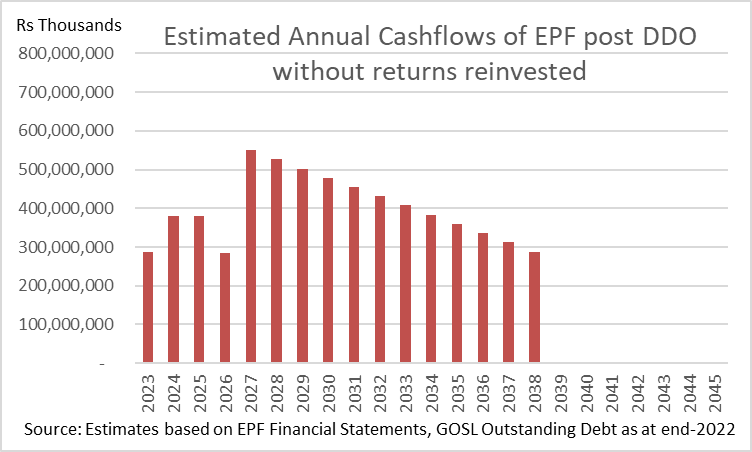

We can then look at what the cash-flow of the DDO would imply. To sum up what the DDO does for the EPF’s bond stock, the face value of the bonds are exchanged for new bonds. These new bonds give a coupon of 12% for 3 years and 9% for the years after that. The new bonds also mature at a different schedule than the previous bonds as well.

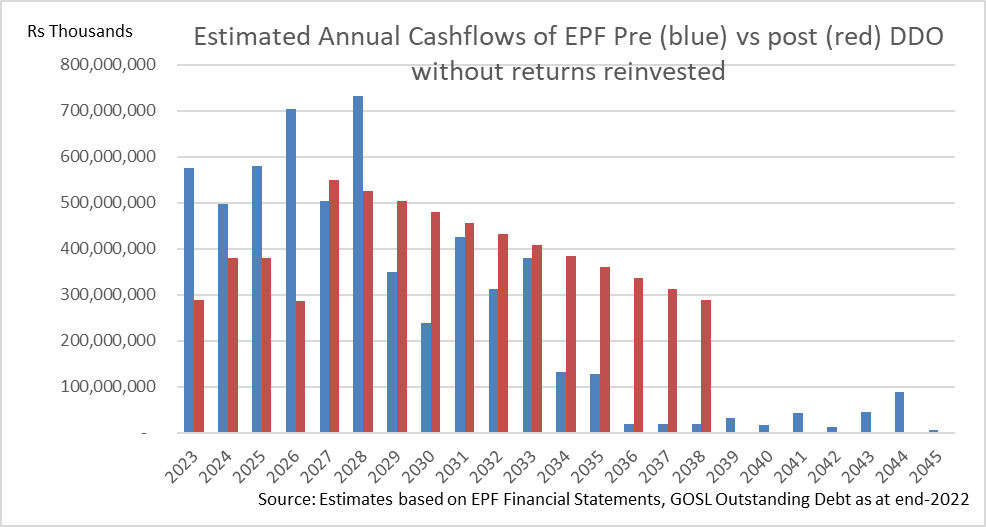

Comparing these 2 cash flows show that the pre-DDO and post-DDO cash flows are such that the EPF’s cashflow would have been higher in a pre-DDO scenario until 2028, after which the post-DDO cashflow is higher until 2038 at which the post-DDO cashflow ends.

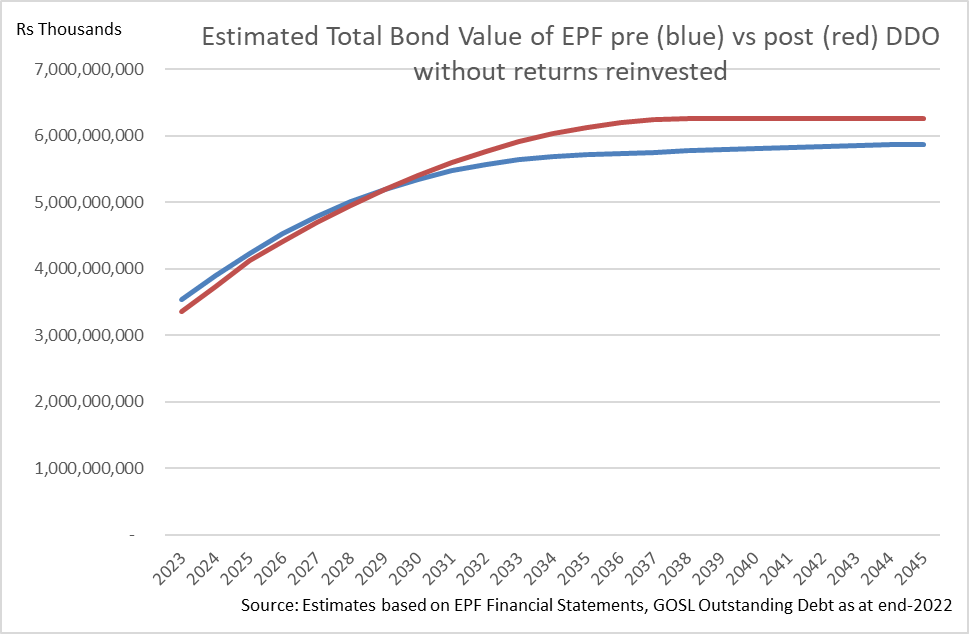

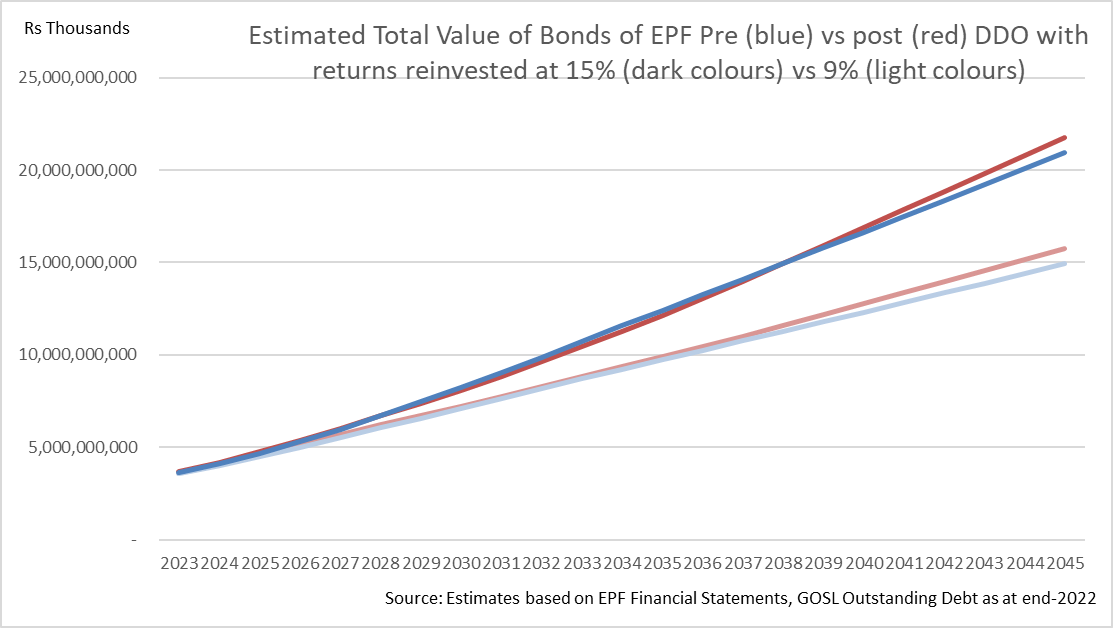

If we take a cumulative look at these, what this means is that in the pre-DDO scenario, the EPF would have had a higher “bond stock” until around 2028 and that after 2029, the post-DDO scenario actually results in a higher bond stock (the term “bond stock” here is a bit of a misnomer, actually it’s the cumulative cashflows, but using bond stock for ease of understanding. The cumulative cashflows for post-DDO actually end at 2038, and I’m showing them as stable afterwards). The reason this happens, is that in the pre-DDO scenario, the principal is paid back quicker, which means that there’s less principal to take interest income on in the middle years. Conversely, since the DDO scenario doesn’t pay back the principal that soon, there is larger interest income in the middle years in the DDO scenario.

But what about the reinvestments?

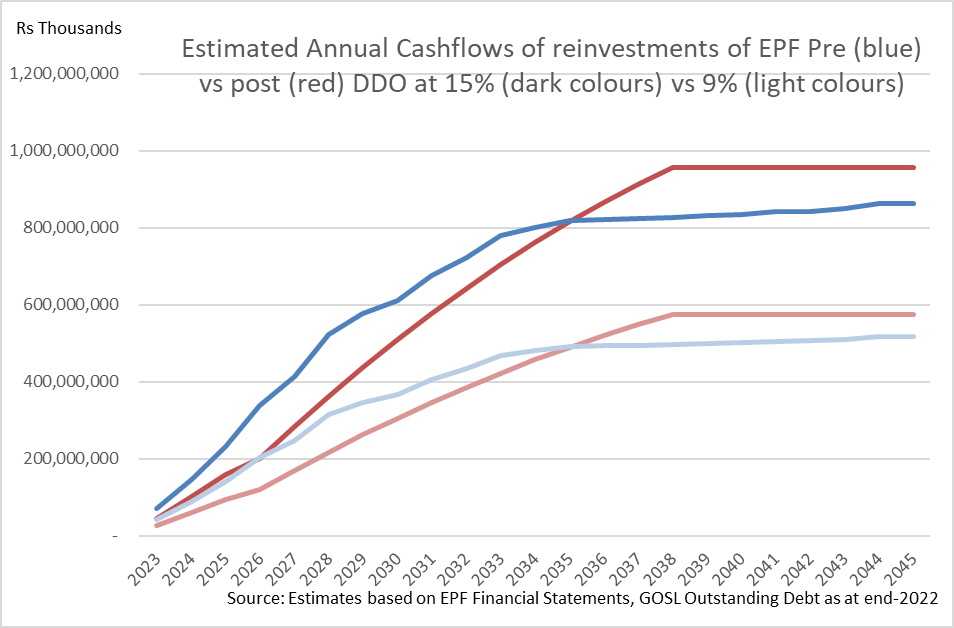

The issue with this approach is that it doesn’t take into account reinvestments. In order to show this as well, what we can assume is that every principal that comes due and every interest payment that comes due from the current bond stock is reinvested in a 2046 bond (beyond the period we’re looking at so we don’t have to worry about the principal of THAT bond being reinvested). To simplify, let’s not reinvest the coupons from this reinvestment again (since that can be a bit of an infinite process - what about the reinvestments of the reinvestments of the reinvestments of the reinvestments etc?).Taking this approach results in another question I tackled here -

https://twitter.com/ChayuDamsinghe/status/1676064993463390210.

What interest rate should we use for the reinvestment? This is actually a critical part, since if we assume a high interest rate for pre-DDO and a low-interest rate for post-DDO, obviously the situation will show a better performance for the high rate pre-DDO situation (even what the CBSL has taken seems to be the two coupon rates of the two scenarios, but like the CBSL itself says, maintaining the pre-DDO interest rate is a non-realistic scenario since it can’t be maintained without another round of restructuring in the future).

But in order to show the varied options that ARE possible, and excluding the possibility of a future restructuring, let’s take 2 scenarios for both the pre and post DDO cash flows - a 9% low rate and a 15% high rate.

If we take this approach, we can show the reinvestment cashflows are higher for the pre-DDO approach compared to the post-DDO approach overall until 2035, at which point the size of the post-DDO reinvestment cashflows are larger.

If we add the without reinvestment cashflow onto this, and then accumulate these cashflows, the full effect of the DDO across scenarios can be seen. The two total accumulated cashflows go largely in line but begin to diverge clearly in around 2035, with the post-DDO cashflows growing larger by 2045. Once again, this is because there is more interest income that is reinvested earlier on in the post-DDO cashflow, because the principal is only paid back later.

What about the different interest rates though?

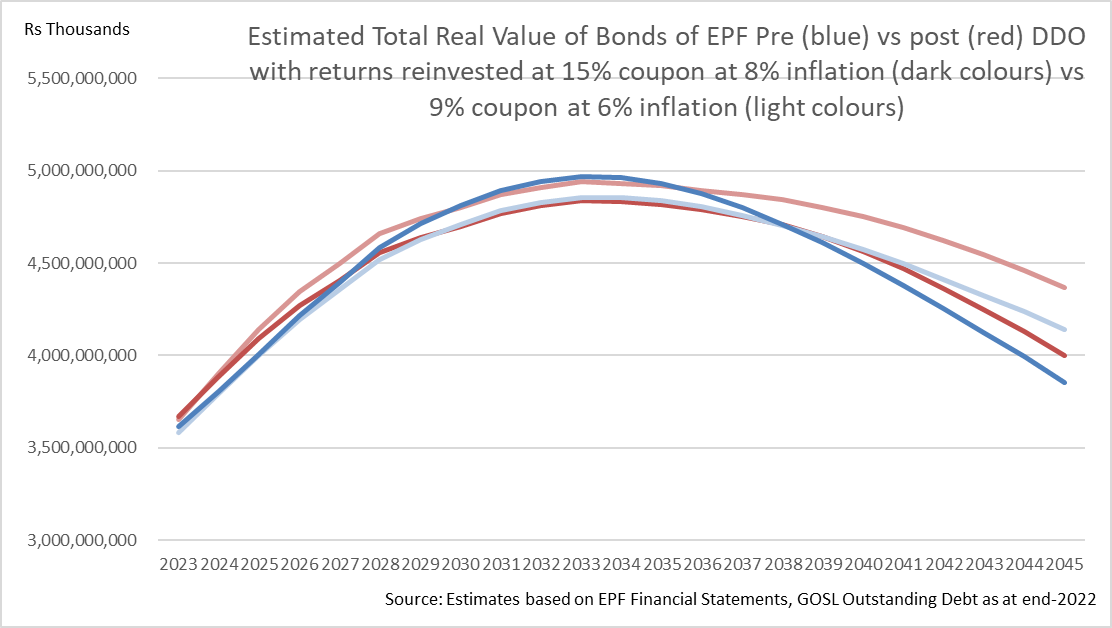

However, as it is clear, the 9% vs 15% coupon rates give different results. This is important, since in reality, the two interest rates that reinvestments would have happened in would have been different. If we compare a high rates cashflow vs a low rates cashflow alone, we can easily show the high rates is better.However, the inflation impact would have been higher if rates are kept at 15%, or if rates are higher in real terms. This means that the economy would have kept high rates for longer. This means that in all likelihood, high rates at high inflation could actually mean a WORSE outcome for the EPF. This is also complicated by the fact that if rates would have stayed higher for longer, some of these cashflows might not have actually happened if the GOSL is pushed to do a larger DDO in the future.

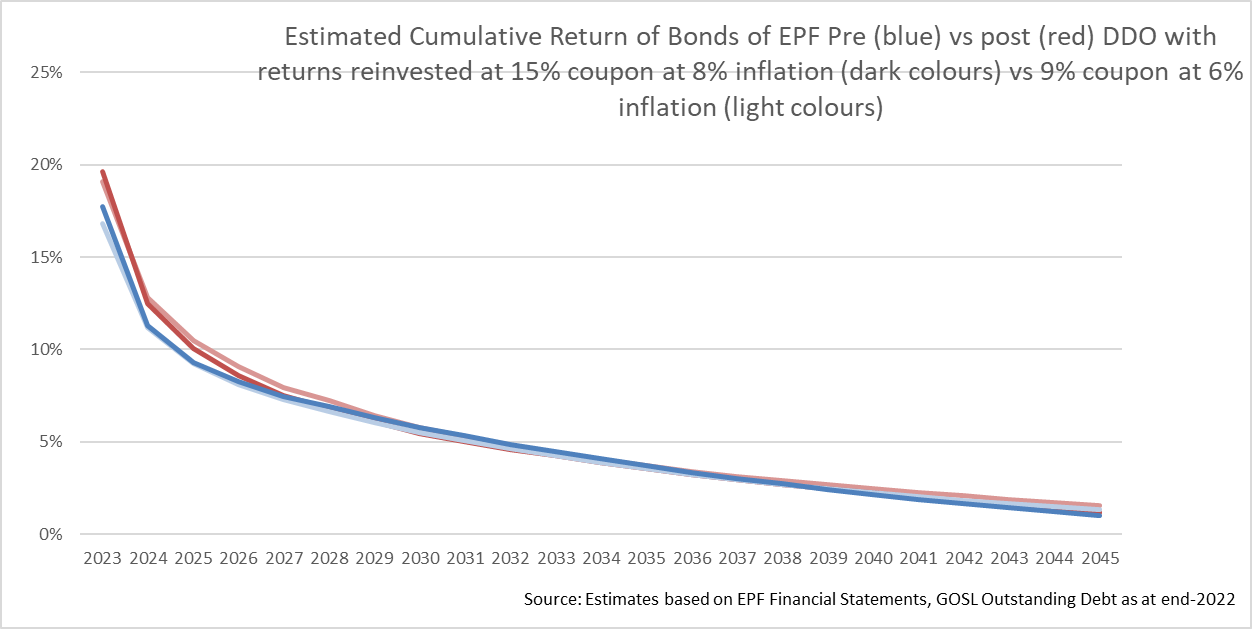

To account for all this, let's take the following assumption - let’s assume inflation is 6% for the 9% reinvestment and 8% for the 15% reinvestment - implying real rates of 3% and 7% respectively, and that the government doesn’t do a future DDO in either scenario. What does that do for the accumulated cashflow?

As is clear, the high rates scenarios, even if the real rate is higher (maintaining 7% real rates is extremely difficult - if rates are 15% long term, in reality inflation is probably in the double digits), results in bigger erosion of real value of the EPF bond stock. This happens because it’s not just the future cashflows that are inflated, but also the current stock. Being ahead of inflation results in the stock rising for a while, but at a point, the inflationary impacts of the whole stock dominate. Arguably, it makes more sense thereby for the long term, even if rates are “lower” now, for the EPF to have a lower inflation. That matters more than the interest rate.

What is the actual rate of return of the EPF?

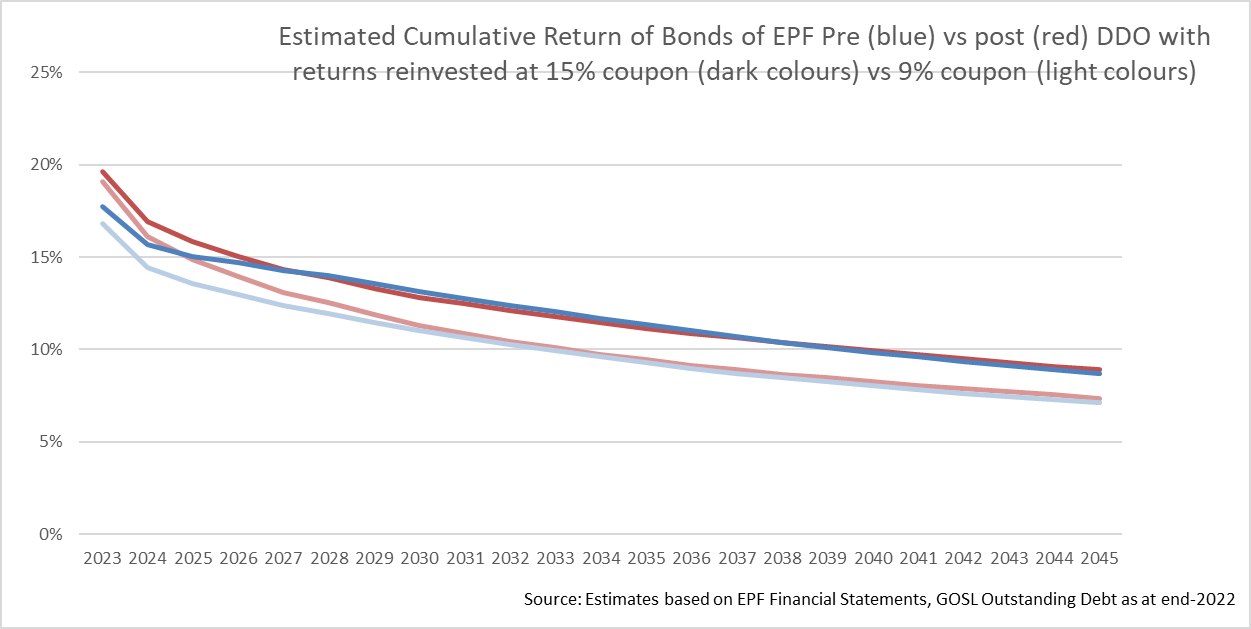

Combining all of this, we can get a value for the “return” of the EPF. There are varied ways we can do this, but to make it very simple, let’s take the difference in the value of a given years’ value of the EPF and the purchase cost of the EPF bonds at end-2022, and then take what the growth rate between the two would be. A more precise method would be to take the return at each year compared to the purchase price at each year, but lets not be too complicated.

What this shows is that the return of the EPF is quite significant for the first few years, but gradually trends lower towards 9%. The two post-DDO returns are higher at the start since the returns on existing portfolio is at 12% while the reinvestment portfolio is still small, but then the 15% pre DDO return catches up once the size of the reinvestments are large enough. The actual return of the EPF would in fact, be higher than all these, since there is also additional contributions from the EPF members that come in as new investments that I haven’t factored in so far. In any case, below is the inflation adjusted return graph - here, the catching up of the pre DDO cashflow is slower since inflation eats away the existing portfolios faster. In all cases, the return trends towards 1-1.5%.

What does all this mean for the EPF?

Fundamentally, the point in putting out this analysis from my perspective is to show a more accurate approach to think about the EPF’s loss. This basis will give varied numbers and scenarios to look at, and one can select and compare the relevant pre vs post DDO numbers one wants. For example, if you compare a 15% pre DDO vs a 9% post DDO, you can show that there is a LKR 5 trillion difference between them by 2045. However, if you compare an inflation adjusted value of the same, you would see that the post DDO gives a better deal. However, if you change the inflation rate again, you can once again get a different deal. Similarly, if you choose a different point (say 2028 or 2035 or 2040) you can give different messages for different points in the future.The point is that when talking about the DDO’s impact on the EPF, all of these have to be considered. You’re talking about many assumptions about the future, and sometimes assumptions upon assumptions. All of these assumptions can change at varied points in the future. This can make it easy to oversimplify and accidentally give an inaccurate message, or hide reality and intentionally give an inaccurate message.

But what the most accurate message I can give is, in my opinion, taking a look at the wide range of options, it feels difficult to fairly argue that the EPF has lost out on a lot as a result of the DDO, and it’s not too tough to show that the EPF could even have gained a little as a result in inflation adjusted terms. Even if we put that aside, my best guess is that this has a very marginal impact on the EPF, and that the impact of things like inflation, how wages grow (and thereby how contributions grow), how much government debt is available for the EPF to invest in, etc matter far far more.

I’ve also pointed out that it isn’t very accurate to say the EPF was singled out -

https://twitter.com/ChayuDamsinghe/status/1694892687273738663.

Different treatment for different creditors, including better/worse treatment for social security funds has happened in other countries. Similarly, many other countries have included social security funds. The bond restructuring is also not the only part of the DDO, and only accounts for about half of the full DDO - the CBSL’s T-bill holdings and the government’s dollar debt from the banking sector accounts for the rest.

However, a major issue I see is that of transparency and communication. Why is it that varied people, myself included, take it upon themselves to do analysis on this? Fundamentally, that speaks to a lack of information and also a lack of trust on the limited information that DOES exist. Given that the EPF is very much a sociopolitically sensitive matter, much more communication and information could have made the situation far easier to handle in my view. I recognise that there are market impacts on all these that limit how much current information can be provided by the authorities, but there could have been far more info released ahead of time and better communication overall to account for that in my view.

All this aside, there’s another benefit of this whole situation. People are finally talking about serious questions regarding the EPF. Whether the EPF should be under the CBSL, whether the EPF should invest in more diverse assets, whether the EPF should have an opt-out option, all of these are important questions I think need to be discussed. Actually implementing these might not be realistic right now, but the conversation around it can one day result in something or at least in more public scrutiny and better management in the meantime.

For now, I will take solace in this and the fact that it doesn’t seem to me that there’s an actual huge loss to the EPF (or even a clearly noticeable loss at all). Hopefully, this piece serves to clarify the varied matters on this, serves to improve the conversation on the matter, and gives a basis for people to analyse varied claims on their own as well.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

No Comment.