Market continued to end in mixed results on Tuesday reflecting a marginal decline in ASI index by 1.44 points (-0.02%) and S&P SL 20 Index increased by 6.26 points (+0.81%). Daily market turnover was LKR 701mn. Foremost blue-chip John Keells Holdings recorded the highest turnover of LKR 469mn along with several negotiated deals and the stock traded heavily during the day. Further, Chilaw Finance, Textured Jersey and Central Investments & Finance were among the mostly traded stocks. Foreign participation for the day was 54.6% while foreign investors were net sellers.

On Wednesday market closed the day on a negative note as ASI and S&P SL 20 Index slipped by 18.26 points (-0.30%) and 3.07 points (-0.09%) respectively. Daily market turnover was LKR 907mn. John Keells Holdings, the mostly traded stock topped the turnover list with a turnover of LKR 596mn which was supported by several negotiated deals. Further Sampath Bank with LKR 55mn and National Development Bank with LKR 50mn were the next top contributors to the daily turnover. Meanwhile Access Engineering, Chilaw Finance and Swarnamahal Financial Services attracted the investor interest during the day. Foreign participation for the day was 42% and foreign investors continued to end as net sellers.

Colombo bourse closed on Thursday in green territory diverging from the flat trend. ASI recorded a fresh six week high and gained 119.38 points (+1.98%). S&P SL 20 Index gained 48.61 index points (+1.42%). Daily market turnover was LKR 1.5bn. Watawala Plantations with LKR 693mn, Sunshine Holdings with LKR 469mn and John Keells Holdings with LKR 130mn emerged as the top contributors to the market turnover. John Keells Holdings, Watawala Plantations, Commercial Bank and Textured Jersey were among the heavily traded stocks for the day. Foreigner investors were net seller and foreign participation accounted for 26% of the market activity.

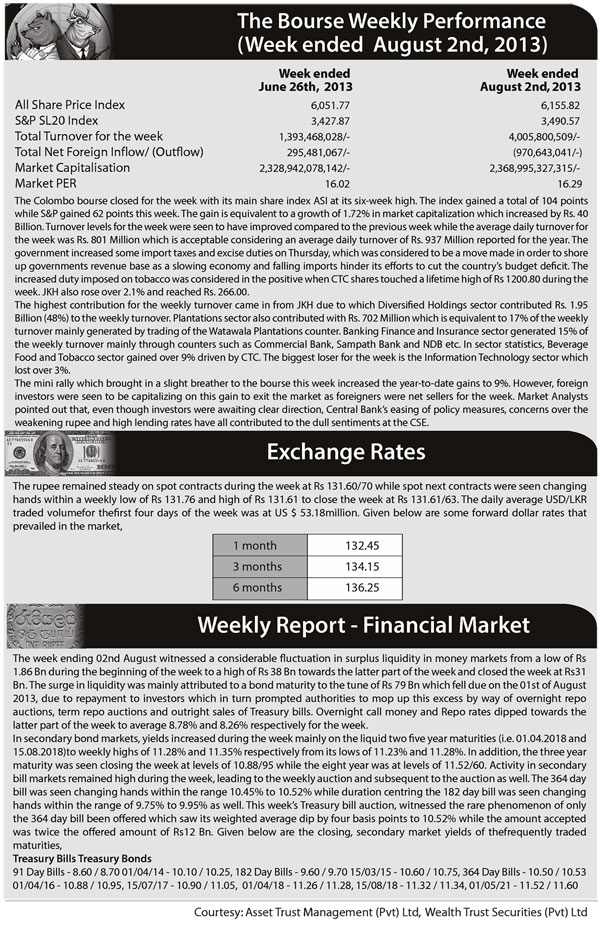

Market closed the operations for the week on Friday with mixed results. ASI closed 6,155.82, down by 0.78 points (-0.01%) and S&P SL 20 Index closed 3,490.57, up by 13.00 points (+0.37%). Daily market turnover was LKR 399mn. John Keells Holdings topped the turnover list with LKR 64mn closely followed by Commercial Bank with LKR 54mn and Sampath Bank by LKR 53mn. Two off-board transactions were recorded from Commercial Bank and Aitken Spence Holdings where 263,972 shares and 384,188 shares changed hands at a price of LKR 119.90 and LKR 124.00 per share respectively.

Meanwhile heavy retail investor interest was seen in stocks such as Agstar Fertilizer, Laugfs Gas and PC Pharma during the day.

Foreign participation for the day was 46% and foreign investors were net buyers with a net inflow of LKR 121mn. Cash map for the day closed at 57.7%.

During the week market cap advanced by LKR 40bn and the benchmark ASI advanced by 1.7%WoW. However foreign investors were net sellers for the week with a total net out flow of LKR 660mn compared to LKR 52mn net inflow which was recorded in last week. Net foreign selling was seen in stocks such as John Keells Holdings, Sunshine Holdings and Access Engineering.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home