By Bandula Sirimanna

View(s): 15846

The Government is hoping to raise US$8 billion from the lease or sale of valuable public assets to bolster rapidly dwindling foreign reserves, the report of a newly-appointed economic advisory committee has revealed.

Among the main items in the list were the long term leases of Katunayake International Airport for $2 billion, Mattala Airport for $300 million and Ratmalana Airport for $400 million.

Arrangements have been made to hand over the Colombo North Port Development Project for an investment of $600 million while Colombo Port City lands will be leased out at a total of $4 billion.

Accordingly, Sri Lanka Ports Authority has planned to do a feasibility study for the Colombo North Port Development Project focused on expanding capacity of container handling while serving all other port services expected from industry.

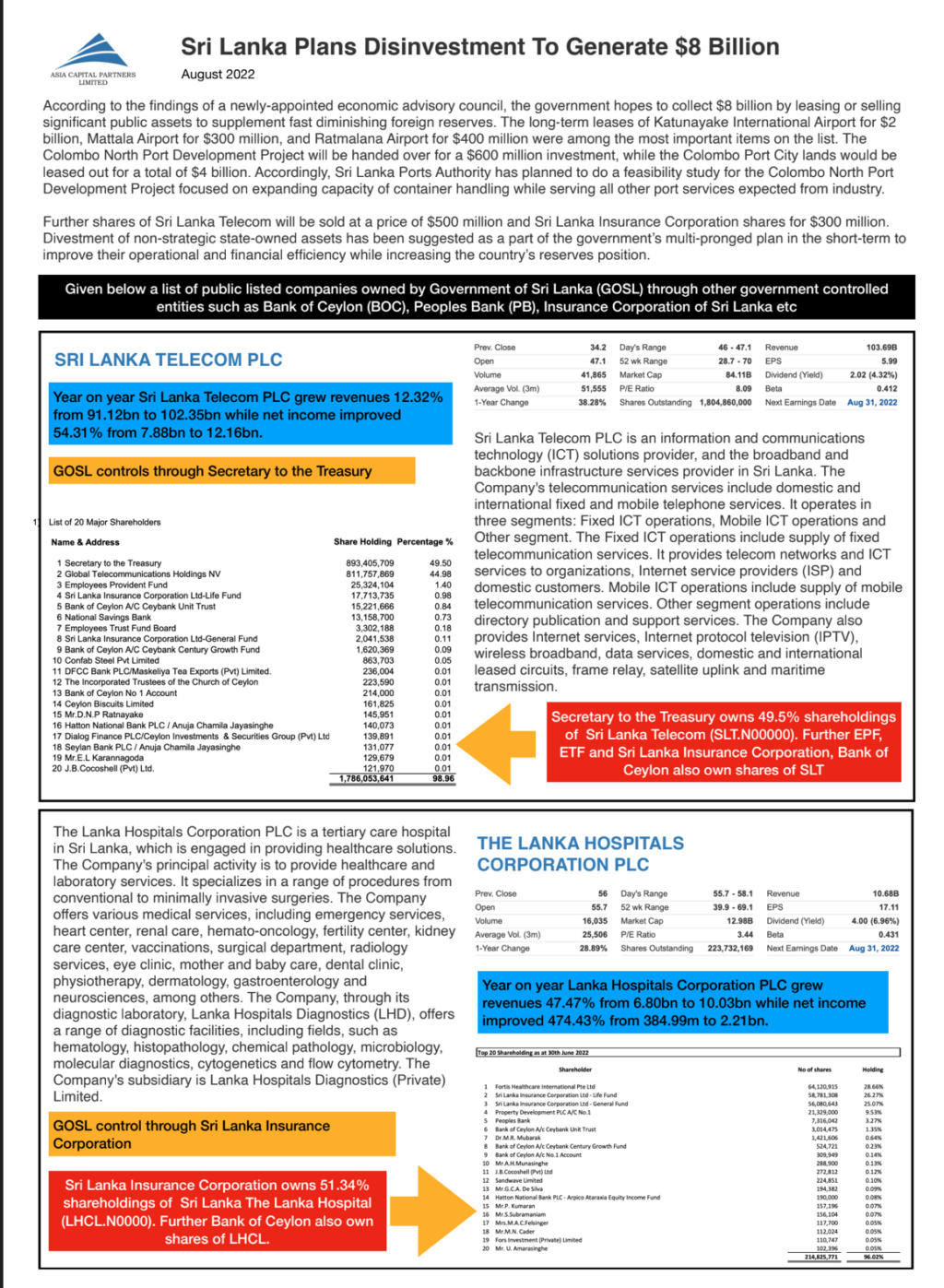

Further shares of Sri Lanka Telecom will be sold at a price of $500 million and Sri Lanka Insurance Corporation shares for $300 million.

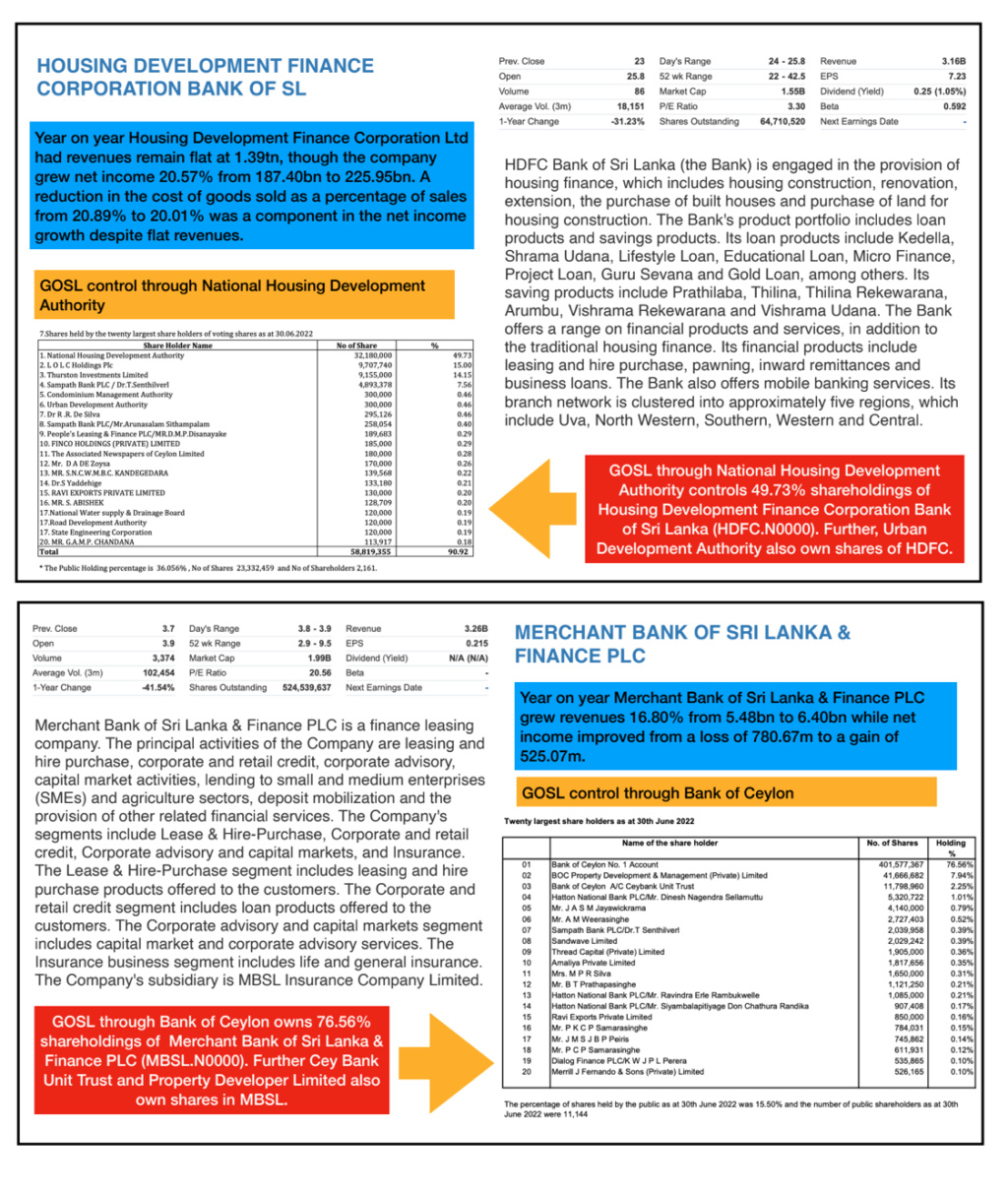

Divestment of non-strategic state-owned assets has been suggested as a part of the government’s multi-pronged plan in the short-term to improve their operational and financial efficiency while increasing the country’s reserves position.

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home