Jana1 wrote:sriranga wrote:Antonym wrote:No, sriranga - The ASI would not increase automatically when a new company is listed...sriranga wrote:

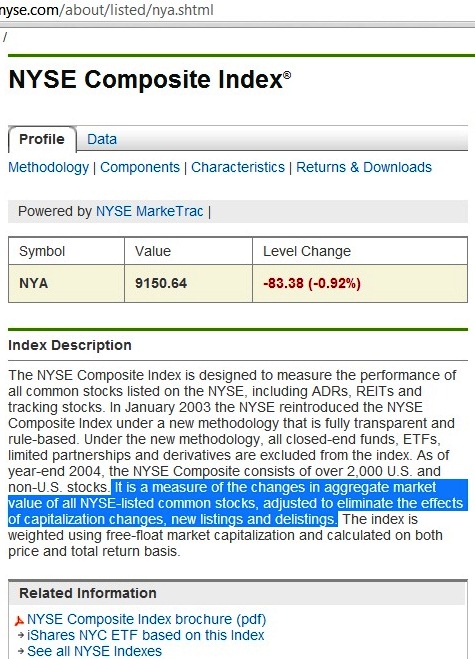

ASPI will increase with new listed companies.

Base Market Capitalisation is fixed.

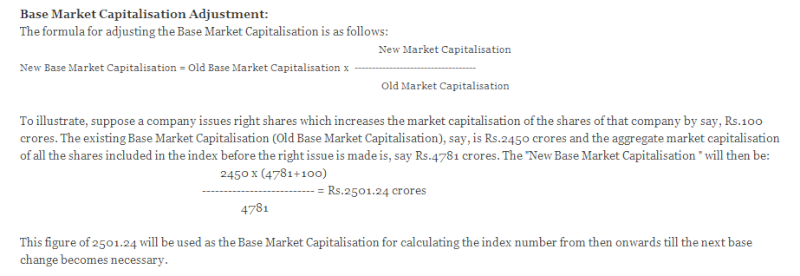

Base Market Capitalization is not fixed; it increases when a new company is listed and decreases when a company is de-listed.

I think Jana1 has understood how it works.

Base Market Capitalisation in CSE is fixed and its related to 1985.

U confused with opening Base Market Capitalisation. That is not base mkt cap. Chk my equation..

I'm not confused, I'm pretty sure the Base Market Capitalisation is at CSE is related to 1985.

Opening base market capitalisation was calculated then by adding all the market days Capitalisation and divided by the number of market days.

Easy way to understand take 11/09/2012 market capitalisation and then take 12/09/2012 and do the calculation. (Why? GSF was introduced on that day)

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home