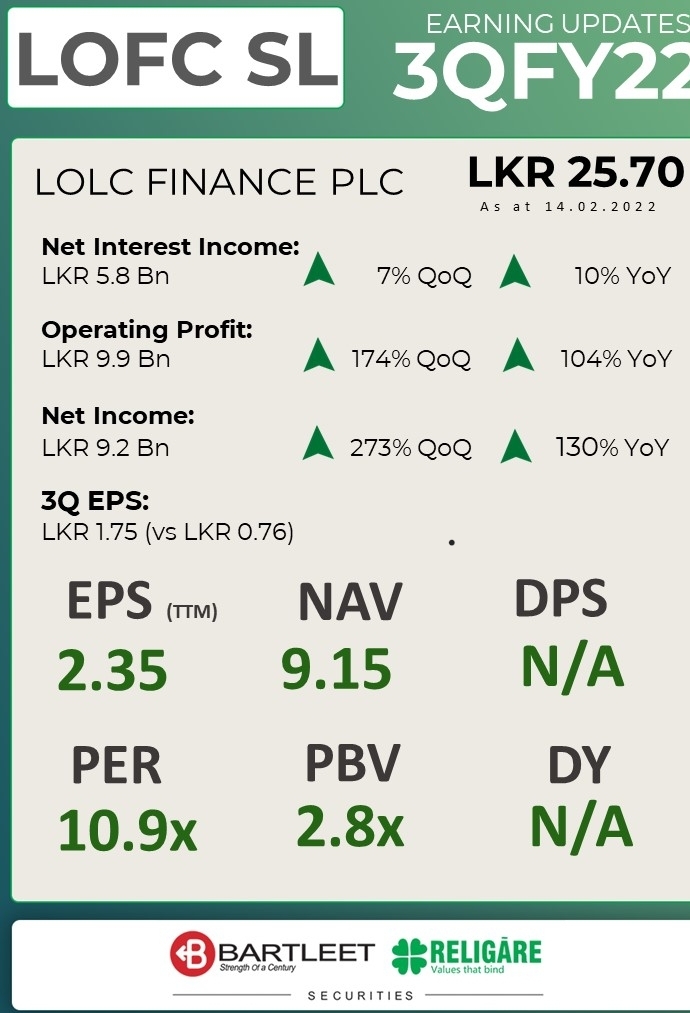

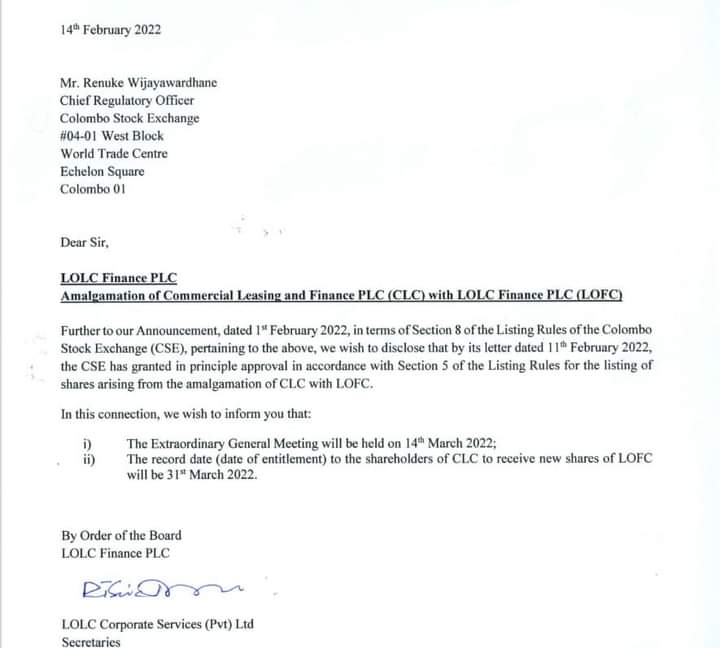

We can not under estimate the lofc.. bz It is funmenally srong share.Riz123 wrote:That's what we've been saying since the beginning. CLC is more valuable than LOFC; at the time of writing, CLC was trading at 80, while LOFC was trading at 10. Their aim is now evident.Captain wrote:But if clc going up means no of shares of lofc will increase once consolidated.samaritan wrote:Huge sell orders is a collection strategy at CSE often used by big players.RAVI1980 wrote:CLC on the move

LOFC holding down by hudge sell orders

After the consolidation is over, LOFC will remain the only much sought after entity.

Better to deal in lofc with care...

I think low risk with clc now

Those who own CLC stock will receive extra LOFC stock. The LOFC is now in a perilous situation.

Registration with the Sri Lanka FINANCIAL CHRONICLE

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc.. All information contained in this forum is subject to Disclaimer Notice published.

Thank You

FINANCIAL CHRONICLE

www.srilankachronicle.com

Home

Home

LOFC CROSSINGS WERE DONE AT 28.....

LOFC CROSSINGS WERE DONE AT 28.....