I fished out an old Colombo Brokers Association Hand book of Rupee companies from 1979-1983.

If you need a blast from the past, I will be happy to give you statistics from that era.

Kicking it of with details for Buki in FY 1978/1979

Profit - Rs 2.5 million

Number of shares issued - 100,000 (increased to 400,000 in 1979/1980)

NAV - Rs 333

EPS - Rs 25

Dividend - Rs 12.50

Share Price as at 31st March 1979 - Rs 55

They dont come so cheap anymore i guess !

|

Below illustration depicts the #stockmarket #return, based on ASI (Bloomberg: #CSEALL ) for the past 35 years from 1985 to 2019, on calendar year basis. #ASI total return

|

|

CBSL to keep policy rates steady amid signs of recovery

Previous Pre-Policy report; CBSL maintains its policy rates

➢In the last policy meeting held in Dec 2019, CBSL maintained its accommodative monetary policy stance at current levels immediately following the tax revisions with the belief that it would support higher economic growth in the short term. Considering the recently provided tax revisions and other benefits, we were of the view that continuation of policy rates were appropriate at that economic juncture. However, we also assigned a 50% probability for a rate cut in...

|

Fiscal loosening weakens 2H2020 Outlook

Yield Curve to move upwards by 50-100bps

• With the rise in borrowing pressure, we expect a gradual increase in pressure on bond yields throughout 2020 excluding the 4Q where debt maturities are onto the lower side. We have moved up our target bond yield bands and expect the yields to enter the bands by 2Q and afterwards gradually move up further during 2H2020.

Banking Rates (AWPR) to remain low c.9.5% in 1H and range from 9.5%-10.5% over next 12 months

• In line with the 5 Yr bond, we expect the AWPR to have bottomed...

|

The Employees’ Provident Fund (EPF) is the largest single fund in Sri Lanka. In 2017, it held over LKR 2 trillion in employee savings. The EPF is a mandatory retirement savings scheme. This means private sector workers must contribute to the fund regardless of the returns they receive. Therefore, the EPF’s investments and returns concerns both the social security and justice for much of Sri Lanka’s working population.

The EPF’s investments are managed by the Central Bank. Since the initiation of the fund in 1958, it has almost entirely invested in government securities....

|

Unofficial information that the expected Touchwood case against Sri Lanka Accounting and Auditing Standards Monitoring Board(SLAASMB) next hearing will be on 26th May 2011. Yes everyone looking the favorable outcome. Today, there are rumors that outcome will be favorable to the company and some brokers recommend to buy at current price. I could see some collection (about 820,000 shares) was made @ 23.60 levels.

I just did some research on the Touchwood Case. It looks like decision will be favorable to company. (This is not a promotion, just merely...

|

REEF results are out and i'm sure we'll get multiple posts about the magical EPS figure of 7 for the March quarter that they have reported. http://www.cse.lk/cmt/upload_report_file/568_1306907002379.pdf But it seems that some of the accountants working for CSE listed companies don't seem to know how to use a calculator. REEF profit after tax for the March quarter 2011 is 14 million and with 47 million shares outstanding my excel gives a figure of 30 cents...

|

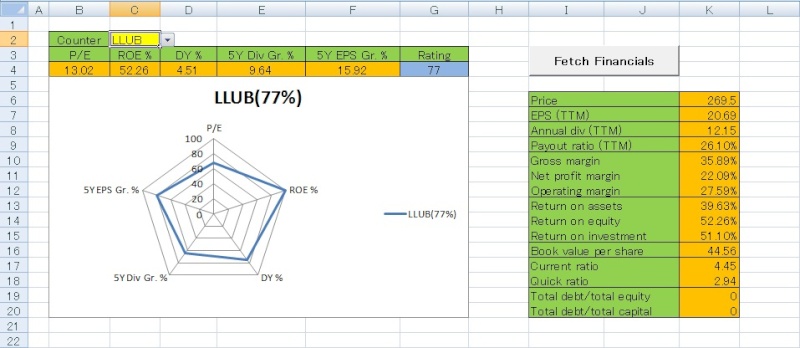

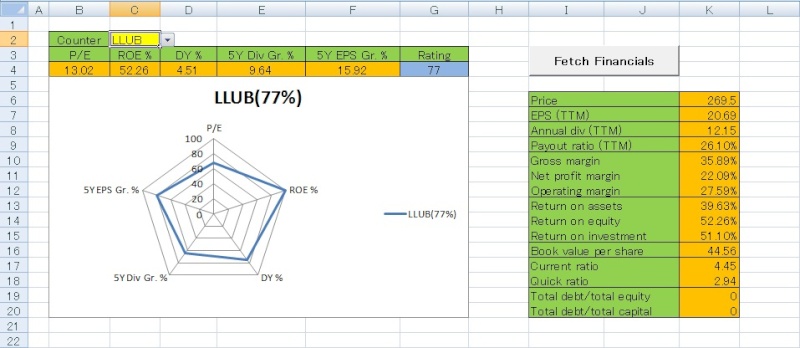

This is a simple tool to check the fundamental value of your counters. This will fetch data from Financial Times(need internet access) and rank the counters based on several parameters and CSE norms. Download the tool here: http://www.mediafire.com/view/utfewtjjpv608j2/HealthCheck_3_0_0.xlsm1. Select the counter in C2 (Yellow cell) 2. Click on "Fetch Financials"

|

Dr Sena Yaddehige made an exciting speech at RICH AGM today. RICH is getting into Palm oil business, overseas. He reviled that they have already acquired 150,000 Acres of land in some other country and finalizing for getting another 40,000 Acres (16,000 Ha) in Indonesia. Very recently, another country has come forward to offer lands for the company and they are considering it too. All are for palm oil cultivation. They are also to develop 1000 Acres of land...

|

Family controlled conglomerate LOLC scrambles to consolidate its bold and fast post war moves - LBR,Thursday 22 September 2011

By Dishani Samaraweera

Approaching noon, on an uneventful May day at the Colombo Stock Exchange, brokers were thinking fondly of their lunch, while keeping a lazy eye on the stock tickers scrolling the day’s trades. As the symbols flashed passed one after the other it took a few seconds until the penny dropped – then suddenly there was a mad flurry of phone calls. In the mayhem the founder Chairman of the Confifi Group of Hotels got a phone call –...

|

The forecasting Pitfall of Fundamental Analysis

The Association methodology is ‘contrarian’ because it is quite different than most applications of fundamental analysis.

The fundamental analysis technique is generally used by banks, pension funds and the majority of security analysts. There are different styles of fundamental investing which range from momentum and growth investing to value and contrarian investing.

In general, a fundamentalist believes that a company’s true value can be determined by analyzing financial indicators such as sales,...

|

Lake House Printer and Publishers (LPRT) own a freehold land at WAD Ramanayake Mawatha, which valued only at Rs 12mn in the Balance Sheet of the Company. Please see below the note given in the 2009/2010 Annual Report.

Page 27 - Annual Report 2009/2010

The freehold land and buildings of the Company situated at No.41,W.A.D.Ramanayake Mawatha,Colombo were revalued as at 10 April 2008 by an Independent Qualified Valuer at Rs.360,060,000 and Rs.33,340,000 respectively. However the revalued amounts have not been incorporated in to the financial statements.

|

Shajesh wrote: sapumal wrote:you will see a huge profit in CARS /Buki income statement. They (Palm oil) don't do translations in SLR, but statements are prepared using SLR. After rupee devalue All the net assets (foreign) marked in foreign currency will converted into SLR. That's 3% of the NAV

Also you have to consider strength of their currency relative to USD I can see that you are crying. but i cant help u I don't need your help. I don't have any CARS group share....

|

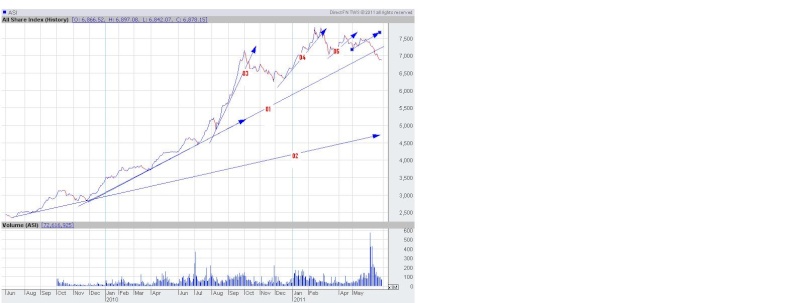

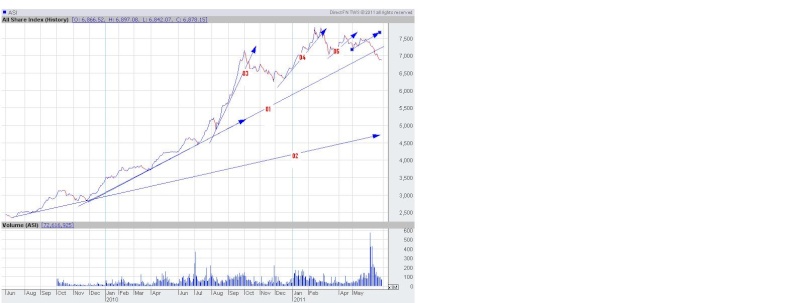

I did some technical analysis on ASI and on several shares would like to share this . At this moment we are experiencing a downturn in the CSE and ppl are tend to go for panic selling though can observe some collecting at low. so actually it seems like bearish condition ,just check with the following chart patterns with the trend ASI had ASI up trends for two year period on daily basis  ASI down trends for the period of two years on daily basis

|

Dear Members

I will be re-publishing series of articles about Value Investing here.

Appreciate your constant participation in this thread to educate newer members who are vulnerable to current speculative investing trends.

We are seeing some high risk high reward trading opportunities in CSE. There would be tendencies by new members to be victims if trades are not managed properly due to limited knowledge.

So this is a huge task for SLEF in the undertaking, but it must be said so that the initial foundation for the newer members would prevent getting too much...

|

I always had this question. Do the EPF funds get invested in good shares?? and do the department analyst do proper study in stock before buying ??

EPF/ETF are people`s money. I think they have done so much mistakes before and im quite shocked who advice to buy.

i can remember, EPF bought huge qty of SPEN at 220, then 180 level , again 167 , latest 135 . And now its 134.. Why such a poor investments ? I mean we all know SPEN and most of the hotels got a higher PE. I mean just using simple ratios anyone can understand that SPEN is over-valued until it falls to 130-135 levels.....

|

I have listed below the reasons why I am so pessimistic about the current investment opportunities in the Colombo Stock Market.

a) Interest rates are on its way up.

From as low as 7% p.a interest rate few months ago the rates are spiraling upward with each bank competing with the one another to attract deposits. Few weeks ago I noticed one of the leading listed commercial bank (Nation Trust Bank) offering 12% p.a for 6-12 months deposits via email campaign few days later be out done by Pan Asia Bank with a offer of 15% p.a for 5 year deposits. With this trend...

|

Amba Research - CTC.N

Please note all copyrights belong to respective owners, published for general public and does not constitute any obligation towards the accuracy.

The research papers are only non commercial use.

|

This share screener will allow you to scan the entire market for any of the following combinations

Hopefully this will save a lot of time for you.

1. P/E Ratio

2. Return On Equity (ROE)

3. Current Dividend Yield

4. Five Year Dividend Growth Rate

5. Five Year EPS Growth Rate

6. Five Year Average Dividend Yield

All you have to do is select the preferred Minimum and Maximum values(YellowCells)

and click on "SCREEN" button.

For example if you want to search for all companies...

|

One of the hardest things about stock trading is self-discipline. You have a set of rules you use for trading, whether you realize it or not. The hard part is sticking to those rules. For example, you may tell yourself that you will never buy a penny stock. Then one day you get a tip or rumour that is boasting about "the next big thing" in the stock market and you go ahead and buy that penny stock. One day later, you have lost 50% of your investment and you are mad at yourself for violating your own rules!

A good solution to the self-discipline problem is to write out your rules on a...

|

|

An Introduction To Behavioral Finance

October 16 2011| Filed Under »

It's hard not to think of the stock market as a person: it has moods that can turn from irritable to euphoric; it can also react hastily one day and make amends the next. But can psychology really help us understand financial markets? Does it provide us with hands-on stock picking strategies? Behavioral finance theorists suggest that it can.

Tutorial: Behavioral Finance

Tenets and Findings of Behavioral Finance

This field of study argues that people...

|

Published in Investing on 19 August 2011 by Kevin Godbold

I'm reading a great book that is making me think about how I've been managing my share portfolio, even after several years of stock-market investing.

It's called "Selecting Shares That Perform" and was written by Richard Koch and Leo Gough, one a successful investor and the other a prolific author of financial and investment books.

Some of their rules for portfolio management challenge my previously held views, but I think they make sense. The following list starts with the rules that are rocking me the most:

|

http://nextgoodbets.blogspot.com/2009/06/averaging-buy-price-to-minimize-risk.htmlThis is something that almost every trader or investor does in his own trading at one point of time or another. I did this myself several times and had to learn the bitter lesson before stopping it. There are several bad consequences that averaging the buy price results in. Typically we tend to think that the risk in a falling stock will be minimized if we buy more quantity...

|

The main idea behind a Discounted Cash Flow model is relatively simple — a stock's worth is equal to the present value of all its estimated future cash flows. This estimate is also called the "intrinsic value" of the company — its true, internal value.

If the stock is trading for less than its intrinsic value, you have a bargain!

The Discounted Cash Flow model can get pretty complex once you bake in several additional variables to predict future cash flows. We use the simpler version of this model to calculate intrinsic values and make our stock purchasing decisions.

|

Hi Guys....

Odel was a highly recommended share by our forum members. so, I got some odel @ 33.50. But at the moment no any positive signal by this share. Is it better to keep it for some time or exit on a green day without much loss???

Your views highly appreciated..... Thanks

|

A T T I T U D E 1+20+20+9+20+21+4+5 = 100 i think we all are rely on rumors & information not about fundamentals & rechnical analysis. we used to it one year ago. but our attitudes have been changed by idiots@ sec.  they r playing with us. we all are waiting for thier positive info. to me it is time to chage our attitude. our companies are performing well, aren't they ?. Financial sector eranings are seems good. dividends are paying. other environmental factors are getting better for businesses....

|

Is there any of you who have experience in long term investments?

Guys if so please share your experiences. We have heard many success stories, is there some one who had been affected by long term investment?

|

Please read the below story. I found it very inspirational at times . Traders can learn a few things from him too as he is mostly a trader as he says. WHo had mostly success and some losses. I admired his guts, determination and skill. But there are few things he did I am not very comfortable with. But I guess you need to do those to go up the ladder. Matter of personal ethics vs pushing for what you want to get. A thin line. overall I am full of admiration still for a guy with only...

|

This is a special section where only the Expert Articles of the Members will be stored for comment and replies. All members are allowed to reply and make comments to the articles contain in this section just like in any other section of the forum.

Moderators at their discretion will move articles that has positive member responses and wider interest to the Expert Chamber from time to time. Further members also can request moderators to move articles contain in other sections to the Expert Chamber. Author could be any member of this Forum.

Objective of this...

|

In every profession, there are probably a dozen or two major rules. Knowing them is what separates the professional from the amateur. Not knowing them at all? Well, let’s put it this way: How safe would you feel if you suddenly found yourself piloting (solo) a Boeing 747 as it were landing on an airstrip? Unless you are a professional pilot, you would probably be frightened out of your wits and would soil your underwear. Hold that thought as you read this essay because I will explain to you how market manipulation works. What the professionals and the securities regulators know and understand,...

|

When ASI hit 7800 with most of the stocks being overvalued, there had to be a market correction if CSE was to sustain. It was needed and healthy. Some people in this forum predicted that too.

But fall is only a fall if it becomes a reality as markets can carry on positive momentum for months. But at some point the reality need to happen. In our case that is exactly what happened and it happened with a vengeance due to many factors with the overvalued market being a prime reason (which badly needed a correction). Other factors such as macroeconomic reasons and more importantly...

|

Not long ago investing was easy. There were few places you could invest and if you had money you wanted to invest, you left it to the professional stock brokers. However, deregulation of the financial markets has changed all this. In the past 20 years new investment products have been launched, changes have been made to the tax systems and retirement plans which have altered the attractiveness of many investment products.

Up to about 20 years ago, share investing was purely in the domain of the wealthy. For most people it was difficult to trade in overseas...

|

An interesting story of Red Indians.......  It was autumn, and the Red Indians asked their New Chief 'the winter is going to be cold or mild?'  Since he was a Red Indian chief in a modern society, he couldn't tell what the weather was going to be. Nevertheless, to be on the safe side, he replied to his Tribe that the

winter was indeed going...

|

...

|

Guys, I don't see any reason for investing our money in the CSE. I entered to this market at the beginning of the year and now my overall lost is around 20% for this year. Few days ago I saw someone stated that CSE is the only Asian market with rising price indexes for month of September with compared to the last year. But day-by-day our lost is increasing slightly.

At the beginning of the September we thought that bullish September has begun. But at the end everyone got losses other than manipulators. Also at the beginning of October we thought in a same way. Now we are in mid of October...

|

SEYB results are absurdly good. Can someone go over them to see if there is any jilmart involved

|

Basic Volume theory includes the following maxims:

* Increasing Volume with an advance is Bullish

* Decreasing Volume with a decline is Bullish

* Increasing Volume with a decline is Bearish

* Decreasing Volume with an advance is Bearish

* A Market Top is imminent when heavy volumes occurs with little or No Gain in the averages.

* Heavy Volume confirms the direction of price breakouts from a Support or Resistance Zones.

* An increase on heavy volumes after a previous substantial rally signals a "Blow Off" with an impending to a Reversal approaching.

|

Will Samp and vone lead the financial rally in coming weeks??????? http://www.ft.lk/2011/12/29/dhammika-to-be-appointed-chairman-of-sampath-bank/Samp share at bottom,Vone below IPO price and recently moved to MPI.

|

About one month ago i bought some ALUF, I did no research , I had no idea i just bought it on a rumor, rumour was group of people were pushing it... Well news seems to be ok, it gained few rupees after i bough it.... Then the unthinkable happened....

Directors wrote to CSE saying they are in serious position of lack of capital... Big fish just exited, i was just left with the going down, going south ALUF... I try to average buying more, any way prices kept falling and falling and falling...

But fortunately i had cash... I knew this a crappy share... a real...

|

----------------------------------------------------------------------------------------------------

First of all this analysis is a routine exercise for me, and for my information, which I would like to open for a fruitful discussion. NOT A BUY, SELL OR HOLD RECOMMENDATION.

----------------------------------------------------------------------------------------------------

I did some analysis on the earnings of Motor Sector shares, as there is some enthusiasm on certain shares in the sector like COLO and UML. Further this is the sector that most analysist's expect with very...

|

I was going through the reports of the companies in the last few weeks.

What I found out was that in many company reports there is a quarter that completely distorts the profits of the company. There is a quarter so that if you add up the other 3 quarters, the total is far less than the other quarter. In that extraordinary quarter there is either a sell off / other income / asset revaluation. This is not a seasonal. It's important to check with other years too.

Another thing I see is many companies have a massive profit from the tea and rubber segment 12 months ago. This number is so...

|

Nations Trust Bank (NTB) is in talks with foreign parties in a bid to raise funds for their tier two capital, officials said. “We are discussing with different parties, many of whom are development finance institutions,” Saliya Rajakaruna, CEO NTB told the Business Times on the sidelines of an Investor Forum to launch its results. Tier two capital is capital which can absorb losses in the event of a bank winding-up.

He also said that NTB plans to set up four new branches during the coming quarter while adding upto 10 branches in 2012 bringing the total branch network to 60 service points...

|

Buyin shares on particular stocks means ur a shareholder in that particular share.. buyin these shares, straightly says u owe a company where ppl kill animals to earn..

what goes around comes around.. !!

who is with me ?? we re stil not late to make our mind.

|

Will be an effect in next week?

The British government has set a deadline for Sri Lanka to show progress in addressing concerns of human rights violations committed during the war. British Foreign Secretary William Hague has told the British Foreign Affairs Committee that Sri Lanka has been told it needs to show progress by the end of this year or Britain will support the international community in revisiting all options available to press the Sri Lankan government to fulfill its obligations.

The Foreign Affairs Committee had criticized the British Foreign office over its failure...

|

LGL - Is this a neglected share these days which has potential to go in medium term? Can we expect good financial performance in coming quarter reports? My streatergy is finding some neglected shares which has growth potential in Medium term

|

Please excuse me for bringing up this topic again, I discussed about it a couple of days back on a different note: http://forum.srilankaequity.com/t6719-market-could-be-red-tomorrowYou can refer nkalansu's post on what is this US debt business is all about: http://forum.srilankaequity.com/t6719-market-could-be-red-tomorrow#45553Now...

|

I have always wondered why IPO's are priced very expensive and they are also equipped with high PE ratios (most of the time higher than the industry average) relative to their EPS.

lets talk about an hypothetical scenario

Suppose a plantation company wants to raise 1 billion rupees. The plantation sector PE is 5. And this particular company's EPS is 2. So a fair valuation to this share would be Rs. 10. Instead the company decides to offer 50 million shares at Rs. 20 a share. when it could have offered 100,000,000 shares at Rs. 10 .

this is what we see in most...

|

Please note that I'm not against for IPOs or introductions. But concerned of their timing. I have stopped subscribing for IPOs sometime back.

SEC has to take immediate action to limit the number of IPOs / introductions within a time frame. Some of our investors chase behind overprices IPOs and burn their fingers. Surprisingly they never learn.

As a group we have to boycot overvalued IPOs and introductions.

The market is slowly dying day-by-day. SEC is helping it to die faster as they are going to list foreign firms at CSE. It should be the other way round where our...

|

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

would enable you to enjoy an array of other services such as Member Rankings, User Groups, Own Posts & Profile, Exclusive Research, Live Chat Box etc..

Home

Home

they r playing with us. we all are waiting for thier positive info. to me it is time to chage our attitude. our companies are performing well, aren't they ?. Financial sector eranings are seems good. dividends are paying. other environmental factors are getting better for businesses....

they r playing with us. we all are waiting for thier positive info. to me it is time to chage our attitude. our companies are performing well, aren't they ?. Financial sector eranings are seems good. dividends are paying. other environmental factors are getting better for businesses....

New posts

New posts![New posts [ Popular ]](https://2img.net/i/fa/prosilver/topic_unread_hot.gif) New posts [ Popular ]

New posts [ Popular ]![New posts [ Locked ]](https://2img.net/i/fa/prosilver/topic_unread_locked.gif) New posts [ Locked ]

New posts [ Locked ]![No new posts [ Locked ]](https://2img.net/i/fa/prosilver_grey/topic_read_locked.gif) No new posts [ Locked ]

No new posts [ Locked ] Cold

Cold Hot

Hot Global announcement

Global announcement